$3.6B in Outflows Signal Caution, But Bitcoin Powers Past $88K

- Bitcoin breached $88k levels even as $3.6 billion was exited by investors within four days.

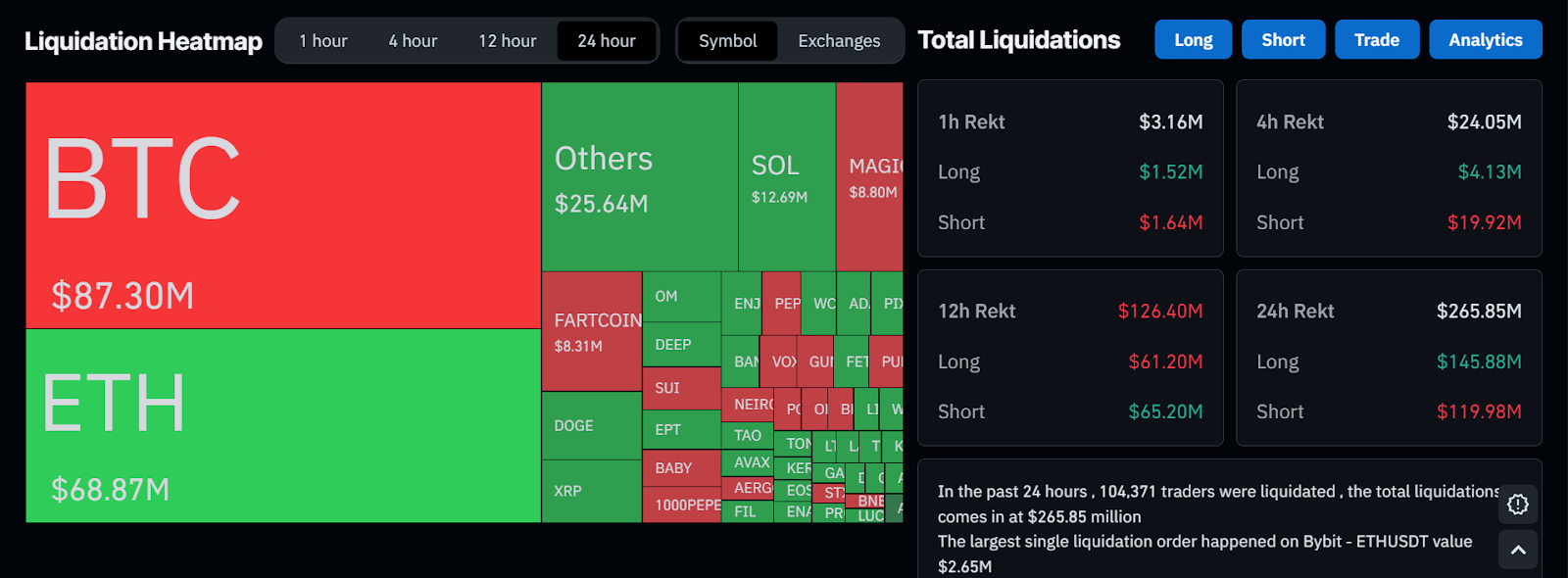

- Over 104,000 traders were liquidated in 24 hours as BTC went against the overall risk aversion trend.

Despite a wave of capital outflows sweeping the crypto market, Bitcoin broke past $88,000, defying bearish expectations. Crypto analyst Ali Martinez has reported that big money was withdrawn from the market for four days in a row: $630 million on April 17, $760 million on April 18, $1.27 billion on April 19, and $971 million on April 20. The total, around $3.6 billion, stems from conservatism and book profit, though it was insufficient to deflate the Bitcoin rally.

That trend stayed intact in the following months as Bitcoin’s rise set the pace for the entire market to surge to $2.76 trillion in total market capitalization. The asset is now hovering slightly above its April highs at around $2.45 trillion, a level that was both a resistance and support level. This suggests that bulls may be regaining the upper hand even if there is volatility in the market.

Investor sentiment also seems to be recovering at the same rate as well. The Fear and Greed Index is now at 47, the highest score since late March, which means that there has been a transition from extreme fear to neutral. This behavioral change has previously been followed by higher market strength, especially when combined with macroeconomic fundamentals.

Liquidations Mount as Bitcoin Defies Risk-Off Sentiment

This came against the backdrop of equities declining as rising trade tensions between the US and its partners intensified. The current unstable atmosphere created by new tariffs and failed negotiations with countries such as China and Japan have made traditional markets unpredictable and uncertain. Simultaneously, the dollar dropped significantly, and gold price hit $3,500 – an indication of investors seeking safety in other markets.

Bitcoin seems to be capitalizing on that trend. It has risen by 1.16% within the past 24 hours while experiencing enormous trader liquidations. Coinglass also reported that more than 104,000 traders were wiped out in a single day with a total loss of $265.85m. Long positions suffered the biggest blow, from which $145.88 million were eroded, while the shorts incurred losses of $119.98 million. Bitcoin posted the highest liquidation figures of $87.3 million, with Ethereum taking second place with $68.87 million.

However, there are clear signs that large holders are coming back into the market again. According to Glassnode, Bitcoin wallets with over 1,000 BTC rose to a four-month high. These levels were last witnessed in the immediate aftermath of Donald Trump’s win in November 2024, when a lot of people were accumulating them.

The rally comes amid rising trust in Bitcoin as being an inflation hedge. Bitget Research further noted that the exchange between Bitcoin and gold has favorable indications of its safe-haven status. BitMEX co-founder Arthur Hayes proposed this to be the last chance to purchase BTC below 100k, citing buyback of the US Treasury bonds as the source of the upcoming liquidity boost.

Ethereum DApp Rankings: Morpho Tops Weekly Volume With Lower User Base

Morpho leads Ethereum DApp rankings with $39.57B weekly volume, while Uniswap V4 tops in user activi...

CrossFi Offers Native $XFI Staking Protocol to Enhance User Engagement

As per CrossFi, the platform is unveiling Native Staking Protocol that will comprise $XFI tokens, en...

CTF Token Trades Sideways as Market Awaits Post-Rally Breakout and Supply Burn

CTF Token consolidates after surging to $748.50, with key resistance at 0.15 and a 1M token burn set...