FTX Unstakes $21.5M in Solana, $619M Still Locked as Market Watches for Next Move

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The bankrupt crypto exchange FTX has just unstaked a significant batch of Solana tokens set for potential liquidation.

On-chain data reveals that FTX unstaked 186,300 SOL tokens worth roughly $21.56 million from the wallet address "H4yiP…Z6agF" earlier today. The unlocked funds remain in the wallet at press time, with no further actions.

Meanwhile, the wallet still holds a massive 5.36 million SOL worth roughly $619 million, which remains staked but is in the process of unlocking.

FTX’s Ongoing Solana Liquidation

This isn’t the first time FTX-related wallets have raised alarms within the Solana community. The latest unstaking is part of what appears to be the defunct exchange’s

monthly token liquidation cycle

.

Just a month ago, an FTX-associated address unstaked 185,345 SOL tokens, valued at approximately $23 million. Shortly after, it distributed the funds across 38 addresses, including major exchanges like Binance and Coinbase.

As one of the largest holders of SOL, FTX’s continuous unstaking sparks recurring concerns about market dumps. Since November 2023, data indicates that FTX has unstaked and sold off around 8 million SOL tokens, with a total value exceeding $1 billion.

https://twitter.com/spotonchain/status/1899992964296040930

With the latest unstaking event, market observers are closely monitoring the situation, particularly during a turbulent time for Solana, which has seen its price crash by 43% over the past eight weeks.

If the newly unlocked SOL is liquidated, it will bring the total amount sold by FTX to approximately 8.2 million, with an estimated value of $1.05 billion. This could jeopardize Solana’s recent rebound. The token has seen a 6% gain in the past 24 hours, pushing the price to $119.65.

FTX Repayment Efforts Underway

Meanwhile,

repayment efforts are ongoing

in the FTX bankruptcy proceedings. Recent reports indicate that around 400,000 former FTX users have not completed the required identity verification process.

Collectively, these users risk losing over $2.5 billion in potential repayments if they fail to verify their identities before the extended deadline of June 1.

The upcoming repayment round will distribute more than $11 billion to creditors. Under the proposed plan, 98% of creditors could receive at least 118% of the value of their original claims.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/499686.html

Previous:AB慈善基金会正式启动 探索“制度信任 + 技术驱动”的全球公益新范式

Next:逍遥kol:大饼以太哆箜双杀再次获利

Related Reading

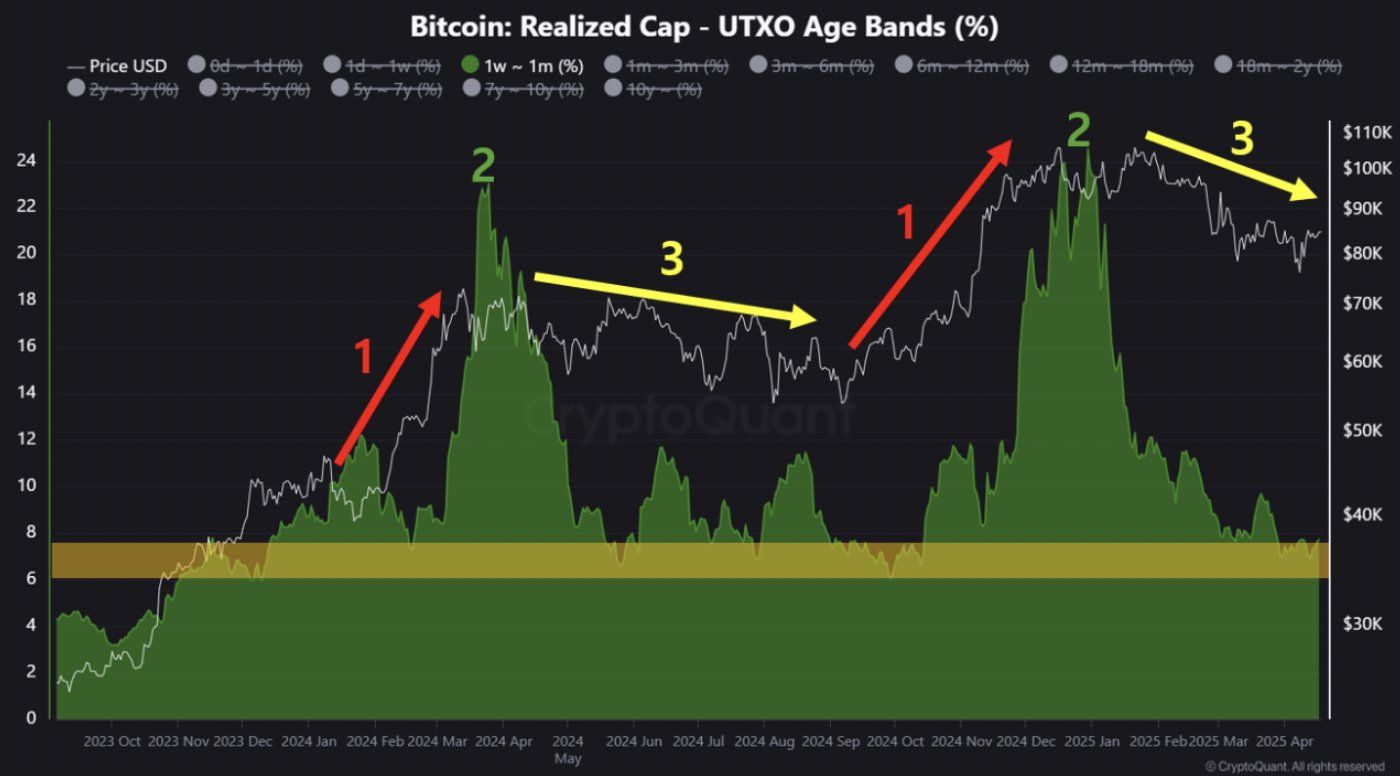

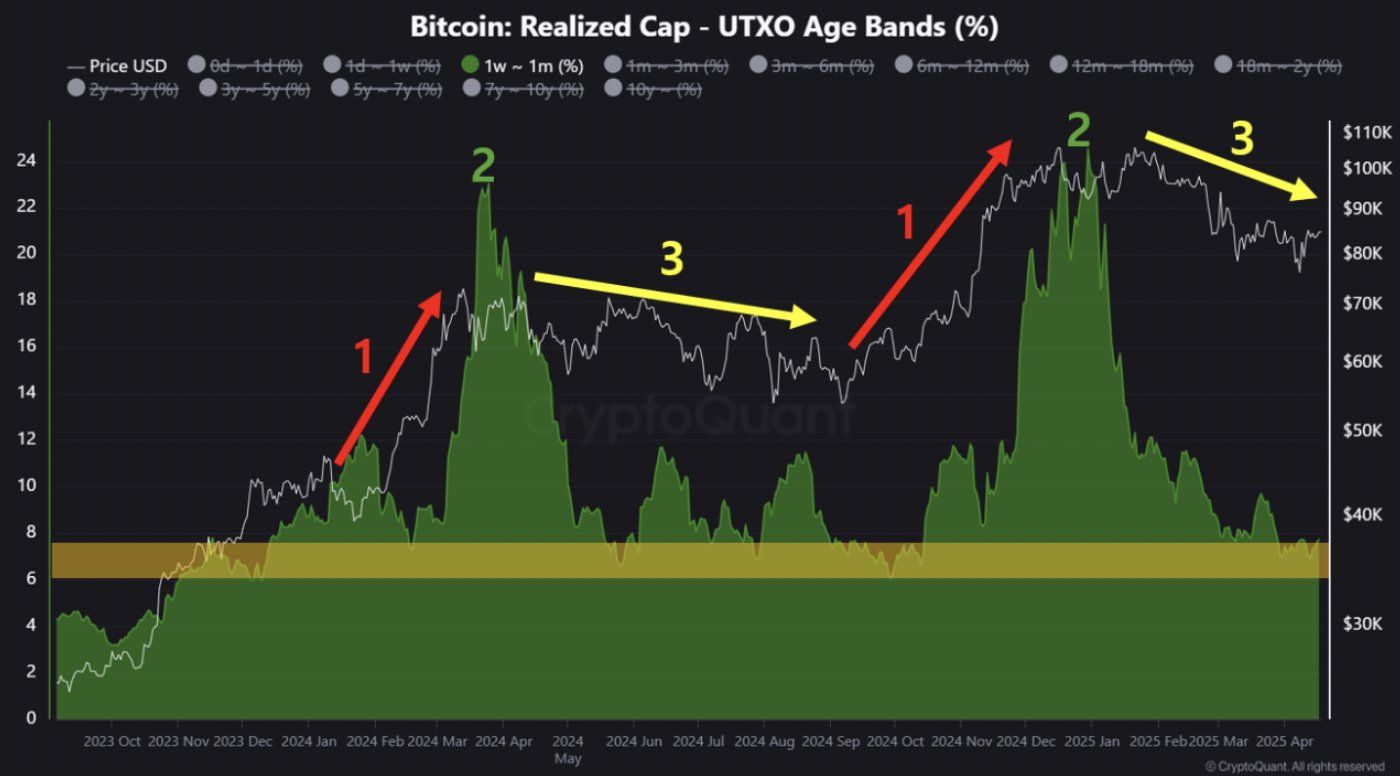

Bitcoin Overheating Phase Hits Bottom, Mirroring 2024 Pre-Blow-Off Top Setup: Details

Although the Bitcoin market has faced challenges since the start of this year, new insights suggest ...

Spar Supermarket Debuts Bitcoin Payment in Switzerland Outlet

Spar supermarket, an international grocery chain, has introduced Bitcoin payment options in Switzerl...

Gemini Confirms Adding XRP to Free Trading Algorithms to Generate Passive Returns

Gemini has officially confirmed adding XRP to its selection of free trading algorithms, to provide u...