UK Will Be Far Poorer If It Fails to Embrace Bitcoin in Sovereign Fund, Says Reform Chairman Zia Yusuf

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Reform UK Chairman Zia Yusuf has unveiled a bold economic blueprint to transform the United Kingdom into a global hub for crypto innovation.

In an

interview

with Bloomberg, Yusuf emphasized that under a Nigel Farage-led government, the country would embrace Bitcoin and blockchain as tools to reclaim economic dynamism and global competitiveness.

He warned that if the country fails to include Bitcoin in its sovereign fund, it will be significantly poorer in 30 or 40 years than it otherwise could be.

Lower Crypto Tax, Bitcoin Reserve, and Paying Taxes in Crypto

In this context, Yusuf laid out several core components of the proposed crypto bill that Reform UK would introduce if elected. These include reducing the capital gains tax on crypto to 10% for eligible assets.

Moreover, banks would be prohibited from denying services to individuals solely for engaging in legal crypto transactions. The bill also proposes establishing a Bitcoin Reserve Fund, a sovereign wealth fund to hold BTC. Its initial components will be crypto assets seized in criminal investigations and payments received via crypto.

Furthermore, the UK’s tax authority would be required to

accept crypto payments

, offering citizens a frictionless alternative.

Building Infrastructure for Bitcoin and Crypto Innovation

Acknowledging concerns about cost and implementation, Yusuf argued that the long-term benefits would outweigh the initial investments. Reform UK plans to introduce a two-year regulatory sandbox for major firms, particularly in the City of London, to experiment with crypto and blockchain solutions under a light-touch but supervised regime.

During the interview, the host raised concerns that embracing Bitcoin could undermine the British pound. In response, Yusuf pushed back, framing crypto adoption as an extension of sovereignty rather than a threat to it.

“This isn’t about replacing the pound,”

he said.

“It’s about enhancing individual and national sovereignty. Bitcoin and stablecoins linked to the pound give citizens choice and protection in an era of politicized finance.”

Yusuf also cited recent de-banking controversies, including Farage’s own experience, as evidence that alternative financial systems are needed to guard against political discrimination in traditional banking.

https://twitter.com/BitcoinMagazine/status/1928425200497930717

“We Can’t Afford to Stay Stuck in the 1970s”

Meanwhile, Yusuf cautioned that the UK is falling behind as countries like the U.S., UAE, and Singapore

invest heavily in crypto infrastructure

.

“We can stay stuck in the 1970s or move forward,”

he said

. “But if we don’t adapt, the UK economy risks being left for dead.”

Yusuf argues that Reform UK’s approach is not a gimmick but a pragmatic response to shifting global realities. With Bitcoin increasingly trading like gold and less like speculative tech, the

proposed Bitcoin reserve

could serve as a long-term hedge and strategic asset.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/509068.html

Related Reading

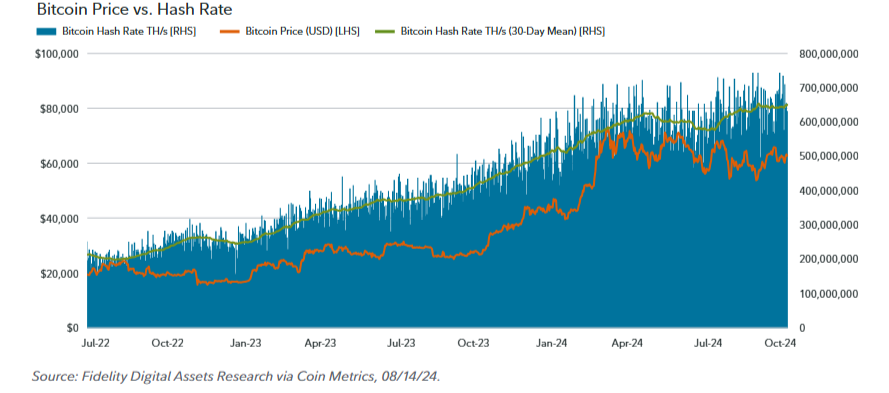

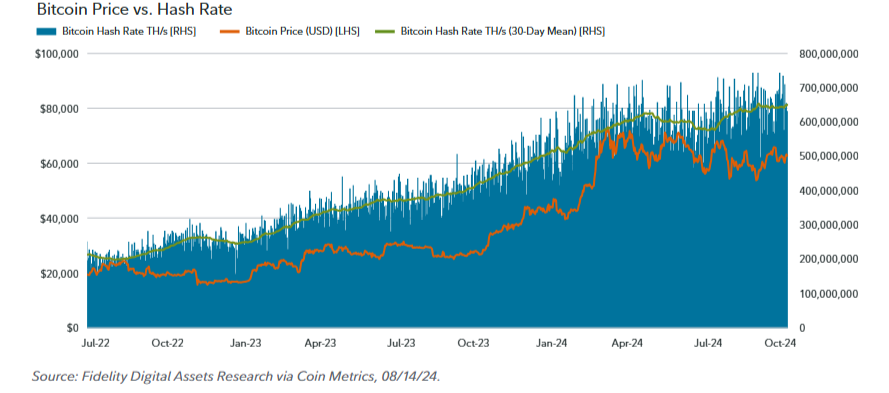

Bitcoin Potential as a Store of Value Sets It Apart from Other Digital Assets: Fidelity

Prominent asset manager Fidelity has highlighted Bitcoin unique features and functionalities in comp...

Publicly Listed UK Gold Mining Firm to Convert Its Gold Revenue to Bitcoin for Reserve

Bluebird, a UK-listed gold mining company, has announced plans to use the money it earns from gold t...

Michael Saylor Says He’s More Bullish on $13M Bitcoin Price Forecast; Here’s Why

Michael Saylor, the executive chairman of MicroStrategy (now Strategy), discloses that he is getting...