Singapore Exchange Enters Crypto Derivatives Market with Bitcoin Futures Offering

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The Singapore Exchange (SGX) has revealed plans to introduce Bitcoin perpetual futures before the end of 2025, targeting institutional and professional investors.

This marks SGX's strategic

move

to expand its product suite amid growing global interest in crypto assets. It aligns with broader trends of traditional financial institutions integrating crypto products.

Notably, unlike traditional futures contracts, perpetual futures do not have an expiration date. This allows investors to trade continuously based on the direction of

Bitcoin

prices.

Bolstering Institutional Confidence in Bitcoin

Industry leaders believe SGX’s entry into crypto derivatives is a significant step in framing Bitcoin as a legitimate asset.

Darius Sit, founder of the crypto-asset trading firm QCP, noted that SGX's Bitcoin product would serve as a strong signal to institutional investors. Specifically, he claimed it helps position Bitcoin not as a speculative asset but as one worthy of consideration as an investment-grade instrument.

Ong Chengyi, APAC head of policy at Chainalysis, echoed this sentiment. Chengyi described the move as a step toward firmly establishing

Bitcoin as a legitimate investment asset

suitable for inclusion in professional portfolios.

Shi Le, managing director at crypto trading firm Auros, pointed out that perpetual futures are popular in the crypto trading arena. However, SGX’s product introduces a regulated alternative. Given its familiar and accessible structure, this could appeal more to participants from traditional finance.

Moreover, the product could be a hedging tool for institutions, similar to how

ETFs

brought crypto into mainstream investing.

Furthermore, Chengyi highlighted that SGX’s Bitcoin perpetual futures offer a transparent avenue for institutional investors to enter the crypto market while mitigating counterparty risks.

According to Robert Krugman, Broadridge's executive, the launch could also prompt exchanges worldwide to consider offering comparable products.

Notably, SGX will prioritize risk management and market integrity as it introduces this new product. Etelka Bogardi of Norton Rose Fulbright emphasized that the exchange must follow stringent procedures under Singapore’s Securities and Futures Act. These procedures include tools like leverage limits, margin requirements, standardized contracts, and clearing controls.

Looking Ahead

With major global financial institutions like Standard Chartered and Fidelity already active in crypto custody, SGX’s entry into perpetual futures may only be the beginning. The launch could catalyze further institutional interest and set the stage for broader crypto product innovation in regulated markets.

As QCP’s Darius Sit put it:

“Hopefully, this is the first Bitcoin product of many to come.”

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/501427.html

Related Reading

Tether Releases First Gold Token Attestation: 7.7 Tons of Gold Back $770M XAUT Supply

The world’s largest stablecoin issuer, Tether, has released its first formal attestation for its gol...

Coinbase to Launch Bitcoin Yield Fund for Non-US Investors

Coinbase Asset Management is preparing to introduce a new investment product that will generate stea...

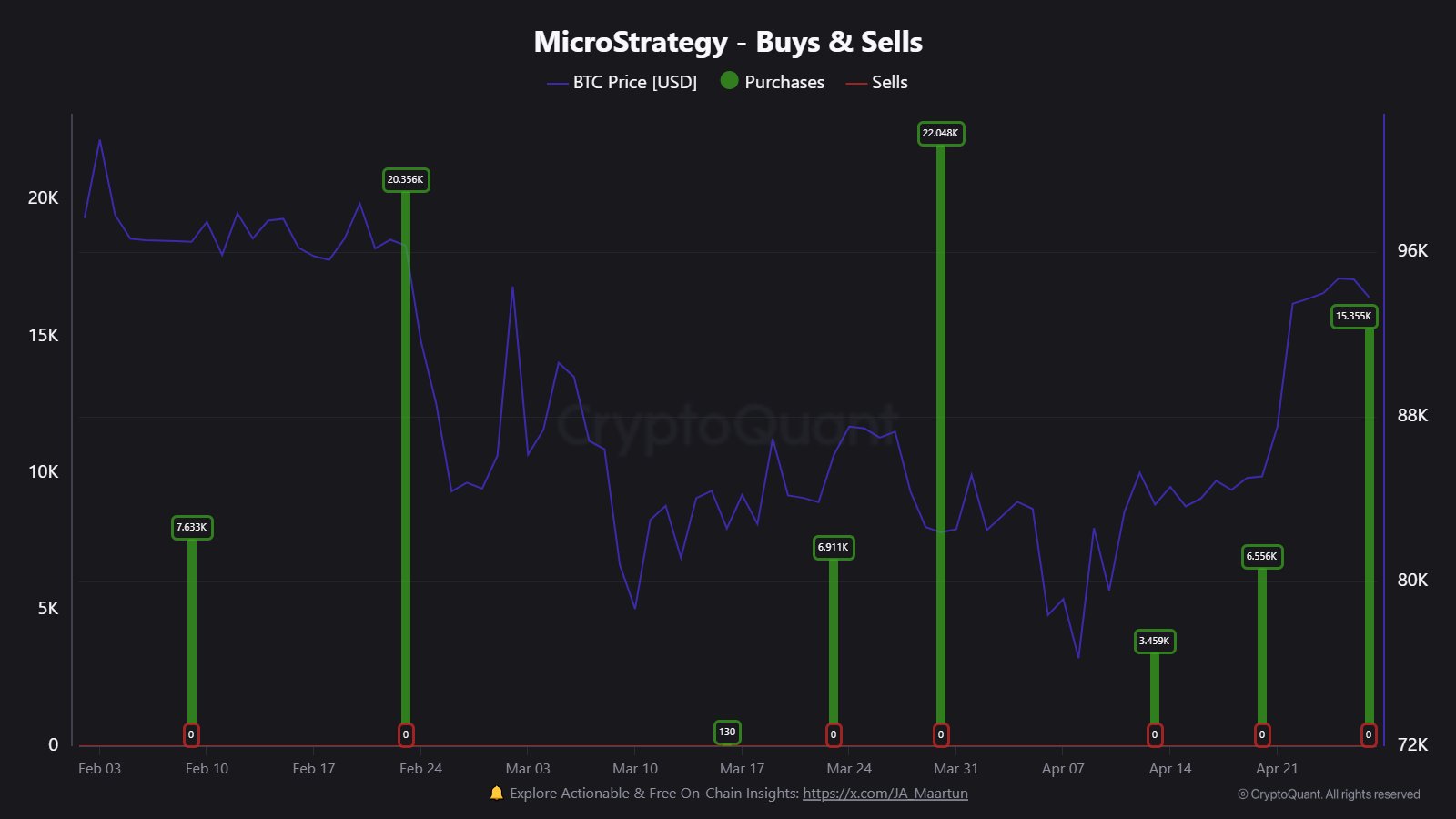

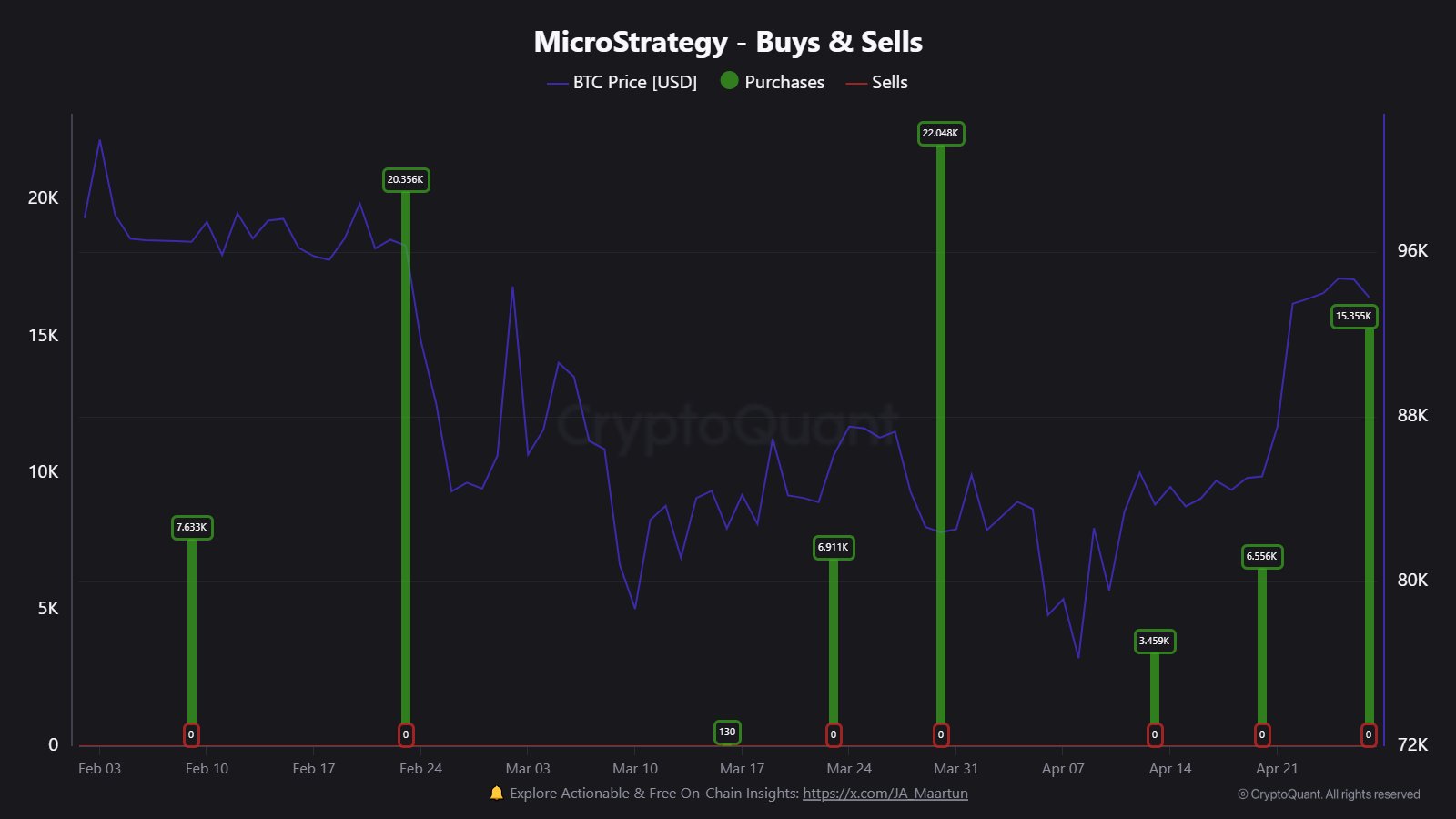

Michael Saylor’s Strategy Further Deepens Bitcoin Holdings with Latest Acquisition of 15,355 BTC

Strategy is back in the headlines after splashing massive cash to secure a new batch of Bitcoin toke...