CME Group Partners with Google Cloud to Explore On-chain Tokenization

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Derivatives marketplace CME Group has joined forces with Google Cloud to pilot advanced solutions for wholesale payments and asset tokenization.

According to a recent

press release

, the partnership will leverage Google Cloud's distributed ledger technology, the Google Cloud Universal Ledger (GCUL), to allow secure financial transactions.

Details of the CME Group and Google Cloud Partnership

Terry Duffy, CME Group's Chairman and Chief Executive Officer, stressed that the initiative syncs with the current administration's push for sensible market structure legislation.

Notably, he highlighted that GCUL could improve processes related to collateral, margin, settlement, and fee payments, especially as the financial sector moves towards continuous, 24/7 trading cycles. As a result, the collaboration is looking to test how this could work out.

Recent developments around

on-chain tokenization

points to its growing importance in the financial sector. In 2024, the global tokenization market was worth $1.32 billion. However, experts have

projected

it to reach $3.37 billion by 2032, a compound annual growth rate (CAGR) of 12.4%.

This growth is largely due to the increasing adoption of blockchain technology to convert physical and digital assets into tradable tokens in an effort to bolster security, liquidity, and transparency. CME Group and Google Cloud's partnership is the latest effort.

Notably, Rohit Bhat, General Manager of Financial Services at Google Cloud, confirmed that the company has a commitment to providing infrastructure that speeds up innovation. He noted that the partnership with

CME Group

shows how collaborations can lead to opportunities within the financial market.

For context, the GCUL platform is a programmable, distributed ledger that integrates with traditional financial institutions. It helps simplify account and asset management and enables transfers within a secure, permissioned network.

Building upon their ongoing partnership, CME Group and Google Cloud plan to commence direct testing with market participants later this year, with plans to introduce new services by 2026.

CME and Google Cloud Embracing Blockchain

Interestingly, CME Group has a history of embracing blockchain technology for better offerings. The company has expanded its crypto derivatives portfolio by introducing futures contracts for assets like Bitcoin and Ethereum. The firm

overtook Binance

in Bitcoin futures volume at one point.

In addition, CME Group has explored the development of flexible blockchain systems. One example is a patent

filing

for a blockchain-based system that allows protocol modifications without requiring consensus from all network participants.

Further, Google Cloud has also been proactive in the blockchain space. In October 2022, the company

launched

the Blockchain Node Engine, a service that helps to simplify the deployment and management of blockchain nodes.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/496169.html

Related Reading

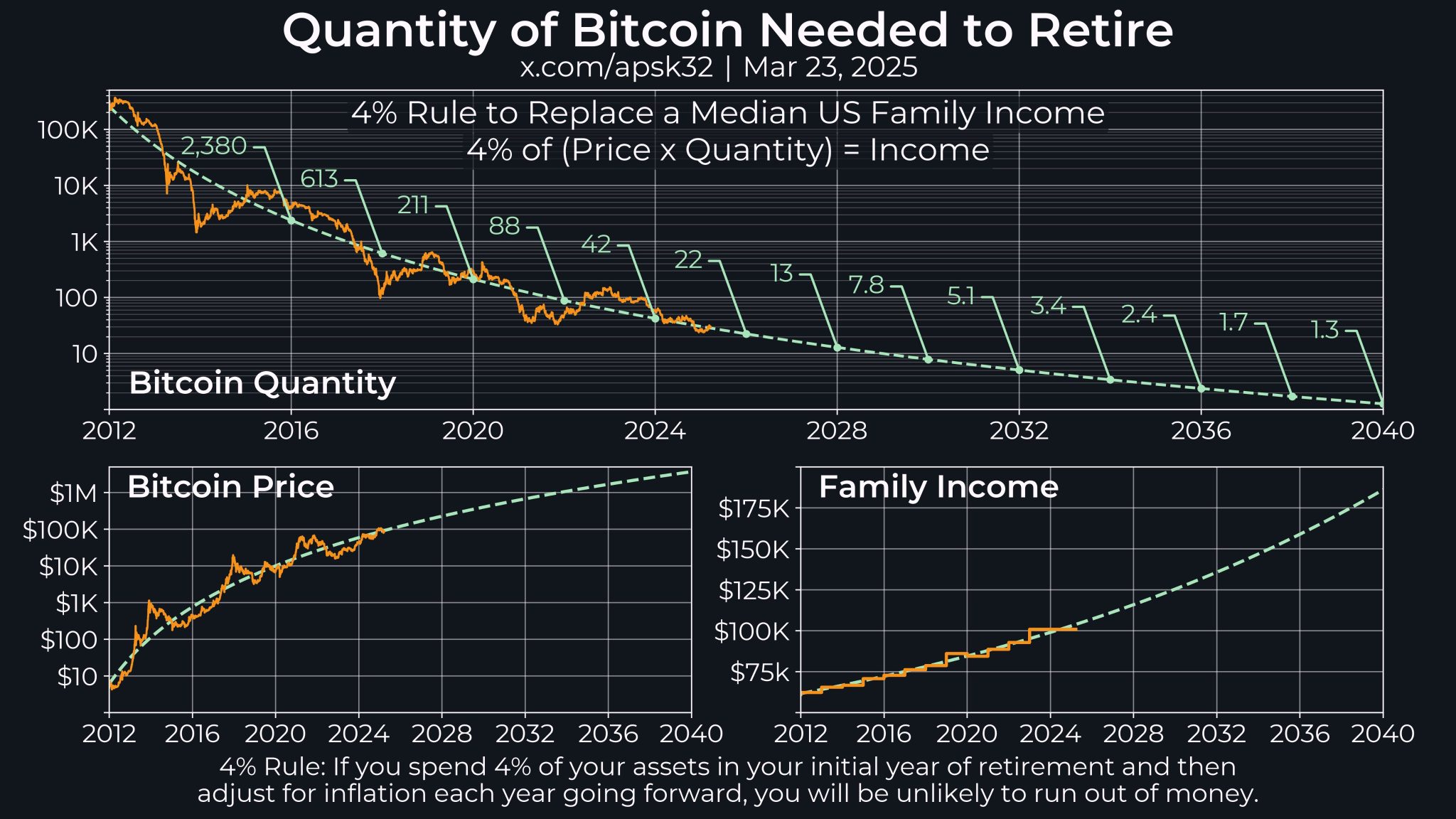

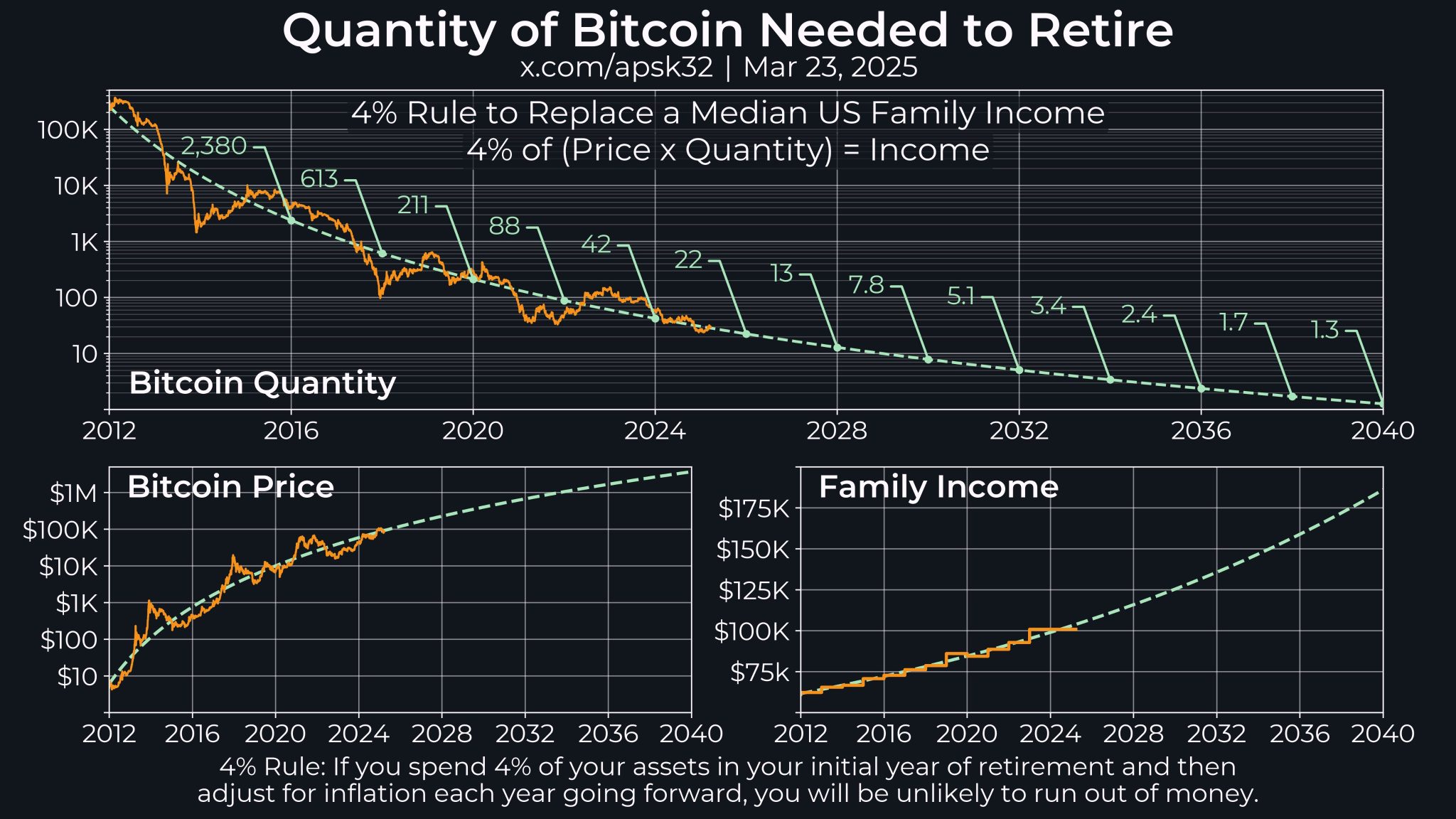

Here’s How Much Bitcoin You Need To Retire Now in the US, According to This Analyst

A leading market commentator has weighed in on how much Bitcoin an investor would need to retire.N...

Bitcoin Firm Strategy Lists STRF Stock on Nasdaq with Dual Yield Opportunity

Bitcoin company Strategy (formerly MicroStrategy) has launched its Strife perpetual preferred stock ...

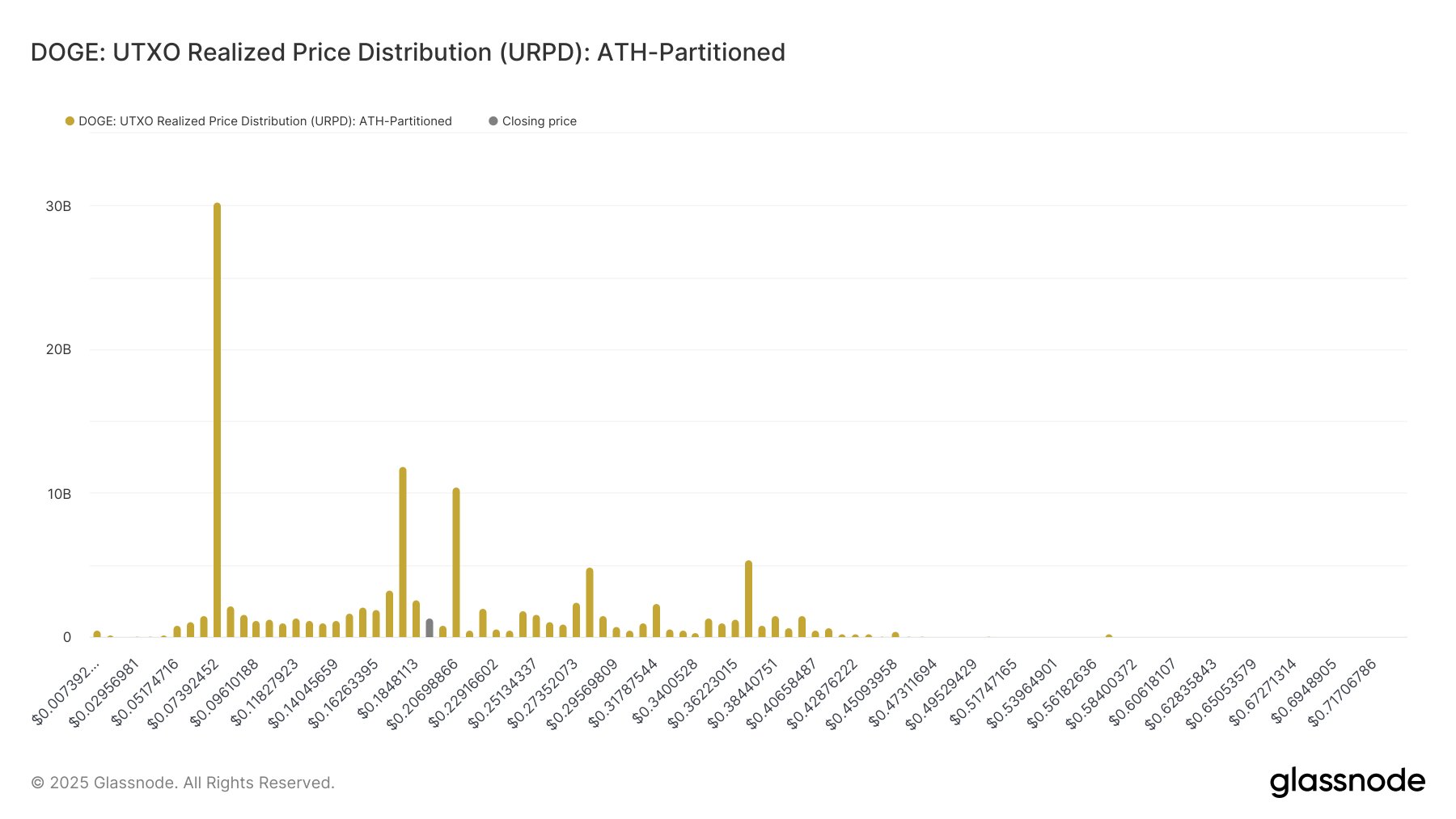

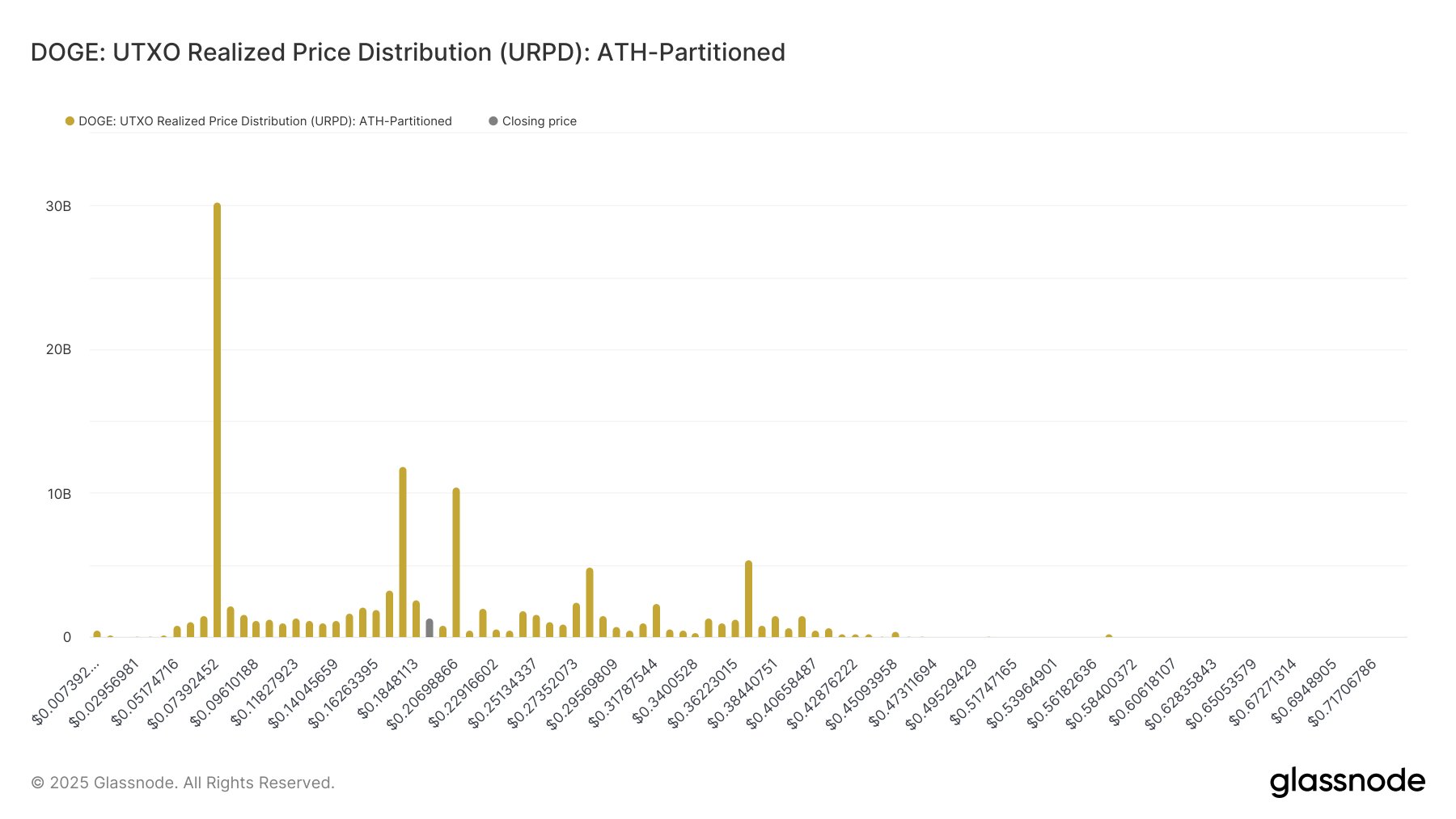

Glassnode URPD Identifies Largest Resistance to Dogecoin Recovery

A recent Glassnode analysis has leveraged the URPD metric to identify the largest resistance level D...