Dogecoin Breaks Out With A 32% Surge: Time To Buy Or Too Late To Chase?

Dogecoin’s recent move has put traders on edge and split opinion across markets. Prices leapt this week as news and big trade flows pushed the token higher, creating a fresh round of buy-or-hold debates on trading desks and crypto chat rooms.

ETF Launch Faces New Delay

Based on reports, the eagerly watched US DOGE ETF has been pushed back again, with the earliest new listing window now sliding toward September 18.

That postponement briefly dented hopes of immediate ETF access, but it did not stop demand from rising. Some market participants treated the delay as a pause, while others used it to enter positions ahead of any eventual listing.

Price Rally Accelerates Momentum

Meanwhile, Dogecoin price is up 15% in the last 24 hours, and 38% in the last week. Traders moved the token above recent swing levels, with on-screen quotes clustered in the mid-$0.20s to $0.30s.

Volume rose alongside the gains. Quick gains like these tend to attract short-term players and cause order books to thin out, which in turn can make price jumps larger and pullbacks sharper.

Institutional Bets Back Dogecoin

Reports have disclosed that a corporate plan has added fuel to the rally. CleanCore Solutions announced a Dogecoin treasury effort backed by roughly $175 million in private capital, and reports name high-profile figures among those expected to take board roles.

The company says it intends to hold DOGE as a reserve asset, and talk of large buys tied to that plan helped lift sentiment among some investors.

What The Price Action ShowsShort-term charts look overheated to some and promising to others. Momentum indicators are positive, and a pattern that some chart watchers call a pennant has formed on intraday charts.

At the same time, resistance remains above current levels and quick reversals are possible. On-chain flows, futures open interest, and large wallet moves will be key in the coming days because they can flip a green session into a sharp drop if liquidations hit.

Dogecoin’s jump this week is driven by a mix of headline buying and reported institutional interest. Reports show a 9% gain in 24 hours and 32% over the week, which is strong but not guaranteed to continue.

For some, the setup still looks like a buy on dips. For others, the rally is already too hot to chase without clear entry rules. Volatility is likely to stay high while the ETF story and institutional moves play out.

Featured image from Meta, chart from TradingView

Is Ethereum Currently Undervalued At $4,700? NVT Reading Suggests So

The latest on-chain data shows that the second-largest cryptocurrency by market capitalization, Ethe...

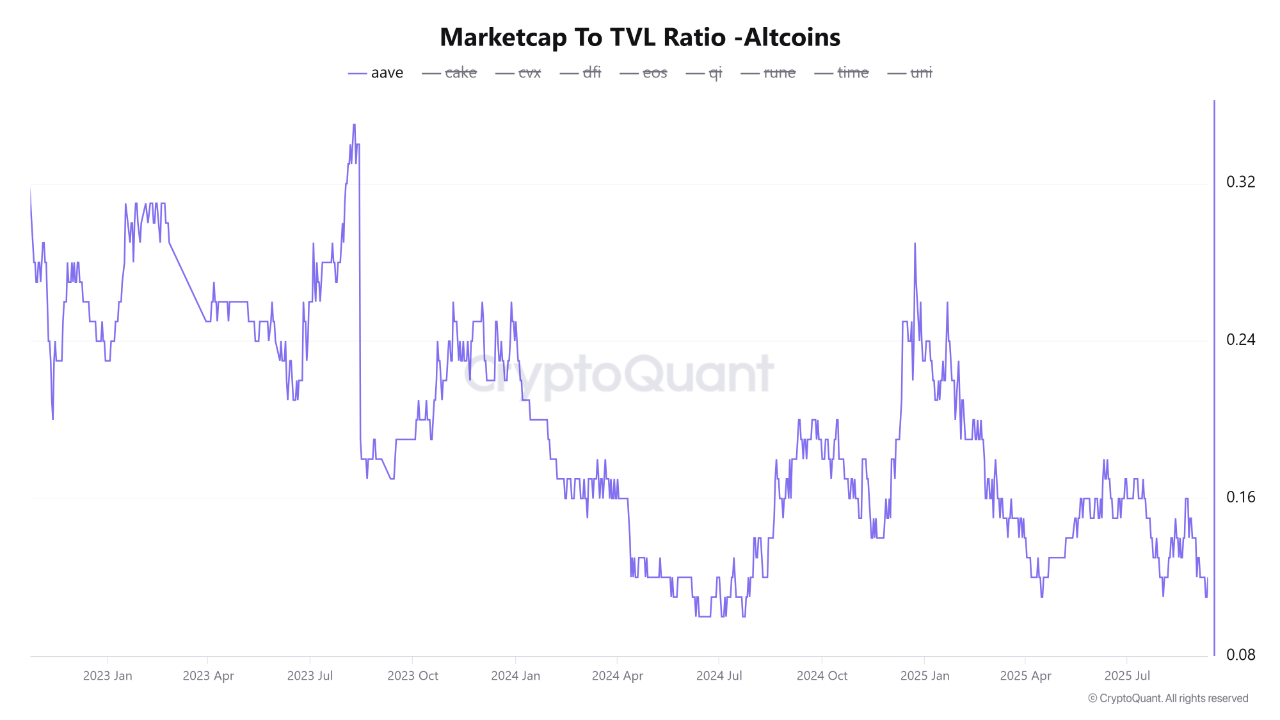

AAVE Price Reclaims $320 As TVL Metric Shows Positive Divergence — What’s Next?

After hovering around the $300 mark at the start of this week, the Aave price appears to have finall...

Dogecoin In Buy Zone: Bulls Eye $0.34 As Immediate Target

Amidst a bullish crypto market, Dogecoin (DOGE) prices have surged by nearly 7% in the last day, cro...