SignalPlus宏观研报(20230815):美债收益走高,市场预测年底将重启加息

Favorite

Share

Scan with WeChat

Share with Friends or Moments

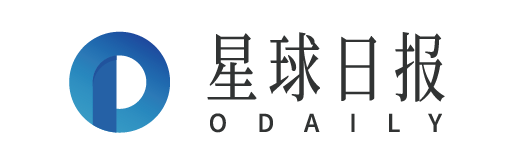

昨天对美国市场来说是相当安静的一天,没有任何值得关注的数据或事件,美债收益率继续走高, 10 年期收益率挑战了非农就业数据后约 4.20% 的高点,市场预测美联储 9 月加息的可能性仍低于 10% , 11 月加息可能性则略升至 30% 。

历经艰难的上周后,股市小幅反弹,主要由上周遭受重创的科技股带动;除了美元兑人民币外汇以外,大多数资产类别的交易量均大幅下降。

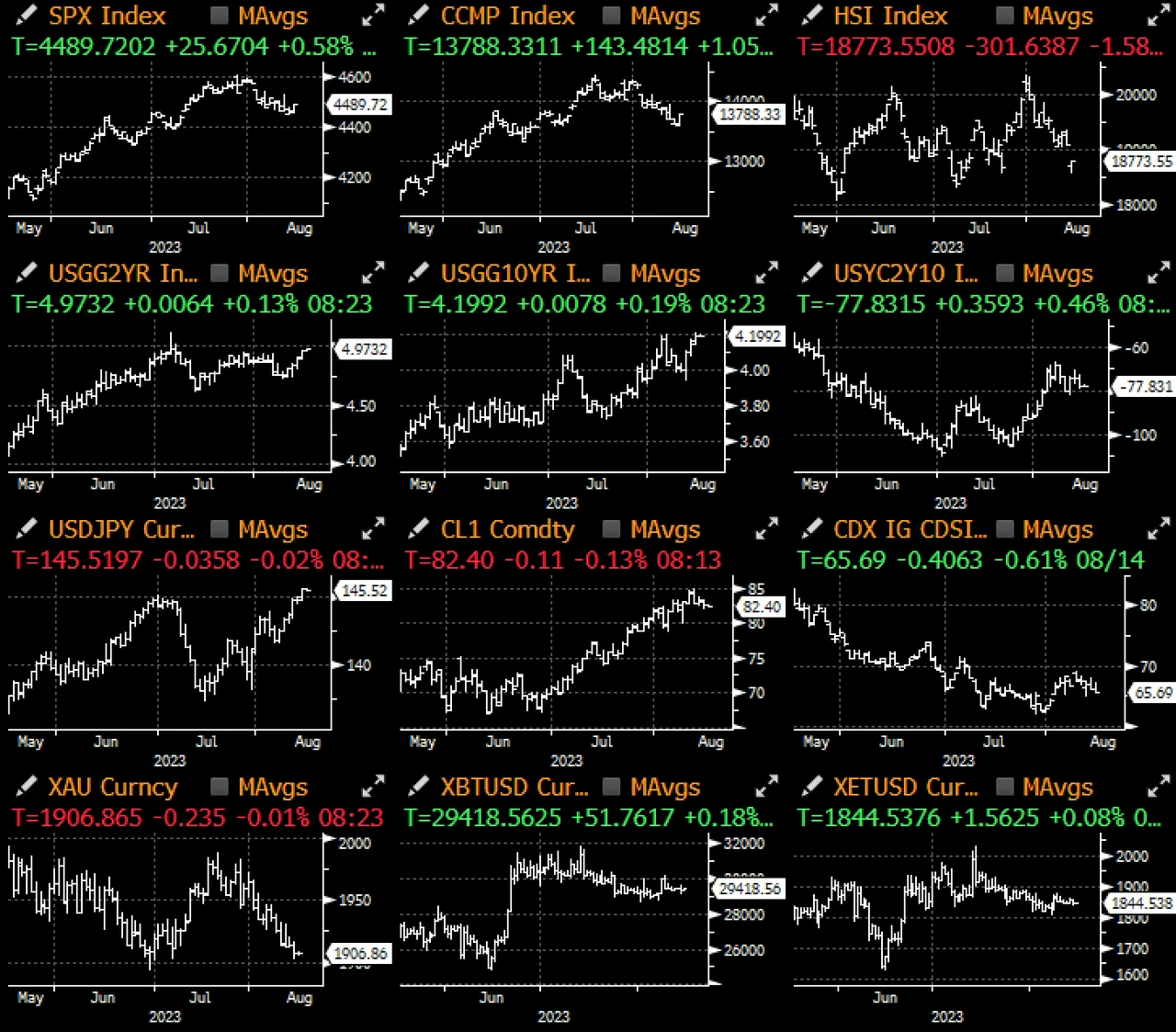

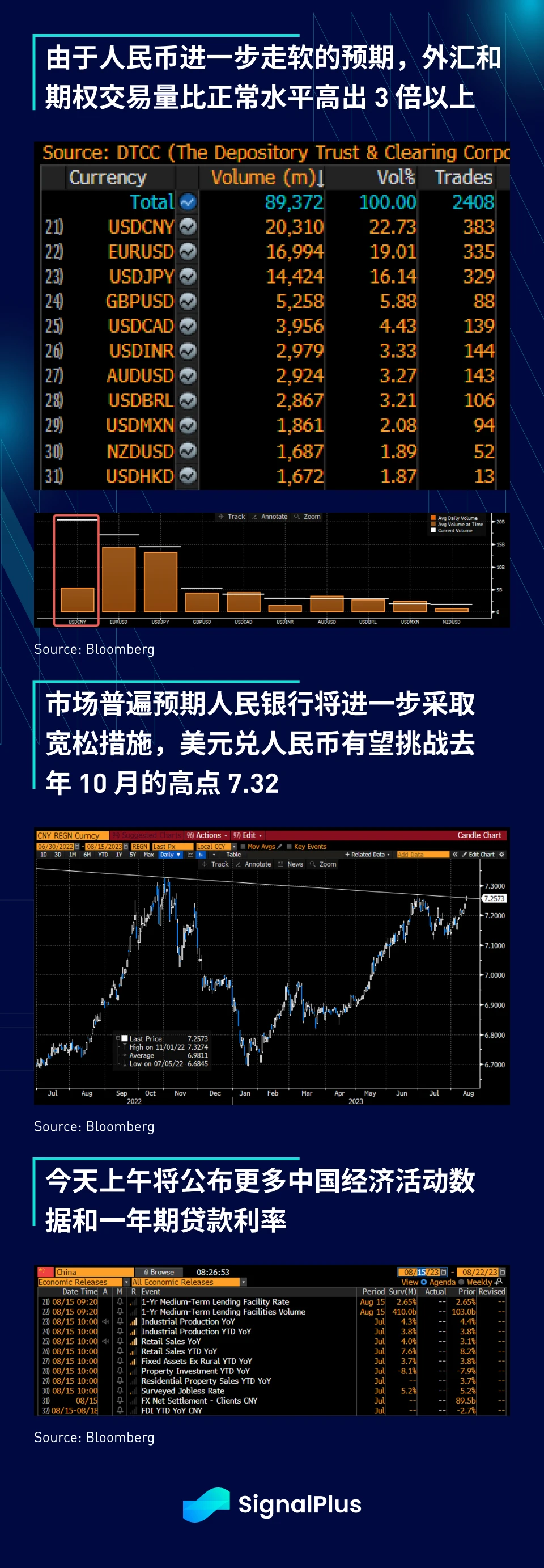

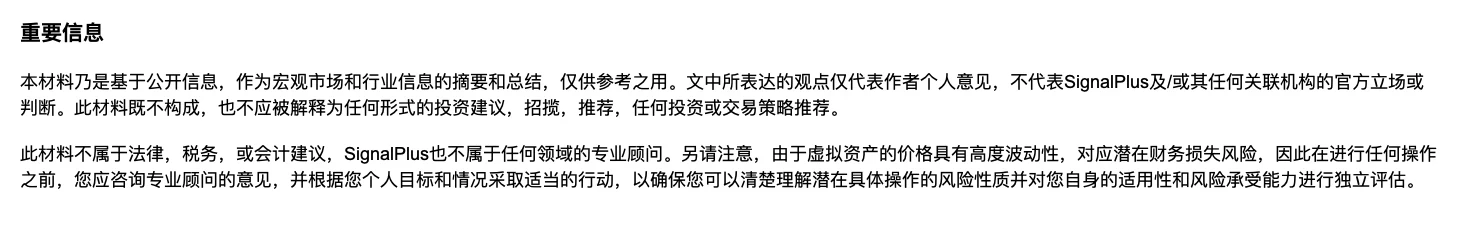

关于中国的利空消息持续不断,中融信托因流动性问题传出无法在周末兑付 1, 900 万美元的理财产品款项,加上早先对碧桂园的担忧,以及中国数据的显著疲软,加剧了外汇交易员对未来几个月人民币进一步走软的预期,现货和期权交易量比平时高出 3 倍以上,美元兑人民币现货已超过 7.25 ,向去年 10 月的高点 ( 7.32) 迈进,而今天上午还将有一系列经济活动数据以及一年期贷款利率发布。

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/445942.html

Related Reading

James Wynn Exits 40x Long, Records Minor Loss And Swings into Short Position

Veteran trader James Wynn closed off his 40x Bitcoin long position today, amounting to a small loss ...

Crypto Top Gainers of the Week: ICP, INJ, SPX Lead the Charge & Other 10 Best-Performers

The list highlighted the top crypto assets that printed massive growth over the week, led by Interne...

Solana Reclaims $141 Support as Whale Moves Spark Market Momentum

A whale unstaked $25M in SOL while Solana regained key support above $141 the price action shows bul...