Bitcoin Enters Re-Accumulation Range After Crash Below $90,000, What To Expect

Bitcoin’s recent price crash took the entire market by surprise , leaving bullish investors reeling in losses. Particularly, this crash saw Bitcoin losing its foothold at the $90,000 price level and extended a crash across multiple cryptocurrencies.

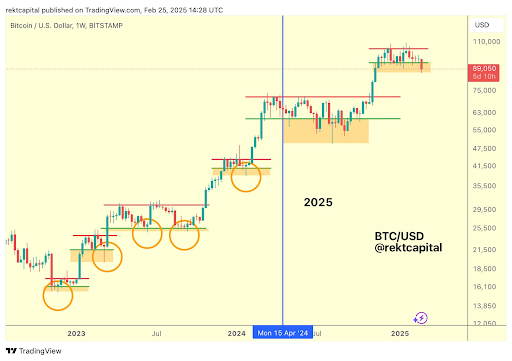

Technical analyst Rekt Capital identified this pullback as a downside deviation within a re-accumulation range, hinting at potential market changes in the coming weeks.

Bitcoin’s Drop Below $90,000: A Necessary Reset?

Bitcoin’s break below $90,000 in the past few days marks its first time trading below this level since November 2024. After months of sustained upward momentum, Bitcoin started to consolidate below the $100,000 price level, spending most weeks trading between $90,000 and $100,000.

This consolidation phase, while unsettling to some investors, was interpreted by some analysts as a natural part of Bitcoin’s broader market cycle. Crypto analyst Rekt Capital has pointed out that Bitcoin frequently undergoes phases of re-accumulation during bull cycles, allowing the market to reset before the next leg upward. According to his assessment, the current price movement aligns with historical trends, where Bitcoin establishes an accumulation floor before another rally.

Interestingly, Bitcoin’s recent break below $90,000 is part of this reaccumulation range phenomenon. Rekt Capital describes this as a “downside deviation” below the range low, which is a pattern Bitcoin has exhibited multiple times in past cycles.

What To Expect From BTC’s Next Move

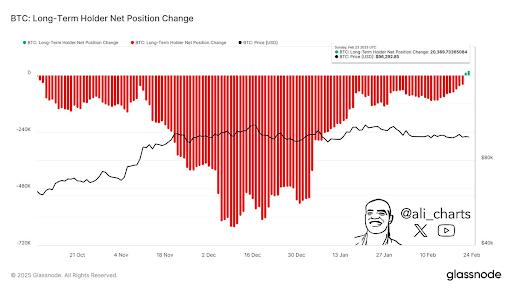

Re-accumulation phases are generally highlighted by buying pressure among a few whales and retail investors while the larger market continues to sell. According to data from on-chain analytics platform Glassnode, some long-term Bitcoin holders have remained unfazed by the recent price crash. In fact, the latest selloff has presented them with a key accumulation opportunity, with these long-term addresses increasing their total Bitcoin holdings by 20,400 BTC in the past 48 hours.

Bitcoin’s future trajectory will depend on how it reacts within this re-accumulation range. If Bitcoin successfully reclaims $90,000, it could confirm that the break below was merely a shakeout before further gains. A strong rebound from this level would likely reignite bullish sentiment, potentially paving the way for a substantial break above $100,000.

However, an extended decline below $90,000 could be very devastating for Bitcoin and its long-term holders who are currently accumulating in the reaccumulation zone, as there isn’t much of a support level to prop up any downtrend until the $70,000 price level.

At the time of writing, BTC is trading at $88,628, reflecting a 7.5% decline over the past seven days. However, the cryptocurrency has shown early signs of stabilization, having rebounded by roughly 2% after hitting an intraday low of $86,867.

SUI Uptick Sparks Hope, But Is This Fleeting Recovery?

Sui (SUI) is showing signs of a potential rebound as its price climbs above the $2.80 mark, sparking...

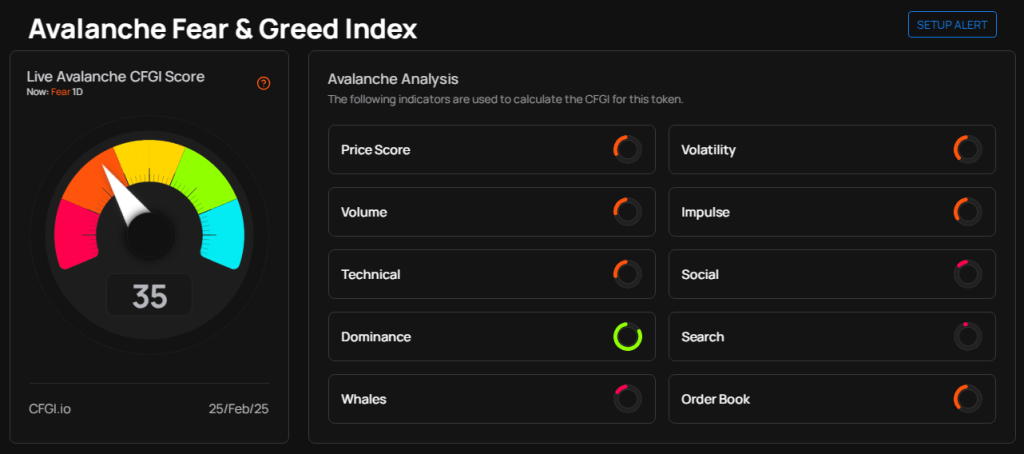

Avalanche (AVAX) Overextended—Is A Market Shakeup Imminent?

Avalanche (AVAX) is currently at a critical point, with its price alarmingly close to the $20 mark. ...

$16 Billion In Possible Liquidations Suggests Where The Bitcoin Price Is Headed Next

Crypto analyst Kevin Capital has provided insights into where the Bitcoin price may be headed next. ...