MoreMarkets Taps Flare to Power New “XRP Earn Account” for On-Chain Yield

MoreMarkets and Flare have announced a partnership to launch the XRP Earn Account, a fully on-chain, non-custodial way for XRP holders to earn yield without wrestling with multiple blockchains, bridges or complex smart-contract flows.

The integration brings MoreMarkets’ on-chain yield strategy to the Flare network. Users will initiate a simple bridge from their XRPL wallet through a dedicated feature on MoreMarkets ; that payment flows into Flare’s FAssets system, minting FXRP on Flare.

From there, MoreMarkets automatically deploys DeFi strategies, such as lending or liquid staking via the Firelight protocol, to generate real yield. Rewards are converted back to XRP and paid to the user’s wallet, keeping the whole experience seamless and accessible.

“This collaboration unlocks new potential for XRP as a programmable asset,” MoreMarkets says, emphasizing that everyday users can now safely participate in DeFi without needing specialist knowledge.

What Makes this Different

Unlike custodial or multi-step yield products, the Flare–MoreMarkets approach is fully on-chain and non-custodial: a user’s native XRP remains on the XRPL while a 1:1 representation, FXRP, is minted on Flare and secured by collateral and Flare’s on-chain oracles.

There are no centralized custodians in the minting process. Because MoreMarkets handles the Flare mechanics behind a single interface, users interact with one straightforward platform while benefiting from complex DeFi strategies under the hood.

A key feature at launch is the Firelight Protocol’s liquid staking flow. Early users will be able to deploy FXRP to receive a liquid staking token (LST) and Firelight Points; the LST can then be used across Flare’s DeFi ecosystem.

When the product reaches feature parity, MoreMarkets plans to let users deposit into multiple vaults that secure Economically Secured Services (ESS), vaults that lease economic security to high-impact DeFi use cases in exchange for fees. The rollout will begin with FXRP support and expand to additional Flare lending markets over time.

Built with Institutions in Mind

Both teams are pitching the architecture as attractive to institutional investors. Flare is completely focused on regulatory alignment and partnerships with institutional custodians such as BitGo, Fireblocks, and Hex Trust. MoreMarkets stresses the need to deliver yield that meets professional security and compliance standards.

Hugo Philion, Co-founder & CEO of Flare: “This partnership is a powerful validation of Flare’s mission: to bring smart contract functionality and real-world data to the entire crypto ecosystem. While MoreMarkets has been building a promising solution for XRP holders, this collaboration positions Flare as the essential, permissionless utility layer that will power their next phase of growth. They are using us, and we couldn’t be more proud.”

Altan Tutar, Co-founder and CEO of MoreMarkets: “Our mission is to make idle assets work for their holders without the headaches of DeFi. The XRP Earn Account is already delivering yield to hundreds of early adopters, and adding Flare gives them another high-quality path to earn. We’re really excited to be working with Flare to build the most liquid XRP onchain ecosystem on Flare!”

For XRP holders, the MoreMarkets–Flare collaboration offers a way to earn on-chain yield while keeping control of their assets and avoiding centralized intermediaries. For the broader XRPFi movement, the partnership positions Flare as a provider of institutional-grade on-chain infrastructure for XRP.

It combines programmable assets, liquid staking, and yield strategies in a single, user-friendly product. As the rollout progresses from FXRP to expanded lending markets, the pair will be watched closely by users and institutions looking for secure, compliant paths into DeFi for XRP.

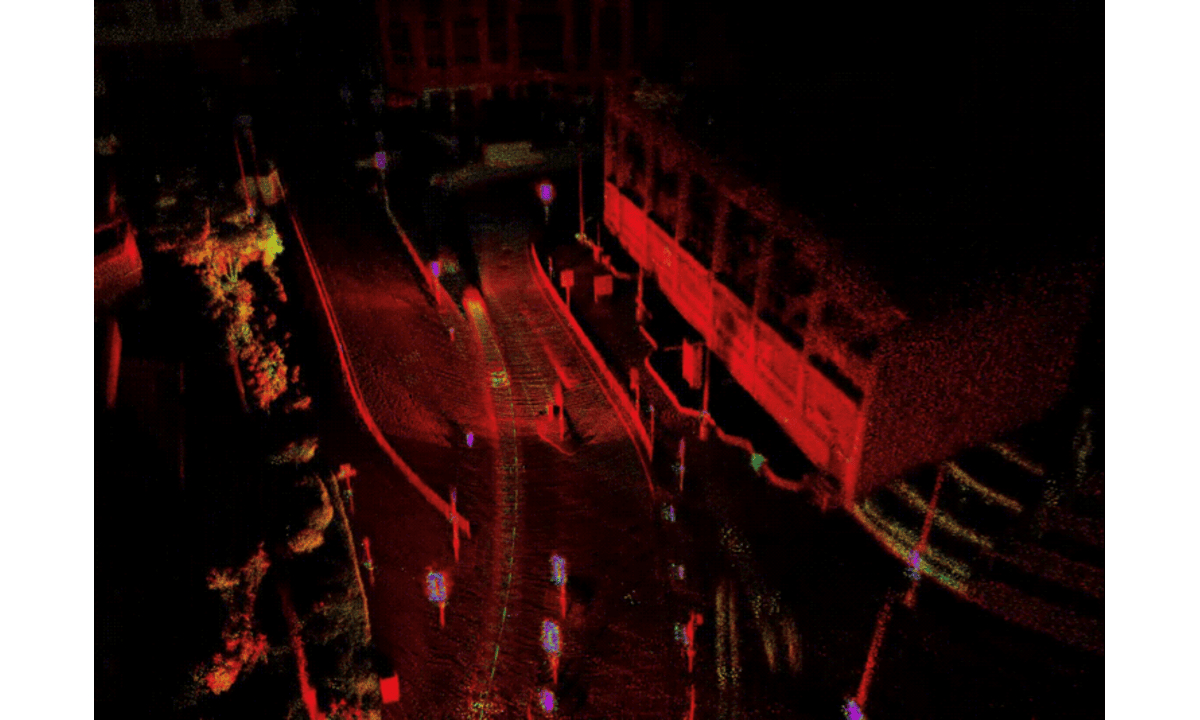

ROVR Releases Open Dataset to Power the Future of Spatial AI, Robotics, and Autonomous Systems

Santa Clara, California, 26th August 2025, Chainwire...

Bitwise Files for First U.S. Spot Chainlink (LINK) ETF, SEC Review Begins

Bitwise Asset Management has filed an S-1 with the SEC for a spot Chainlink (LINK) ETF, marking the ...

Cold Wallet’s Cashback Model & Tiered-Rewards Leads Top Cryptos of 2025 List with HYPE, ADA, & NEAR!

Analyze the top cryptos of 2025 as Cold Wallet gains traction, Hyperliquid grows trading power, Card...