Bitwise Unveils 3 New ETFs to Help Investors Profit from Crypto Volatility

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Leading asset manager Bitwise has launched three option income strategy ETFs to help investors capitalize on the volatility in the crypto market.

The ETFs are Bitwise MARA Option Income Strategy ETF (IMRA), Bitwise COIN Option Income Strategy ETF (ICOI), and Bitwise MSTR Option Income Strategy ETF (IMST).

Notably, Bitwise

designed

the ETFs to give investors exposure to stocks of three crypto-related companies: Coinbase (COIN), Strategy (MSTR), and Mara Holdings (MARA).

Funds Features

The funds will generate income by selling out-of-the-money call options on COIN, MSTR, and MARA while maintaining a long position in the underlying stocks. Bitwise will distribute the income to investors monthly upon selling the call options.

Foreside Fund Services, LLC, will distribute the newly launched ETFs. It is noteworthy that Foreside is not affiliated with Bitwise or any of the company’s associates.

Active Management

A portfolio management team from Bitwise, led by Jeff Park, the company's head of Alpha Strategies, will manage the funds daily.

Furthermore, the team, which consists of four members, will actively monitor developments within the crypto market. This includes industry capital flows, market sentiment, option pricing, regulatory updates, and other crypto-related developments.

The active management of these funds is crucial in ensuring that investors remain exposed to the underlying stocks' performance and participate in the income generated from the options.

https://twitter.com/BitwiseInvest/status/1907780427001073703

Caveat

Meanwhile, Bitwise urged potential investors to consider the investment objectives, risks, expenses, and charges before investing in the ETFs. It clarified that investing in ETFs does not give investors direct ownership of the underlying stocks.

Furthermore, Bitwise highlighted a covered call risk whereby income generated from the options sale may be insufficient to offset losses if the underlying stock’s price crashes.

Notably, Bitwise remains one of the largest crypto index fund managers. It boasts over $5 billion in assets under management (AUM) across its investment products, including its

dual Bitcoin and Ethereum ETF

.

The company seeks to introduce more investment products, particularly spot crypto ETFs, in the United States. It has filed with the U.S. SEC to launch separate ETFs for

XRP

,

Dogecoin

, Aptos, and Solana.

The SEC has acknowledged these filings, with sources speculating that some of the funds, especially those tied to XRP and Solana, might launch this year.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/498114.html

Related Reading

Here’s How high Dogecoin Price May Reach by 2030 if DOGE Rises 10% Per Month

Dogecoin holders could see a cumulative gain of 228X by 2030 if DOGE stages a consistent 10% monthly...

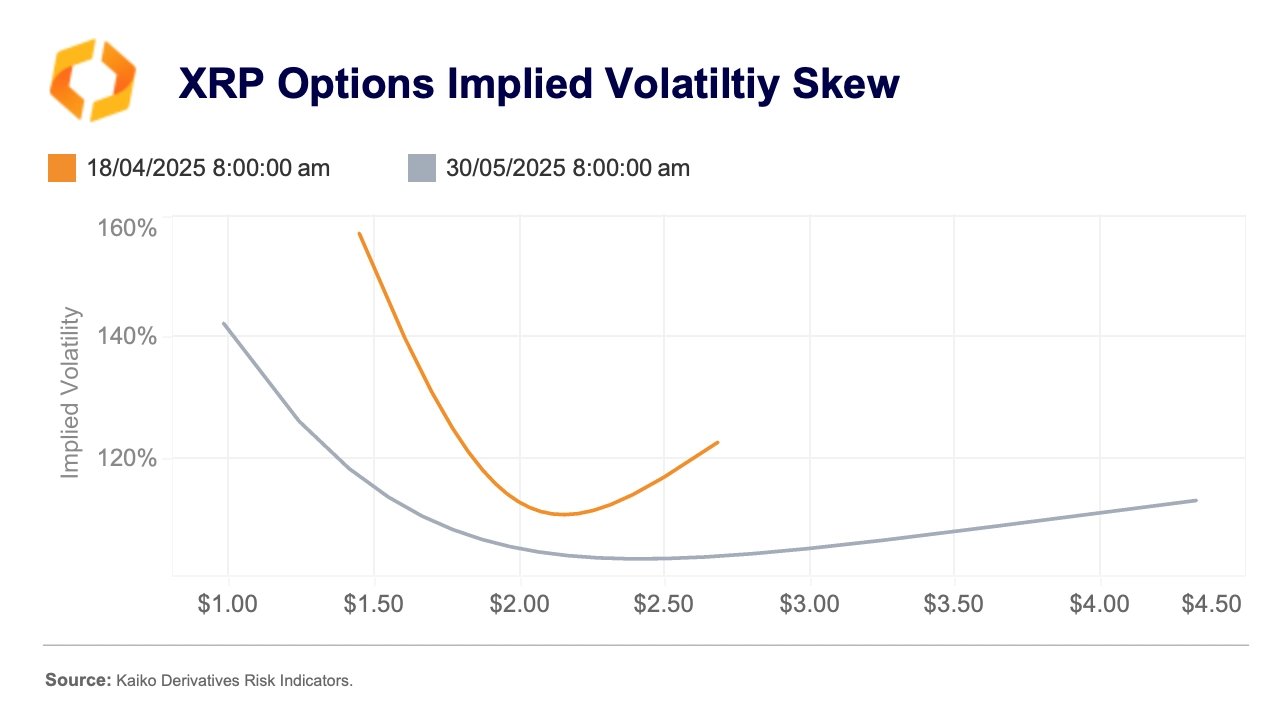

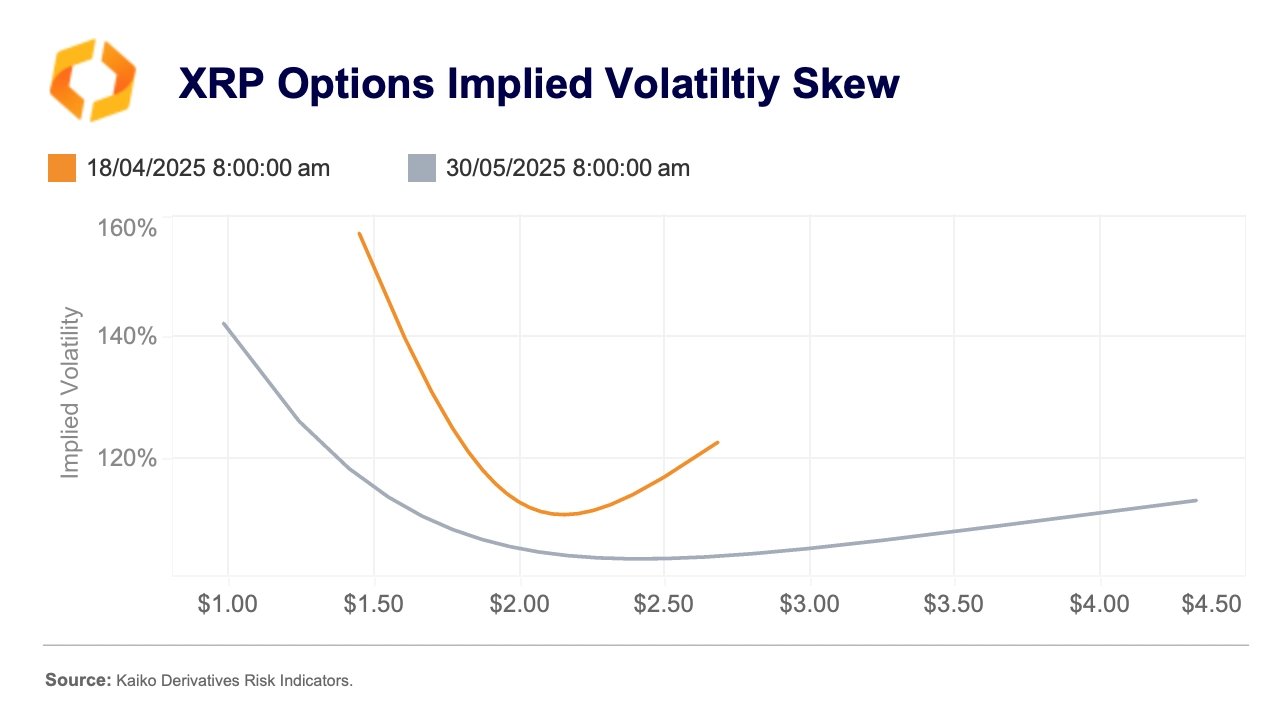

XRP Options Market Skewed Bearish Despite Positive Tailwinds

Despite a wave of bullish developments surrounding XRP, options traders on Deribit are pricing in ca...

Elliott Wave Setup Signals Shiba Inu May Skyrocket 741% Above $0.0001, Says Top Analyst

A notable market analyst has provided an update on Shiba Inu path to a new all-time high using the E...