Morgan Stanley Plans to Launch Spot Bitcoin Trading for E*Trade Retail Clients

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Morgan Stanley, a leading wealth manager and bank with an AUM of $1.7 trillion, is preparing to offer spot crypto trading on its E*Trade brokerage platform.

According to a Bloomberg

report

today, Morgan Stanley plans to list popular cryptocurrencies like Bitcoin on the platform. The initiative would allow the banking giant’s E*Trade retail clients to buy and sell crypto assets directly from their existing brokerage accounts.

Still Early

Bloomberg reports that while the plan is still in its early stages, Morgan Stanley expects to launch the spot crypto trading service by next year.

In the meantime, it is exploring potential partnerships with established crypto entities, which will provide the necessary infrastructure for the service. It bears mentioning that Morgan Stanley has been having internal discussions about launching a crypto trading service on its E*Trade brokerage platform since late last year.

In January, Morgan Stanley reportedly explored the E*Trade crypto marketplace. At the time, the move was fueled by its anticipation of a favorable regulatory environment in the U.S. under Donald Trump’s administration.

Interestingly, the bank is proceeding with the plans to launch the E*Trade crypto trading service by 2026.

Morgan Stanley’s Previous Exposure to Crypto

Prior to this time, Morgan Stanley already had significant exposure to crypto. The bank

offers

its rich clients access to crypto-related products, including futures and exchange-traded funds (ETFs).

In August, it gave its financial advisers the green light to pitch Bitcoin ETFs to these wealthy investors. At the time, the recommendation was restricted to only BlackRock and Fidelity Investments’ Bitcoin ETFs. Two months later, the wealth manager

disclosed

in a 13F-HR/A filing that it holds about $272 million worth of Bitcoin ETF shares.

While Morgan Stanley’s high-net-worth clients already have exposure to cryptos, this latest initiative would be the bank’s first crypto-related offering targeting everyday E*Trade users. If launched, Morgan Stanley would be in stiff competition with established exchanges like Kraken and Coinbase.

Besides Morgan Stanley, other traditional financial institutions like Charles Schwab are also considering launching crypto trading services. Others have also launched the service in different parts of the world. For instance, Spain’s second-largest bank

secured

a license to provide its retail clients with crypto trading and custody services.

Positive Regulatory Environment Fuels Morgan Stanley Crypto Push

Meanwhile, the latest development comes as the United States continues to roll out pro-crypto regulation since Trump’s inauguration. Last month, the Federal Reserve

rescinded

95% of its anti-crypto regulation, allowing banks to engage in crypto activities without obtaining permission.

Additionally, Trump has ordered several U.S. agencies, like the SEC, to establish clear and fair regulations for the industry. Amid these regulatory efforts, Morgan Stanley has commenced plans to launch crypto trading services on its E*Trade platform.

However, at the time of this publication, the bank had yet to issue a public comment confirming the development.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/503401.html

Related Reading

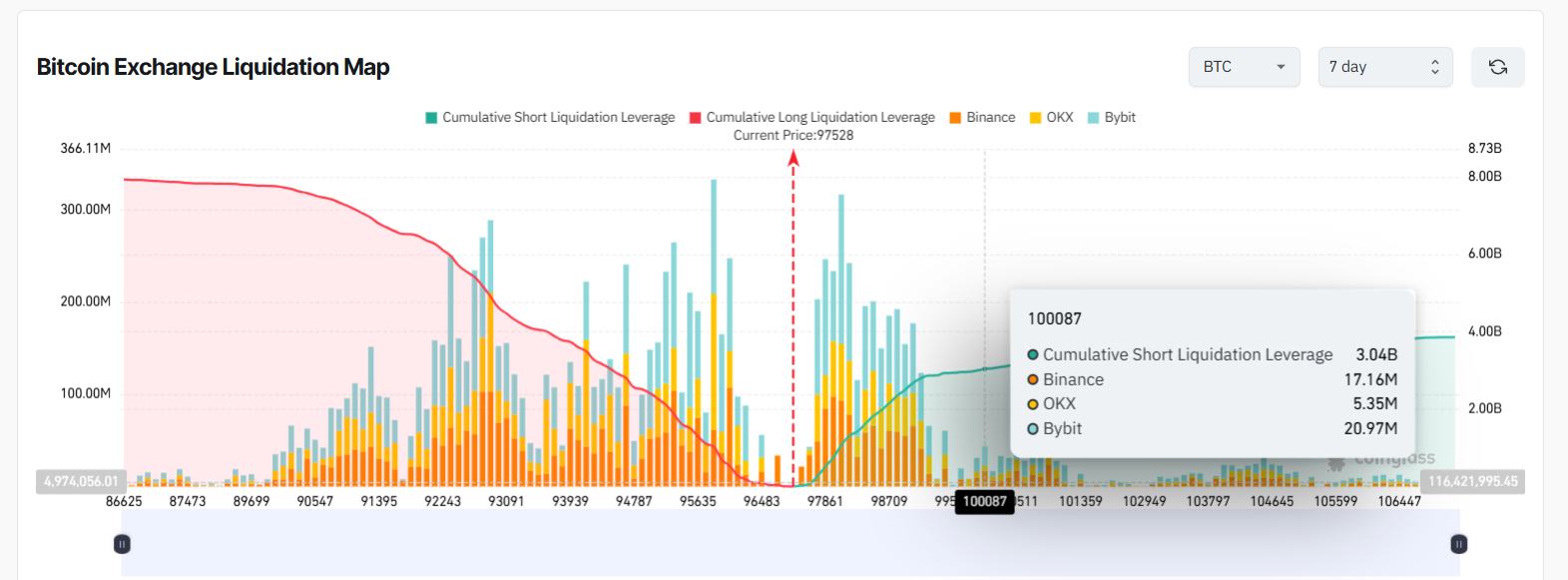

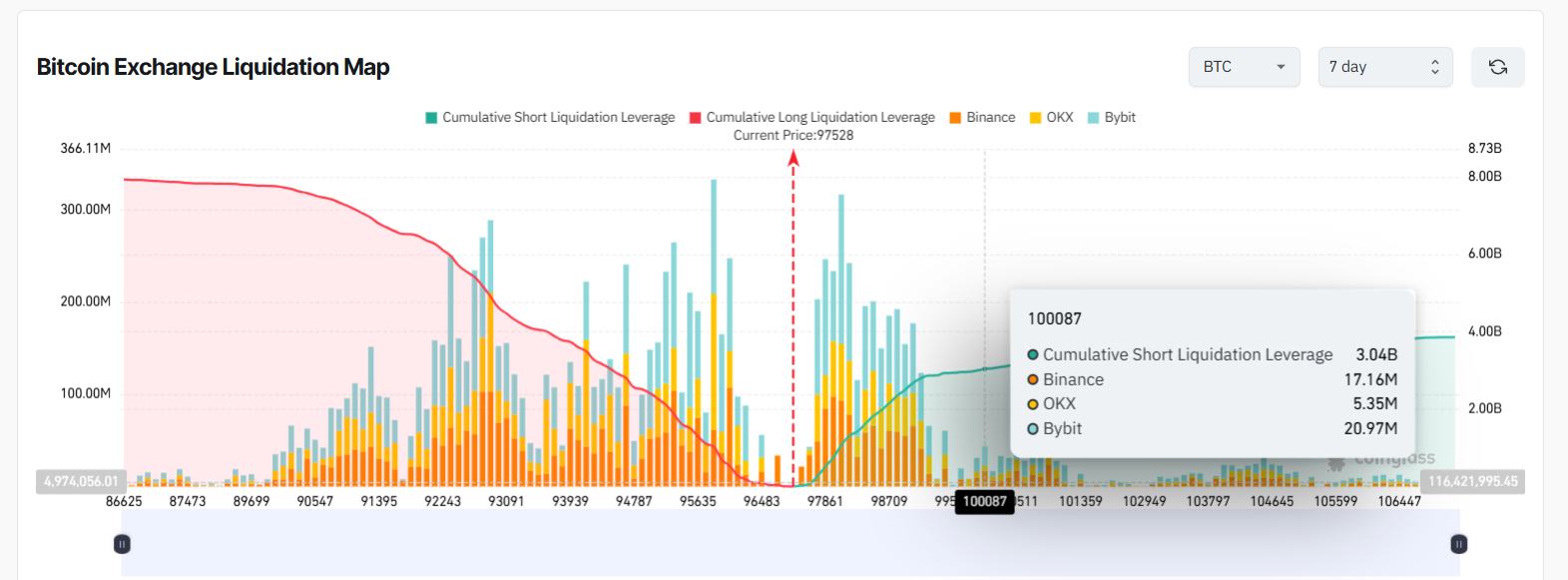

Over $3B in Bitcoin Shorts Set for Liquidation at $100K: Details

With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at ri...

Goldman Sachs Ramps Up Crypto Exposure, Eyes Tokenization Opportunities

Goldman Sachs is intensifying its involvement in the digital asset space, according to its head of d...

Bitcoin Dominance Hits New 4-Year Peak: Here’s What This Means for the Altcoin Season

Bitcoin dominance has claimed a high last seen in the previous bull run, leading to discussions arou...