Economic View: More Pain for Cryptos

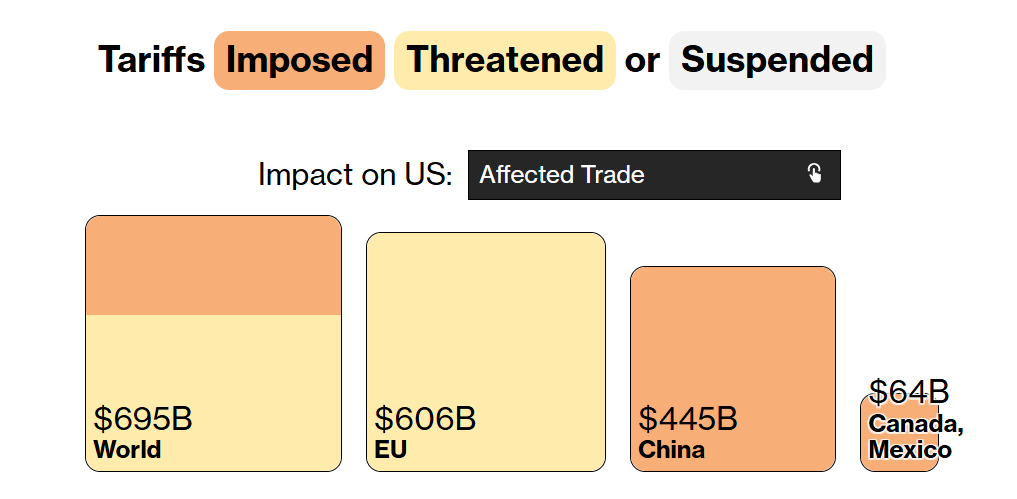

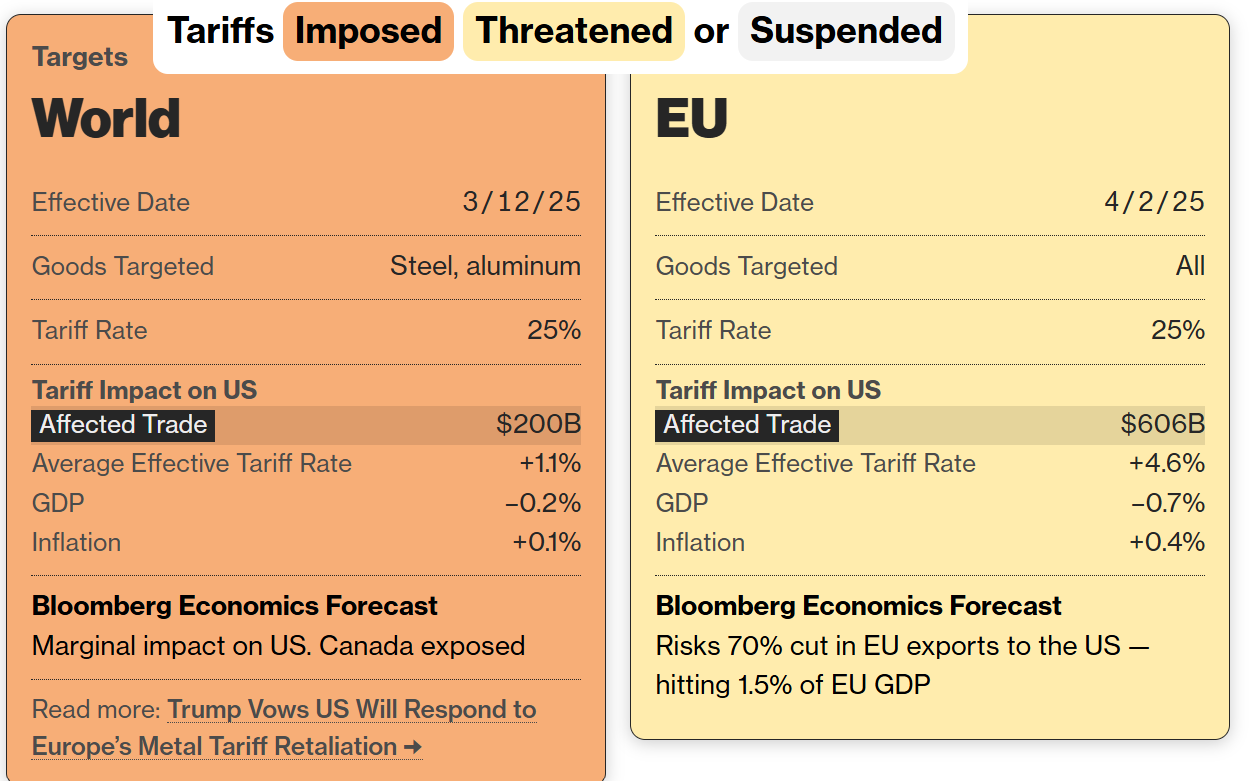

In only a few short months, US President Donald Trump has completely turned the $24 trillion global trade market upside down.

He has warned of additional actions on the way and imposed heavy duties on top trading partners and countries that are economic rivals. Trump has shifted gears and halted some raises in an effort to coerce concessions from countries by threatening them.

Will those countries fall in line or respond with tit-for-tat tariffs themselves, has the world watching.

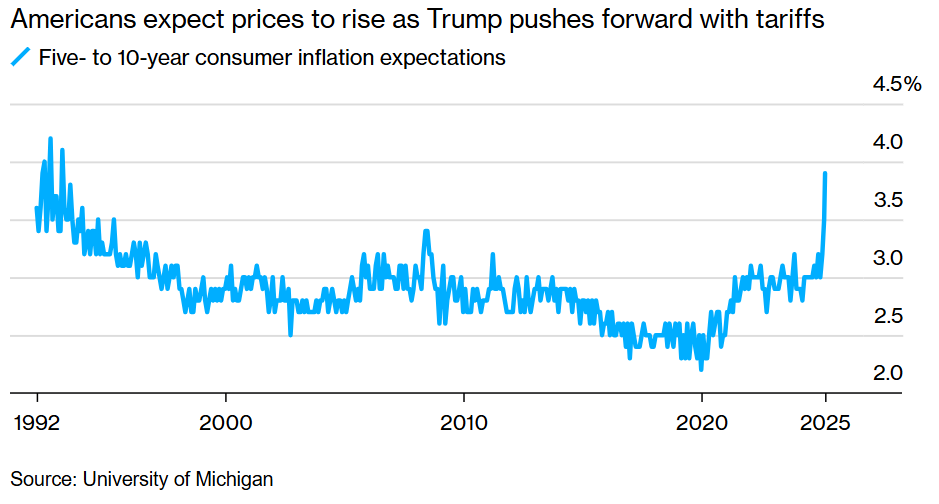

Globally, everyone is learning how precarious price stability can be, right when it seemed like the Great Inflation era had just about ended due to the pandemic closures and fallout.

Trump has indicated his intention to move forward with more forceful actions despite the uncertainty and possibility of a recession roiling financial markets.

On April 2, he intends to penalize American businesses with trade obstacles beyond import taxes and implement so-called reciprocal tariffs on countries that sell much more to the US than they import from it.

For cryptos, global economic health is a cause for concern as the wider adoption gained traction with a pro-digital assets administration in the US.

The moves in crypto markets since Trump's inauguration day surge is a clear sign of the momentum squeeze despite several digital asset-friendly policies.

The macro headlines are weighing on one sector, which was predicted to go just one way—up.

The directional bias now is more for a downward trend.

However, cryptos have moved in the other direction, similar to risk assets, with the correlation between tech-heavy Nasdaq and Bitcoin becoming even more pronounced in the deep sell-off on Wall Street and global markets.

With no let-up in Trump's economic broadsides, the digital asset sector eyes more pain ahead, with the next trigger of Federal Reserve rate cuts under economic strain becoming more of a bane rather than a boon.

Stagflation fears have made a comeback, and data on Tuesday showed consumer confidence in the US tumbling again to the lowest level since early 2021 after the COVID-led fallout back then.

According to analysts, tariffs will hinder growth since higher product costs strain household budgets. Businesses may be hesitant to invest or hire due to Trump's inconsistent and unpredictable threats.

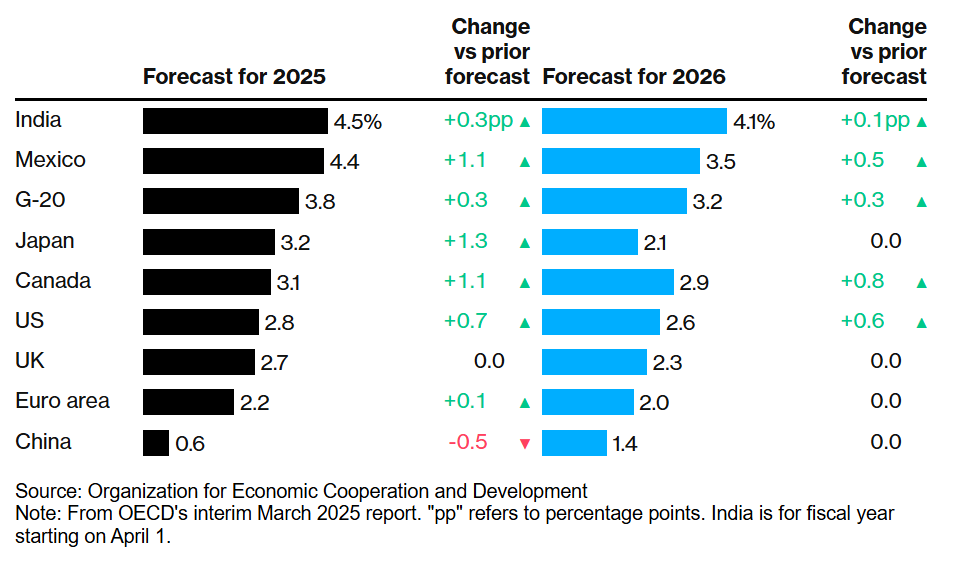

The estimated figures for the impact of tariff wars suggest that the US will take a bigger hit and that it will also weigh on the global economy.

Pandemic Stress Returning?

A worldwide energy crisis in 2021 fueled the fire of price increases caused by COVID-19-related supply-chain disruptions and lockdowns. Because of this, monetary policy tightening was more vigorous and coordinated than in the previous 40 years.

While major central banks successfully brought inflation down from multidecade highs, their progress has now paused. Trump's tariff battle could lead to price increases again, slowing economic activity.

Those stagflation fears will complicate the Fed's course as well.

Companies in the United States will have to pay more because of Trump's tariffs, which are charged for imported goods.

Companies could choose to absorb these additional expenses and maintain their current pricing structures, but they will likely raise prices to transfer part of the financial burden to their customers.

This was evident during Trump's first term's trade war.

Now, it looks even more like a bad economic hit job, weighing on every asset class, with moves in cryptos even more pronounced during the fall this year.

The massive tariffs Trump has levied this time around could affect more consumer goods, like computers and stainless steel cookware, making them more widely felt in the US than during his first term.

The issue now is not whether the effect on prices will be short-lived but whether it will be permanent and more damaging.

The market reaction suggests the price impact will be longer-lasting.

According to US Treasury Secretary Scott Bessent, a "one-time price adjustment" may be possible.

However, even a one-time abrupt increase could negatively impact consumers, and if inflation expectations increase, it could trigger a vicious cycle of escalating wages and prices.

The Organization for Economic Cooperation and Development (OECD) has raised its inflation forecasts for major nations for this year and next compared to its previous predictions from December.

OECD's Inflation Projections

As a result of the trade war, inflation is likely to be higher than anticipated.

Bitcoin's price moves this year tell us a compelling downward narrative from a record high on 'Trump in the office' euphoria.

The OG token rose to a new all-time high of above $109,000 on Trump 2.0's first day but has since fallen significantly to below $88,000—about a $21,000 fall in price action.

April 2 becomes a new event date for cryptos, and the broad plans and expectations include a watered-down tariff play.

However, at this point, it's difficult to predict what Trump will do.

Elsewhere

Blockcast

Chris Yu co-founded SignalPlus in 2021 to address key gaps in the crypto options market, leveraging his experience as a trader and his insights into the market's early-stage potential.

In this Blockcast episode, Yu explains why he sees the state of crypto options resembling the FX options market around 2000 and why there is an opportunity to build infrastructure that could scale with the industry's growth.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Options Point to Bitcoin Below $80,000 Bets

There are significantly more put options being traded than call options, suggesting a prevailing exp...

Southeast Asia Blockchain Week Cancelled Due to Myanmar Earthquake

The Main Conference was set to be held at TRUE ICON HALL in Bangkok, Thailand, from April 2nd to 3rd...

Will Bitcoin Fall Back Below $80k? Options Bets Say Yes

Your daily access to the backroom....