Bitcoin News Today: $300K BTC Possible as Bollinger Bands Reach Extreme Levels, Analysts Call ETH and MAGACOIN FINANCE the Best Buys

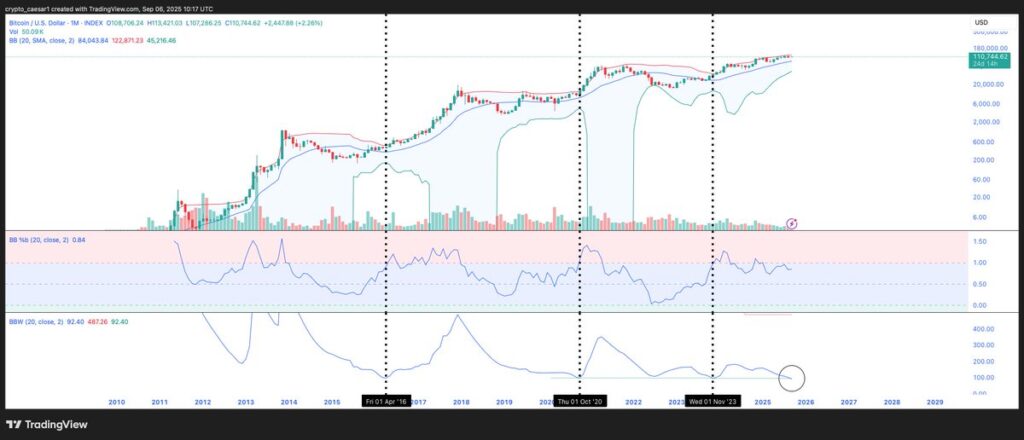

Bitcoin is entering one of the most pivotal technical phases in its history. On the monthly chart , Bollinger Bands have contracted to their tightest range ever recorded, according to data shared this week by TradingView and Cointelegraph analysts. Previous periods of similar compression, such as in 2012, 2016, and 2020, all preceded massive rallies, with BTC multiplying by double- or triple-digit percentages in the following months. The current setup has prompted forecasts that Bitcoin could surge toward $300,000 if the breakout mirrors earlier cycles.

This optimism comes as Bitcoin continues to trade above $110,000–$115,000 , establishing firm support even amid short-term volatility. Institutional inflows into U.S.-listed Bitcoin ETFs remain positive, reinforcing the idea that large players are quietly positioning ahead of the move. Analysts argue that the combination of historical patterns, tightening supply, and favorable macro conditions provides the strongest bullish backdrop since 2020. And while Bitcoin dominates headlines, presale attention is shifting toward MAGACOIN FINANCE , a project gaining traction as one of the cycle’s most promising hidden gems.

Bitcoin’s volatility squeeze raises $300K potential

The mechanics behind this setup are straightforward yet powerful. Bollinger Bands measure volatility by plotting two standard deviations around a moving average. When they contract heavily, it indicates extreme consolidation, a precursor to sharp directional moves. With BTC’s Bands now at their narrowest point ever, traders believe a breakout is imminent.

Some analysts point to $125,000–$130,000 as the first upside target, followed by potential extensions toward $200,000–$300,000 if momentum accelerates. The bullish case is further supported by declining exchange reserves, showing that long-term holders are withdrawing BTC to cold storage rather than selling. This pattern, historically, has signaled confidence before major price expansions. On the downside, failure to hold support near $110,000 could trigger short-term dips, but many argue these would simply offer accumulation opportunities in the broader bullish structure.

Presales rarely achieve the balance of credibility and cultural firepower that drives explosive adoption, but analysts say MAGACOIN FINANCE is breaking that mold.

What has really ignited momentum is the PATRIOT50X code , which grants early investors 50% more tokens . This incentive is creating urgency across Telegram and X groups, sparking competition between retail buyers and whales for allocations. Many now describe MAGACOIN FINANCE as more than a meme project – it’s being positioned as a cultural phenomenon with scarcity baked in , the kind of setup that could deliver returns reminiscent of Ethereum’s earliest days. Forecasts of 52× upside are already circulating, and analysts warn it may not stay under the radar much longer.

Ethereum adds strength to the breakout setup

Ethereum is also reinforcing the bullish case for the broader market. ETH has climbed above $4,400 , driven by whale accumulation and falling exchange supply. If ETH can defend these levels and extend gains toward $6,000–$9,000 , it will further validate the risk-on environment for crypto assets. Analysts note that Ethereum often acts as a secondary confirmation for Bitcoin’s trend, when ETH rallies in tandem, it amplifies confidence in the cycle’s strength.

Together, Bitcoin’s volatility squeeze, Ethereum’s accumulation trends, and presale momentum from MAGACOIN FINANCE are forming a trifecta that could define the next leg of the bull market. Each plays a different role: Bitcoin as the institutional anchor, Ethereum as the infrastructure powerhouse, and MAGACOIN FINANCE as the high-upside cultural play.

Risks and factors to monitor

Despite the bullish alignment, risks remain. Extreme Bollinger Band squeezes can trigger fake-outs before the true direction emerges. A short-term breakdown below $110,000 could unsettle traders even if long-term structure remains intact. Macro shocks, unexpected inflation spikes, rate hikes, or geopolitical tensions, could also curb risk appetite, slowing momentum.

For Ethereum, resistance around $4,800 will be crucial to clear convincingly. Failure there could cap upside temporarily.

Conclusion

Bitcoin’s Bollinger Bands are tighter than ever, signaling that an explosive move is on the horizon. If history is any guide, BTC could push well beyond $125,000, with some models projecting as high as $300,000 in this cycle. Ethereum is showing strength of its own, building momentum toward $6,000–$9,000, while MAGACOIN FINANCE is capturing retail excitement as a presale that blends meme culture with audit-backed legitimacy and scarcity-driven design.

Together, these three represent different dimensions of opportunity, from institutional-scale security to cultural breakout potential. But what sets MAGACOIN FINANCE apart is that it is still at the ground floor, where exponential growth is possible. Bitcoin and Ethereum already command trillion-dollar valuations, which limits their percentage upside. MAGACOIN FINANCE, by contrast, enters the market with scarcity, incentive-driven tokenomics, and cultural energy, giving it the unique ability to deliver the kind of outsized returns early ETH and DOGE investors once experienced. For investors looking ahead to 2025, the alignment may mark the beginning of crypto’s most powerful chapter yet.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com Access: https://magacoinfinance.com/access Twitter/X: https://x.com/magacoinfinance Telegram: https://t.me/magacoinfinance

This article is not intended as financial advice. Educational purposes only.

Dogecoin Price Today: DOGE ETF Buzz Builds as Meme Rotation Expands to MAGACOIN FINANCE and Shiba Inu

Dogecoin price jumps on ETF rumors, fueling a meme revival. Shiba Inu gains while MAGACOIN FINANCE e...

Analysts See Shiba Inu and Pepe Hitting New Highs, but Layer Brett May Be the 100x Play

Shiba Inu and PEPE show bullish setups, but Layer Brett’s $0.0055 presale, L2 speed, staking rewards...

Cardano vs Solana: Analysts Say ADA Falls Short, But Layer Brett Could Challenge SOL’s Momentum

Cardano tests $0.90 and Solana eyes $300, but Layer Brett’s $0.0055 presale, fast L2 network, and bi...