Bitcoin (BTC) Price Could Soon Witness a Strong Jump & Hit $110K—Here’s Why

The post Bitcoin (BTC) Price Could Soon Witness a Strong Jump & Hit $110K—Here’s Why appeared first on Coinpedia Fintech News

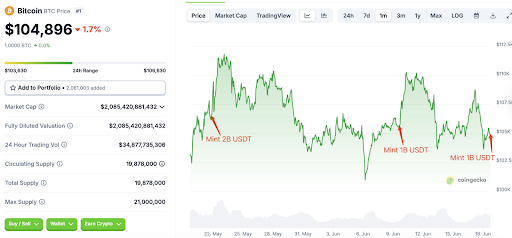

Bitcoin is currently trading around $105K, having edged down about 1.4% today after peaking near $106.5K. The recent aftermath of geopolitical tensions, especially in the Middle East, and a cautious macroeconomic outlook have driven mild risk-off sentiment. Yet, technical indicators such as Bollinger Bands expansion and a positive MACD histogram hint at an imminent surge in volatility that could fuel a breakout. Will this, can the BTC price reclaim $108K?

Massive Bullish Bitcoin Signal

Tether has been mining new tokens very frequently in recent times, which has been heavily contributing to the volatility within the markets. Each time Tether minted a billion tokens, the Bitcoin price witnessed a significant push. The price rebounded from the local bottoms and surged to reach the local highs or even an ATH.

The data from Lookonchain suggests Tether has minted another billion, which could be considered a huge bullish signal. In the past few weeks, the BTC price has experienced a significant rise following two Tether-minted USDT. Therefore, now that the USDT has minted one more billion tokens, there is a huge possibility of Bitcoin triggering a strong upswing.

The US has just passed the new Stablecoin bill, or the GENIUS Bill, which is expected to shake up Tether’s dominance in the market. With the tighter regulations coming, USDC and the other stablecoins could gain ground. Despite this, the USDT maintains stability at $1, solidifying its position with a $155.58 billion market cap. One of the major reasons behind the stability could be the influx of new USDT tokens into the market.

Will the BTC Price Rise Again?

Bitcoin price has held strongly above the crucial support at around $102.8K as it has revived a strong rise, soon marking the bottom. Currently, the price is facing a huge compression with the long/short ratio almost 50/50, which opens both the possibility of a breakout and a breakdown. Therefore, a confirmation of any trend could depend on the price deviating either above $107K or dropping below $103K. However, in the wider perspective, the Bitcoin price is at the neckline of a huge bullish structure, and hence, a breakout could propel the token to a new ATH.

Crypto Market Faces Short-term Bearish Sentiment After Fed Left Interest Rate Unchanged Akin to BoJ

The post Crypto Market Faces Short-term Bearish Sentiment After Fed Left Interest Rate Unchanged Aki...

FED Rates Remain Unchanged—What Does This Mean for Bitcoin & the Crypto Markets?

The post FED Rates Remain Unchanged—What Does This Mean for Bitcoin & the Crypto Markets? appeared f...

Ethereum Price Prediction 2025: Here’s Why ETH is Poised for a Megarally

The post Ethereum Price Prediction 2025: Here’s Why ETH is Poised for a Megarally appeared first on ...