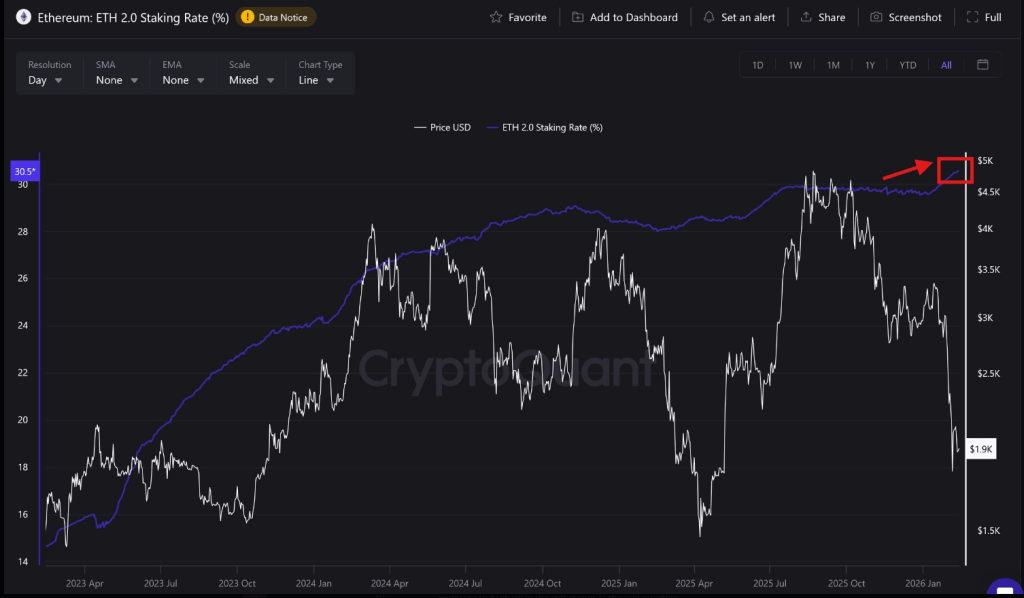

According to CoinMarketCap, Ethereum changed hands around $2,050 at one point, with a single-session move of about 7%. Reports have disclosed that roughly 30% of the total ETH supply is now locked in staking contracts, a level not seen before.

That is a big shift in where supply sits, and it matters because locked coins are not available for quick trading.

Staking Participation Hits A Record

On-chain trackers show a steady climb in staking since early 2023. Back then roughly 15% of the supply was staked; today that figure has roughly doubled. People who lock ETH as validators do it to earn rewards and to help keep the network running.

Many of those accounts are built to stay long-term. That matters because long-term holders change how supply and demand play out.

Ethereum staking rate just hit a new all-time high. Over 30.5% of all ETH is now staked!

Meanwhile ETH is trading at ~$1,950.

Since early 2023, the staking rate has gone from ~15% to 30.5% in an almost perfect straight line.

Bear market, bull market, crashes, rallies. Doesn’t… pic.twitter.com/8dS4xv7bok

— Leon Waidmann (@LeonWaidmann) February 13, 2026

Liquid Supply Has Shrunk

When a chunk of coins is tied up, it takes some selling pressure off the market. Locked ETH lowers the pool available on exchanges for fast sales. That does not guarantee a price surge, but it does tighten one side of the market.

Traders watching supply flows often weigh that factor alongside macro moves and liquidity conditions. Some traders see this as a slow-burning bullish signal. Others remain cautious because other forces can push prices down even when supply is tighter.

Ether Shows Volatility Around $1,900–$2,000

Ether Shows Volatility Around $1,900–$2,000

Prices have been bouncy. One day sees gains; the next day shows pullbacks. Reports note that ETH slipped below $2,000 at times as broader crypto momentum cooled.

Some sessions point to strength, and some to weakness. Over the last week movement has been uneven. This is a market where headlines and flows still swing prices more than network fundamentals sometimes do.

Validator Growth May Support ConfidenceThe rising staking rate also points to growing validator infrastructure and investor patience. More validators means the consensus mechanism has more hands on deck.

That has implications beyond price: it affects network security and how rewards are distributed. For many long-horizon investors, that steady build of validators is a reason to remain involved.

Timing of withdrawal unlocks is on watch lists. So is how quickly new staked ETH can return to exchanges when withdrawals are permitted at scale.

Another big item is macro moves—rates, liquidity, and major market shifts. Those will likely control the next big price swings more than staking alone.

Featured image from Unsplash, chart from TradingView