Crypto Pundit Claims XRP Will Hit $1,000 – Here’s The 10 Reasons Why

In a new video , CryptoSensei (@Crypt0Senseii)—the founder of the Cryptonairz community—laid out a comprehensive argument for why he believes XRP could soar to four- and even five-digit price territory. The video, titled “THIS WILL GUARANTEE A $1000 XRP PRICE,” focuses on ten key factors that, according to CryptoSensei, could significantly boost XRP’s adoption and market valuation in the coming years.

#1 Regulatory Clarity For XRP

CryptoSensei begins by underscoring the ongoing legal situation involving the US Securities and Exchange Commission (SEC) and Ripple Labs, mentioning the partial appeal of the court’s July 2023 ruling . While stressing that the appeal does not designate XRP itself as a security, he notes that “we still have the case against Brad and Chris [referring to Ripple executives] going.”

The resolution of these legal hurdles, he argues, is crucial for broader institutional adoption within the United States. “If we want the type of movement we’re looking for inside the US, we need those things to come to an end,” CryptoSensei says, alluding to the potential for major banks like Bank of America, Wells Fargo, and BNY Mellon to officially engage with XRP once regulatory clarity is achieved.

#2 Institutions Standing By To Use XRPThe video highlights a series of statements from major financial institutions, including the CEO of BNY Mellon, who indicated that crypto custody and tokenized assets are among the bank’s future priorities. According to CryptoSensei, banks are “ready to jump in,” but are hesitant to make large-scale commitments without clear regulatory guidelines. He emphasizes that if XRP were to host “even 5 or 10%” of a multi-trillion-dollar global tokenization market, the price could reach four- or five-digit figures.

#3 Potential SEC Case DropsA noteworthy discussion point is the SEC’s recent trend of dropping cases (or opting not to pursue them) against certain crypto firms. CryptoSensei mentions that the Commission “dropped the case against OpenSea, Coinbase, [and] Robinhood,” suggesting a possible shift in enforcement strategy.

“Is Ripple, in fact, next? … If the [former] Trump administration wants to stand by their word of working with the crypto industry and not against them, I do believe this is coming,” he posits.

#4 Tokenization Of Real-World Assets (RWAs)Central to CryptoSensei’s thesis is the growing trend of tokenizing traditional assets—ranging from real estate to debt instruments—on blockchain networks. He cites Ripple Chief Technology Officer David Schwartz, who says the XRP Ledger (XRPL) could be “a really good platform” for these tokenization projects, thanks to its low fees, integrated decentralized exchange (DEX), and multi-asset support. Schwartz explained: “If someone’s going to buy or sell tokenized real-world assets, they want to be able to do that with whatever asset is convenient for them.”

CryptoSensei further highlights how Robinhood’s documentation from January 2025 (mentioned in the video) cites Ripple’s success in tokenizing hundreds of millions of dollars in real-world assets on the XRPL—projects that aim to expand into the billions and eventually trillions.

#5 Interoperability BridgesAnother critical piece is interoperability. CryptoSensei references the Axelar network, which is bridging the XRPL mainnet, the XRP Ledger EVM sidechain , and over 55 other blockchains. The expansion of cross-chain liquidity is described as “liquidity, liquidity, liquidity.” He points out that the XRPL’s design—integrating DEX functionality directly into the protocol—simplifies asset swaps and liquidity provisioning, boosting its appeal for large-scale tokenization.

#6 Cross-Border Payment SolutionsRipple’s long-standing focus on remittances and cross-border payments also features prominently. CryptoSensei shows a clip describing how a US-to-Mexico corridor, facilitated by XRP, can settle in mere minutes at a fraction of legacy fees. “All of that takes about 10 minutes, which used to be three days,” says a Ripple spokesperson in the included clip, also noting that these transactions can be up to “20-odd basis points cheaper.”

He argues that such improvements in speed and cost will eventually outcompete outdated correspondent banking rails, potentially capturing a significant portion of the multi-billion-dollar global remittance market.

#7 Collaborations With Key Global InstitutionsIn the video, CryptoSensei showcases the Bank for International Settlements’ (BIS) Cross-Border Payments Interoperability and Extension Task Force, listing Ripple alongside only a handful of major international payment networks—such as Mastercard, SWIFT, and EBA Clearing. He emphasizes Ripple’s unique position as the only blockchain infrastructure provider on the roster, describing it as a testament to the company’s significance in shaping next-generation payment standards.

#8 Treasury Market On XRP LedgerReferencing Ondo’s tokenization initiatives, CryptoSensei highlights the possibility of US Treasuries migrating onto blockchains, potentially including the XRP Ledger. He notes the US Treasury market alone stands at over $28 trillion, while globally, the bond market encompasses roughly $130 trillion.

“Could you imagine five or ten trillion dollars finding its way onto the XRP Ledger over the next five to ten years?” he asks, suggesting even a fraction of that capital would profoundly affect XRP’s valuation.

#9 Derivatives ExpansionAccording to the video, derivatives—often said to represent notional values in the hundreds of trillions to over a quadrillion dollars—are a prime target for on-chain tokenization. CryptoSensei points to Bitstamp, which is building a derivatives exchange on the XRPL. He believes that capturing a slice of these massive markets could drive significant demand for XRP, especially if large holders lock up tokens for long-term liquidity provisioning.

#10 Central Bank Digital Currencies (CBDCs)Finally, the pundit underscores Ripple’s work with various central banks on CBDC pilots . He cites projects under the Hong Kong Monetary Authority (HKMA) and notes that Ripple was recently named the top technology provider for CBDCs by Juniper Research. From the Bank of International Settlements to major economies in Asia, CryptoSensei posits that the institutional relationships Ripple has forged place XRP in a strategic position to bridge disparate currencies and networks.

“Ripple is working with up to 30 central banks,” he states, emphasizing that these ongoing partnerships may open doors for XRP to serve as a liquidity tool in sovereign-level digital currencies.

While some of the claims—such as XRP reaching “four or five digits”—are extremely bullish and hinge on multiple converging factors, CryptoSensei remains steadfast: if even a few of these catalysts unfold in Ripple’s favor, he envisions a drastically higher valuation for XRP.

Throughout the video, he stresses that regulatory clarity in the United States is the linchpin to unlocking widespread adoption. “If all of these things happen,” he concludes, “you better believe we’re looking at a four to five digit price.”

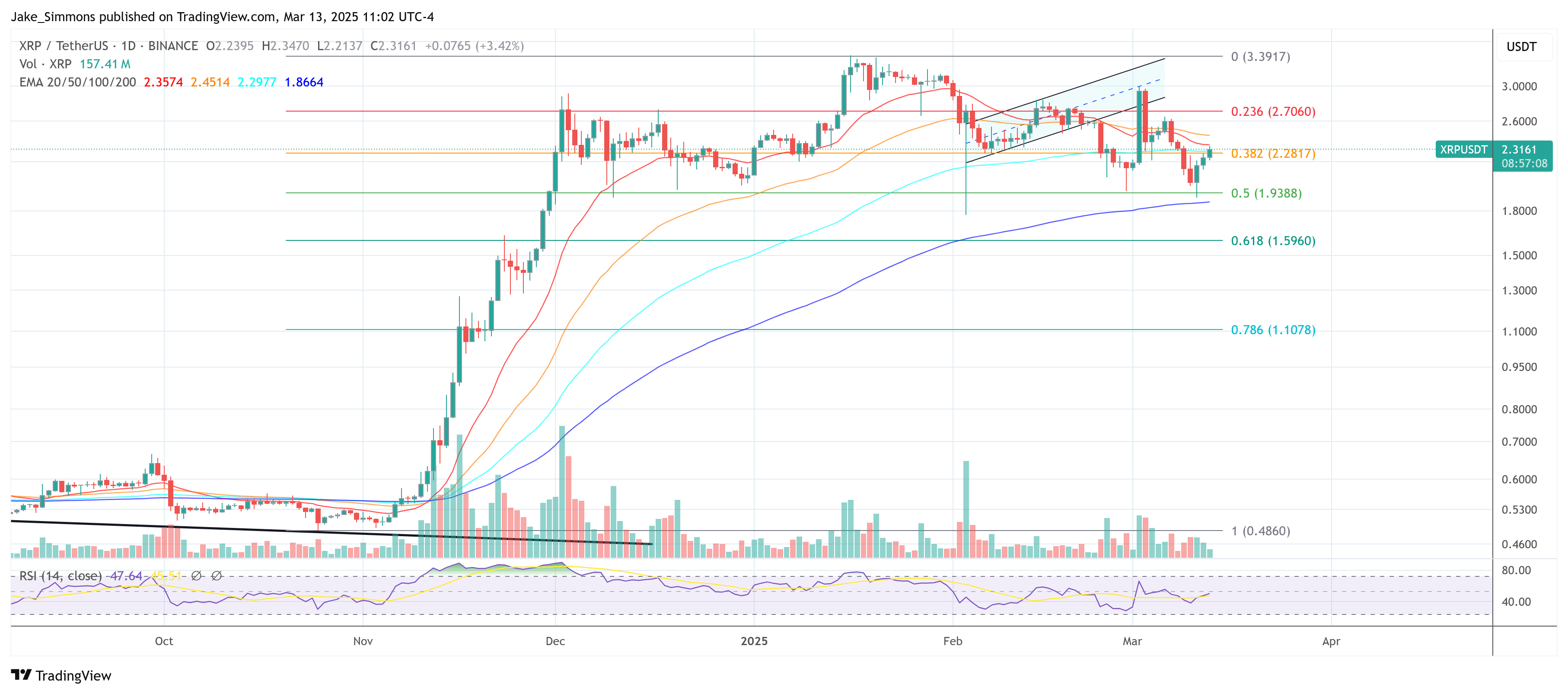

At press time, XRP traded at $2.31.

Crypto Faces Uncertain Future As Trump’s ‘Short-Term Pain’ Plan Unfolds

US President Trump’s outspoken acceptance of near-term economic hardship has placed risk assets—incl...

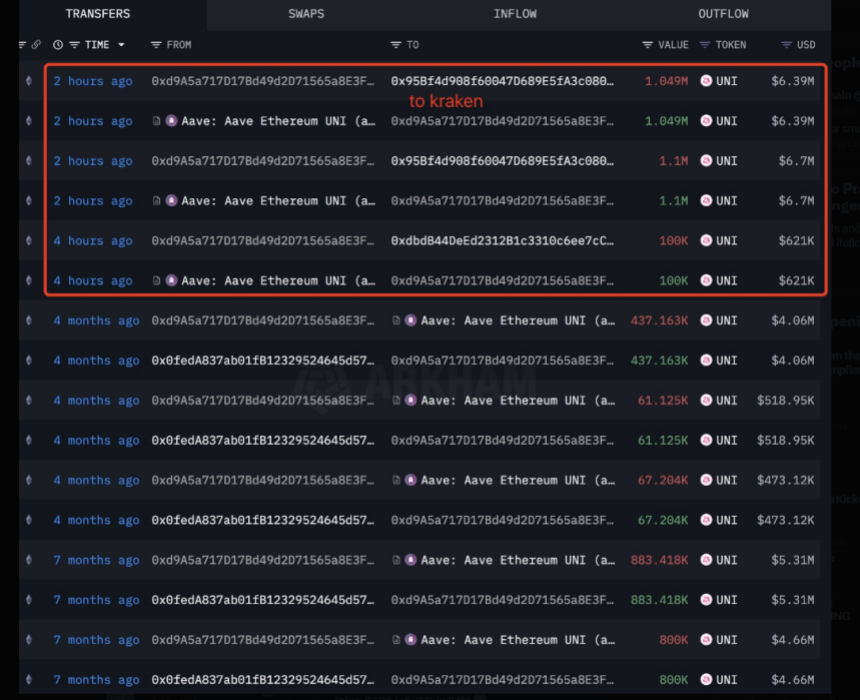

Uniswap Bleeds 20%—Is This Whale Behind The Drop?

One crypto exchange’s loss is another crypto exchange’s gain. This holds true with cryptocurrency ex...

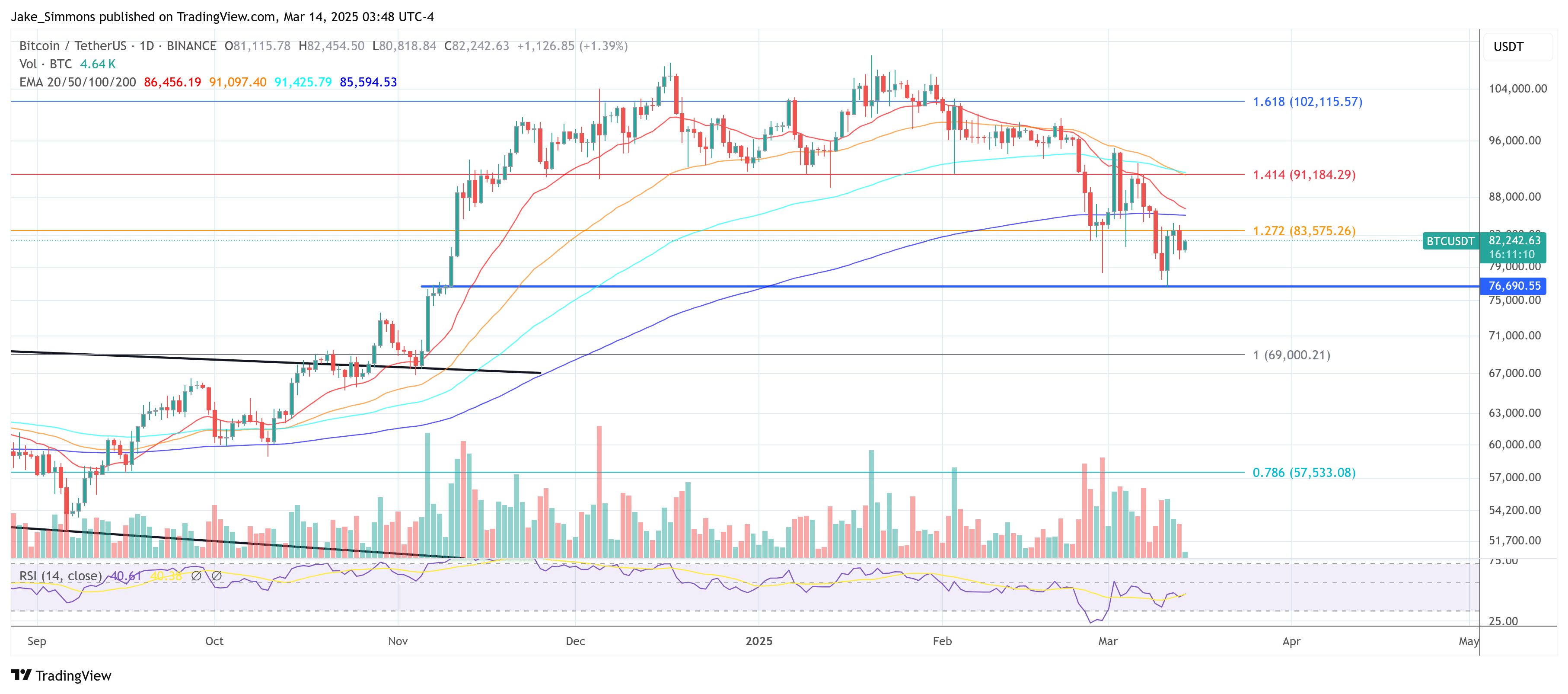

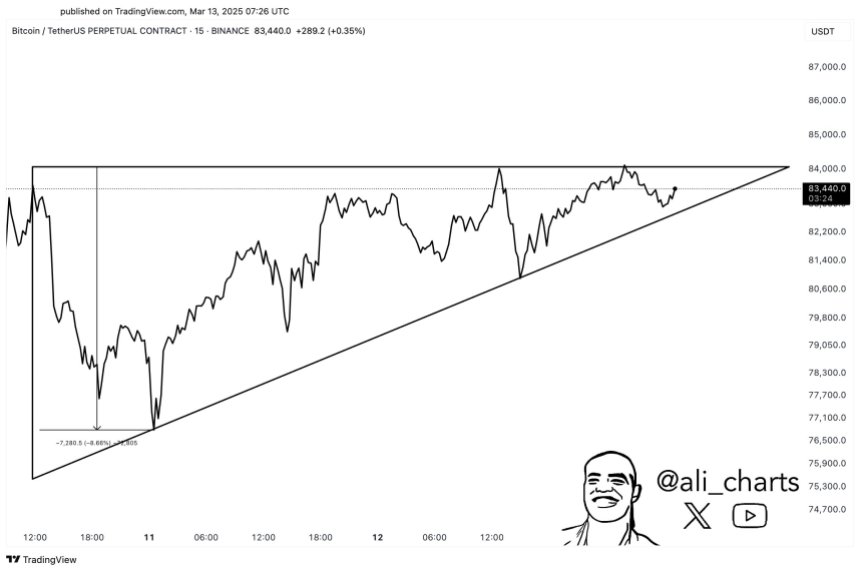

Bitcoin Faces Rejection At $84,000, But Analysts Show 2020 Similarities – Recovery Ahead?

Bitcoin (BTC) has failed to reclaim $84,000 resistance again and has fallen 4% to retest another cru...