Bitcoin Bull Score Sees Sharp Jump, No Longer Signals Bear Phase

CryptoQuant’s Bitcoin Bull Score Index has jumped from 20 to 50 in just four days, suggesting a swift shift out of bearish territory for the asset.

Bitcoin Bull Score Index Is Back In Neutral Region

In a new post on X, CryptoQuant head of research Julio Moreno has talked about the latest trend in the analytics firm’s Bull Score Index . This indicator basically tells us about which phase of the market Bitcoin is in right now.

The index combines the data of several key on-chain metrics to determine its value. Some of these indicators include the Market Value to Realized Cap (MVRV) Ratio , keeping track of average investor profitability on the network, and the Stablecoin Liquidity, measuring the amount of capital stored in the form of fiat-tied tokens.

When the Bull Score Index has a value of 60 or higher, it means the majority of the underlying metrics are currently giving a bullish signal. On the other hand, the metric’s value being 40 or lower implies BTC is in a bear phase according to its indicators.

Now, here is the chart shared by Moreno that shows the trend in the Bitcoin Bull Score Index over the past year:

As is visible in the above graph, the Bitcoin Bull Score Index was sitting at a low of just 20 four days ago, but since then, its value has witnessed a sharp climb to the 50 level. This means that on-chain metrics are signaling neutral market conditions for the asset now.

This shift comes just as the Federal Open Market Committee (FOMC) kicks off its two-day meeting on Tuesday. BTC price itself has taken to sideways movement ahead of it, indicating that the market is divided about the event’s outcome.

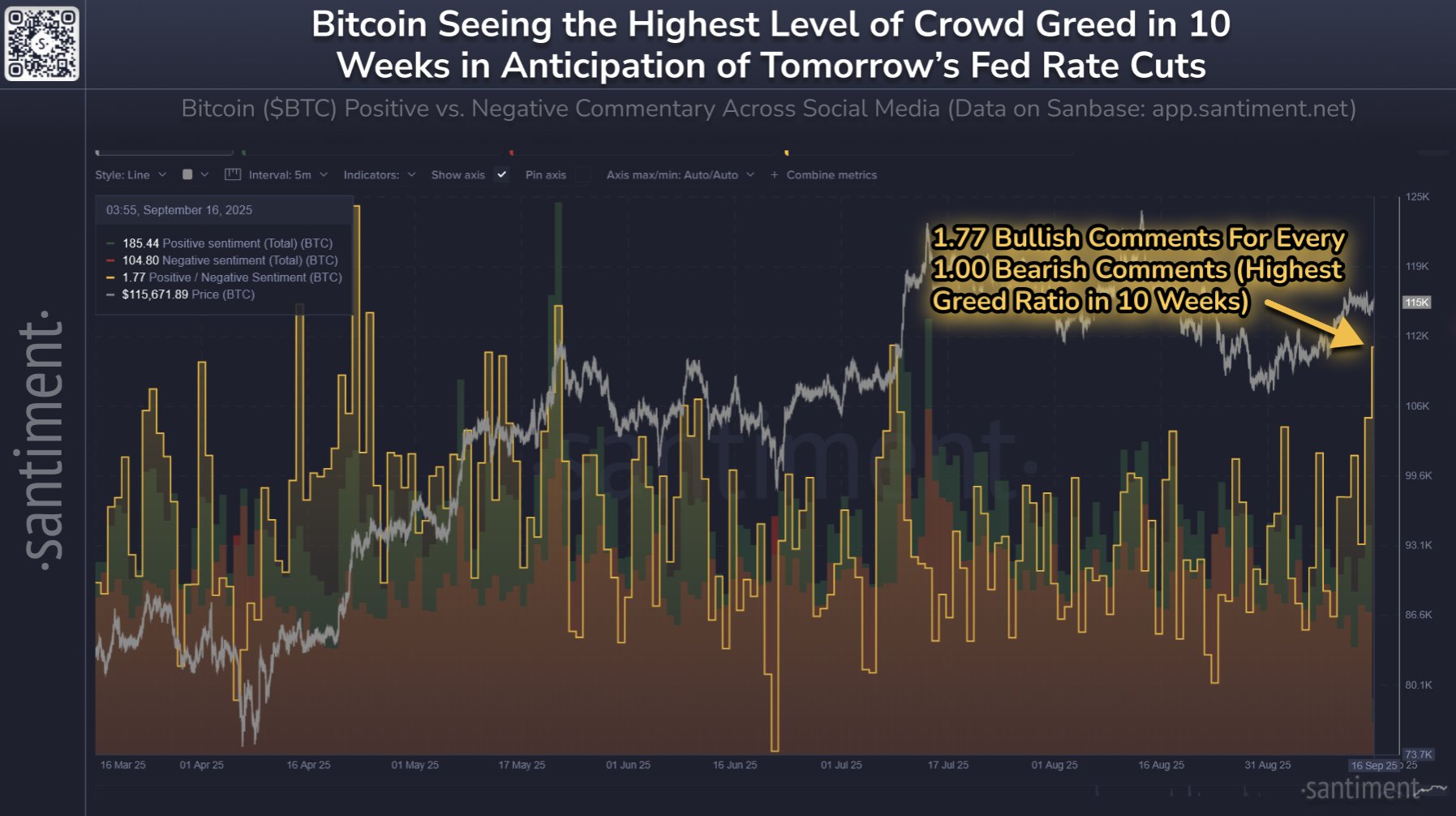

Analytics firm Santiment has shared in an X post about how social media users are reacting to the meeting.

In the chart, Santiment has attached the data of the “Positive/Negative Sentiment,” an indicator that compares the bullish and bearish posts related to Bitcoin that are appearing on the major social media platforms.

This metric has surged recently and hit the 1.77 mark, suggesting that there are 1.77 positive comments being made for every negative comment related to the cryptocurrency. This is the most bullish that retail traders have been on social media in around 10 weeks.

While some excitement can be normal, an excess of it isn’t usually a positive sign. As the analytics firm explains, “historically, markets move in the opposite direction of retail’s expectations.”

BTC Price

At the time of writing, Bitcoin is trading around $115,700, up more than 2.5% over the last week.

Dogecoin Price Eyes 1,250% Surge To $3.5 – Here’s The Roadmap

The Dogecoin price recorded one of the most notable recoveries over the weekend, rising by more than...

Viral Meme Coin Pudgy Pandas Sparks Maxi Doge Presale to Soar Beyond $2M

A new meme coin from China, Pudgy Pandas ($PANDA), raised over $300K in one day on presale, gaining ...

Citi’s Ethereum Forecast: No New All-Time High Expected, Year-End Target At $4,300

Following an all-time high (ATH) reached last August, Ethereum (ETH), the market’s second-largest cr...