Miner Position Index Rises As Bitcoin Rebounds Post-CPI Data—Here’s What It Means

Bitcoin (BTC) is showing signs of recovery following a brief market retreat triggered by the latest US Consumer Price Index (CPI) update. The asset had slipped to lows near $116,000 following inflation data.

However, BTC has rebounded since, reaching $119,248 earlier today and trading at $119,187 at the time of writing, roughly 3.1% below its all-time high of $123,000 set earlier this week.

While broader macroeconomic concerns are shaping price sentiment , new on-chain metrics from the mining sector are drawing attention. A CryptoQuant analyst has watched miner activity closely, as some key indicators suggest that miners may be preparing to sell.

This development could influence short-term price action, though the broader outlook for Bitcoin remains largely unchanged, according to the analyst.

Bitcoin Miner Behavior Points to Short-Term Pressures

CryptoQuant contributor Avocado Onchain highlighted in a recent post that the Miner Position Index (MPI) has jumped to 2.7. This index compares the amount of Bitcoin being moved by miners to exchanges with the historical one-year average.

A high MPI reading generally implies increased selling intent, as miners move assets to trading platforms. Avocado noted that the current reading may indicate mild selling pressure, which could contribute to a near-term correction or sideways trading pattern.

However, he also emphasized that the current MPI value is still far from the elevated levels typically observed at market cycle peaks. The analyst suggested that this activity may be part of a recurring intra-cycle trend in which brief corrections are followed by further upward movement .

He advised that it remains uncertain whether this miner activity marks a one-off event or signals a larger selling wave. Either scenario may affect short-term volatility, but not necessarily the broader trajectory.

Network Flows Support the Data Trend

In a separate analysis , CryptoQuant contributor Arab Chain examined the implications of increased miner activity. According to their findings, network data reveals a noticeable uptick in miner-related movements, levels last seen in November 2024.

Arab Chain explained that while miner activity on the blockchain is rising, this alone doesn’t confirm sales unless Bitcoin is transferred to exchanges.

To further validate the outlook, Arab Chain analyzed platform inflow data. They observed a correlation between BTC transfers to exchanges and Bitcoin’s recent climb above $116,000. This movement may indicate that miners view current prices as favorable for selling , possibly to cover operational costs or secure liquidity.

The data also hints at miners anticipating a potential correction, which could drive more transfers and further market fluctuations . They concluded that the extent of any correction would largely depend on whether this wave of miner activity persists.

Featured image created with DALL-E, Chart from TradingView

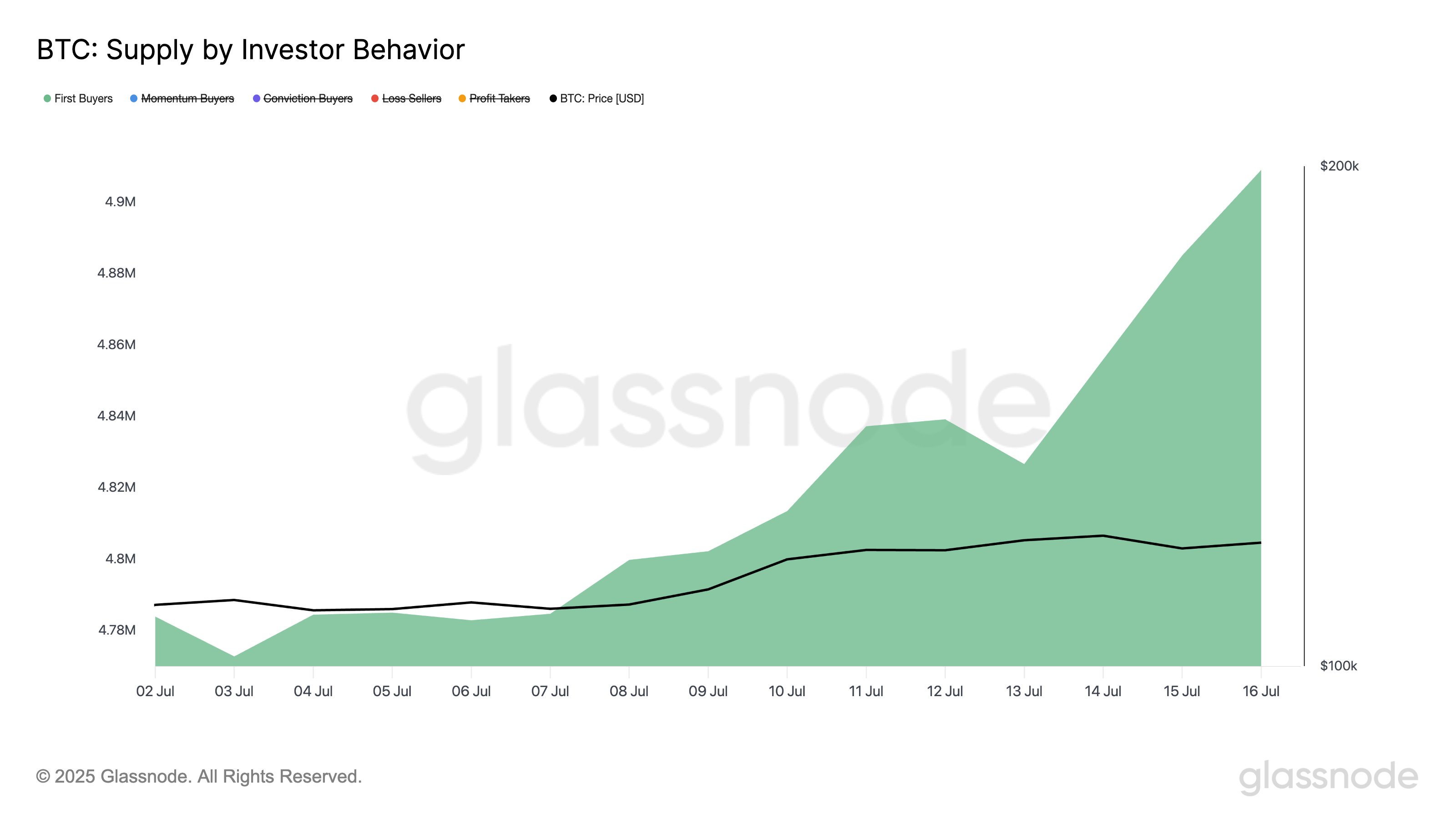

Bitcoin Sees Influx Of New Capital: First-Time Buyers Add 140,000 BTC

On-chain data shows the supply held by new Bitcoin buyers has seen a jump recently, a sign that the ...

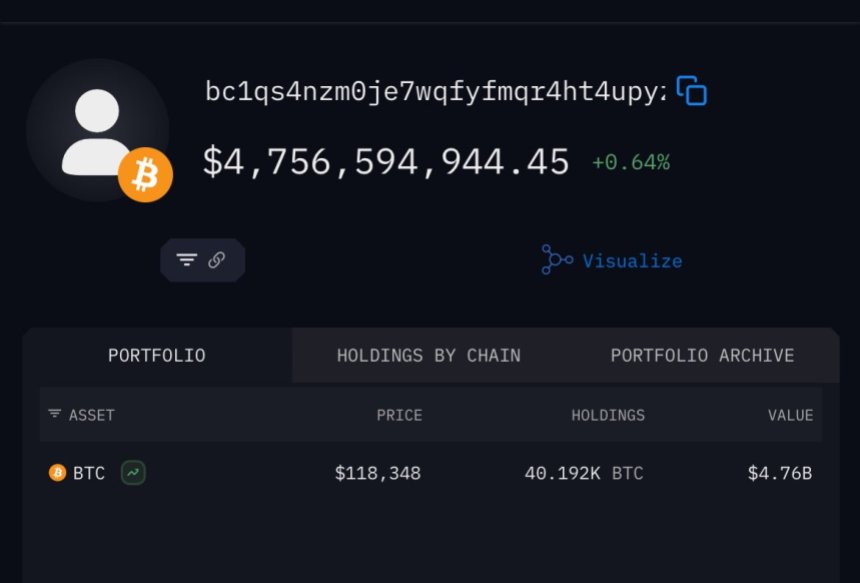

All 40K Remaining Bitcoin From The 80K Whale Just Moved: $4.75B In One Wallet Now

After reaching a record high of $123,200, Bitcoin is now consolidating around the $118,000 level. Ma...

Did The US Government Dump 170,000 BTC? Marshals Reveal Shocking Bitcoin Holdings

A rumor is rapidly spreading among crypto investors that the US government may have quietly sold off...