M31 Capital Ranks First in Crypto Fund Retail ROI Performance

- M31 Capital leads with highest retail ROI at 2,530.9x among active crypto funds.

- Top-performing funds focused on early-stage Web3 infrastructure and consumer projects.

- Retail ROI data highlights fund selection impact on investor outcomes in token sales.

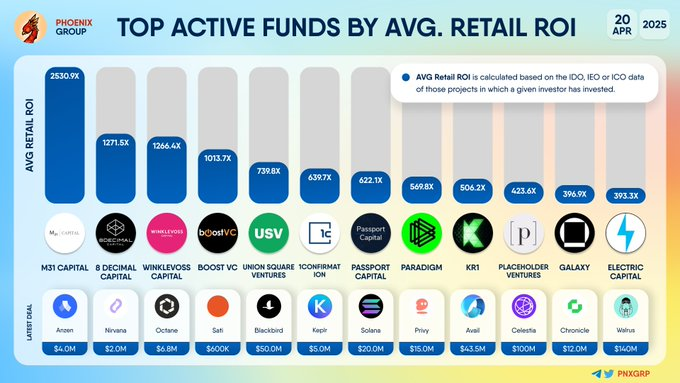

According to data released by Phoenix Group on April 20, 2025, M31 Capital has posted the highest retail return on investment (ROI) among active crypto venture funds. The findings are based on aggregated token sale performance, including Initial DEX Offerings (IDOs), Initial Exchange Offerings (IEOs), and Initial Coin Offerings (ICOs), providing a view into how early-stage crypto backers have influenced retail-level profitability.

The list compares multiple investment firms by the average ROI of retail participants who invested in token launches involving projects backed by these funds. M31 Capital topped the ranking with a retail ROI of 2,530.9x, leading a diverse set of firms that vary in strategy and asset exposure.

Strong ROI Figures Highlight Top Performers

Trailing M31 Capital, 8 Decimal Capital secured the second position with a 1,271.5x ROI, while Winklevoss Capital followed closely in third with a 1,266.4x return. These funds have participated in various early-stage ventures focused on infrastructure and consumer tools, with 8 Decimal backing Nima in a $6.8 million raise and Winklevoss Capital investing in Octane.

Boost VC came in fourth with a 1,013.7x average ROI. Its performance was supported by investments in projects such as Sati and Blackbird, indicating a pattern of exposure to emerging protocols and startup platforms.

Union Square Ventures (USV), a firm known for its involvement in early Web3 adoption, ranked fifth with a 739.8x ROI. This ROI metric represents the average returns earned by public investors who followed USV into token sales for crypto-related projects.

Mid-Tier Funds Show Consistent Gains

Several funds reported solid returns beyond the top five. 1Confirmation achieved a 639.7x ROI, while Passport Capital posted a similar 622.1x figure. Paradigm, which maintains a broad investment approach across the crypto space, reported a 569.8x ROI.

KR1 ranked next with a 506.2x ROI, followed by Placeholder Ventures at 423.6x. These numbers demonstrate sustained value creation for retail investors despite varying market cycles and project categories.

Despite these mid-cap funds not boasting themselves at the rate of the leading players, their fairly stable returns demonstrate the role of appropriate project identification and rapid entry into the rounds of Blockchain financing.

Galaxy and Electric Capital Close Out the List

Galaxy and Electric Capital rounded out the top 10. Galaxy posted a 396.3x ROI, while Electric Capital followed with 393.3x. Both were linked to recent fundraising rounds by Chronicle, a Web3 infrastructure project. Electric Capital contributed a $140 million raise, while Galaxy took part in a separate $12 million investment in the same project.

This information features Phoenix Group’s recent mergers and acquisitions, as well as the top funds’ performance. M31 Capital’s investment in Arcon ($4 million) signals its continued focus on Web3 infrastructure. These entries effectively provide a real-time snapshot of how each fund is actively participating in the digital asset market at any given time.

$52.78M in SOL Withdrawn from Binance Signals Bold Market Play By a Whale

A big whale has executed an unexpected SOL transaction recently. The whale executed a withdrawal of ...

Atok, Bitgert to Redefine Web3 Infrastructure and Advertisement

The partnership aims to leverage the digital advertising forum of Atok and the resilient blockchain ...

XRP ETF listed in the United States: SAVVY MINING teaches you how to make $28,800 a day with XRP and DOGE

XRP’s first 2x leveraged ETF launches on NYSE Arca as investors flock to SAVVY MINING for simple, hi...