Nearly $360M In Crypto Shorts Squeezed As Bitcoin Recovers To $116,000

Data shows cryptocurrency short investors have suffered large liquidations during the past day as Bitcoin and altcoins have made a recovery.

Bitcoin, Ethereum Have Surged In The Last 24 Hours

Bitcoin and other cryptocurrencies have witnessed a rally during the past day, breaking away from the slump the market had earlier fallen into. At the height of this surge, Bitcoin broke past $116,000, while Ethereum touched $4,250.

The assets have since seen a small retracement. The chart below shows how BTC’s latest trajectory has looked.

At its current price of $115,400, Bitcoin is up about 4% on the weekly timeframe. Similarly, Ethereum at $4,160 is in a profit of 3.4%. Most other digital assets have seen similarly positive returns, although there are some outliers like Tron, which is down more than 7%. The market-wide recovery during the past day has meant that a large amount of short liquidations have piled up on the derivatives exchanges.

Crypto Market Liquidations Have Totaled At $467 Million

According to data from CoinGlass , about $467 million in cryptocurrency-related derivatives contracts have been liquidated over the last 24 hours. A contract is said to be “liquidated” when its platform forcibly shuts it down after it accumulates losses of a certain degree (as defined by the exchange).

Given that coins across the board have rebounded, the contracts crossing this threshold would mostly be the short ones. And indeed, the data would confirm so.

As is visible above, liquidations related to bearish cryptocurrency bets have reached $358 million in this window, representing 76.6% of the total flush in the sector. Bitcoin led the liquidations with $177 million in contracts involved, while Ethereum contributed the second most with $130 million in contracts. Out of the rest, Solana witnessed the largest flush at $34 million.

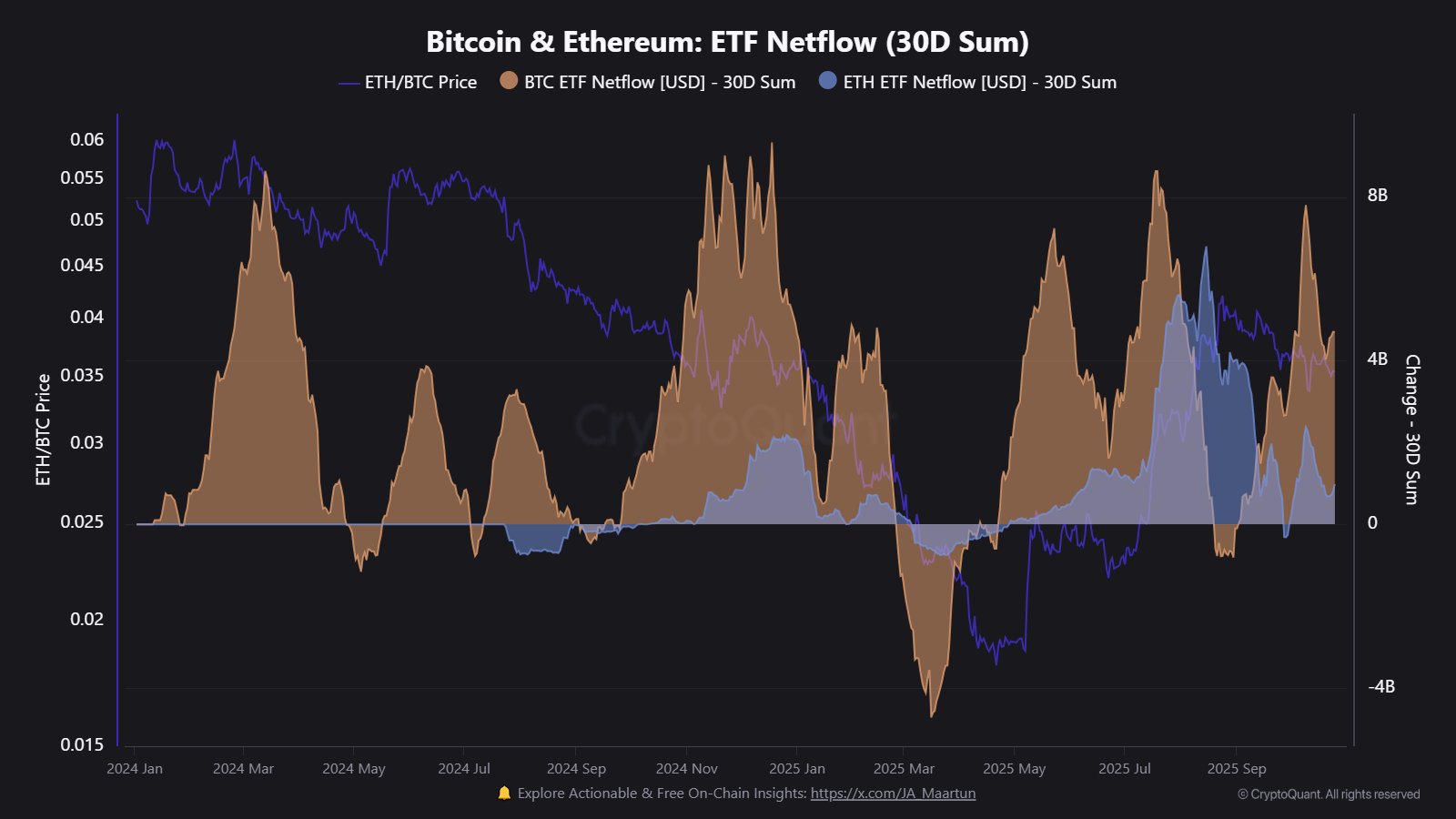

In some other news, Bitcoin spot exchange-traded funds (ETFs) have observed a notable amount of inflows over the past month, as CryptoQuant community analyst Maartunn has pointed out in an X post .

Spot ETFs refer to investment vehicles that allow investors to gain exposure to an asset without having to directly own it. The US SEC approved BTC spot ETFs in January of 2024. Here is the chart shared by the analyst that shows how the 30-day netflow for these vehicles has fluctuated since:

As displayed in the above graph, Bitcoin spot ETFs have seen inflows of $4.7 billion during the past month. Ethereum spot ETFs, which gained approval in mid-2024, have also enjoyed inflows in this period, although their value of $983 million is significantly less than BTC’s.

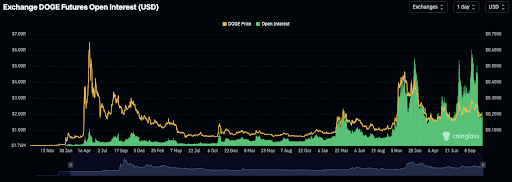

Dogecoin Open Interest Crashes 50% From October Highs, Volume Is Worse, What’s Going On?

Dogecoin (DOGE) is facing a steep market cooldown after weeks of heightened trading activity in earl...

Here’s Why The XRP Price Still Isn’t Bearish Despite The 50% Flash Crash

The XRP price recently saw a sharp drop that was very scary for many traders, and some in the crypto...

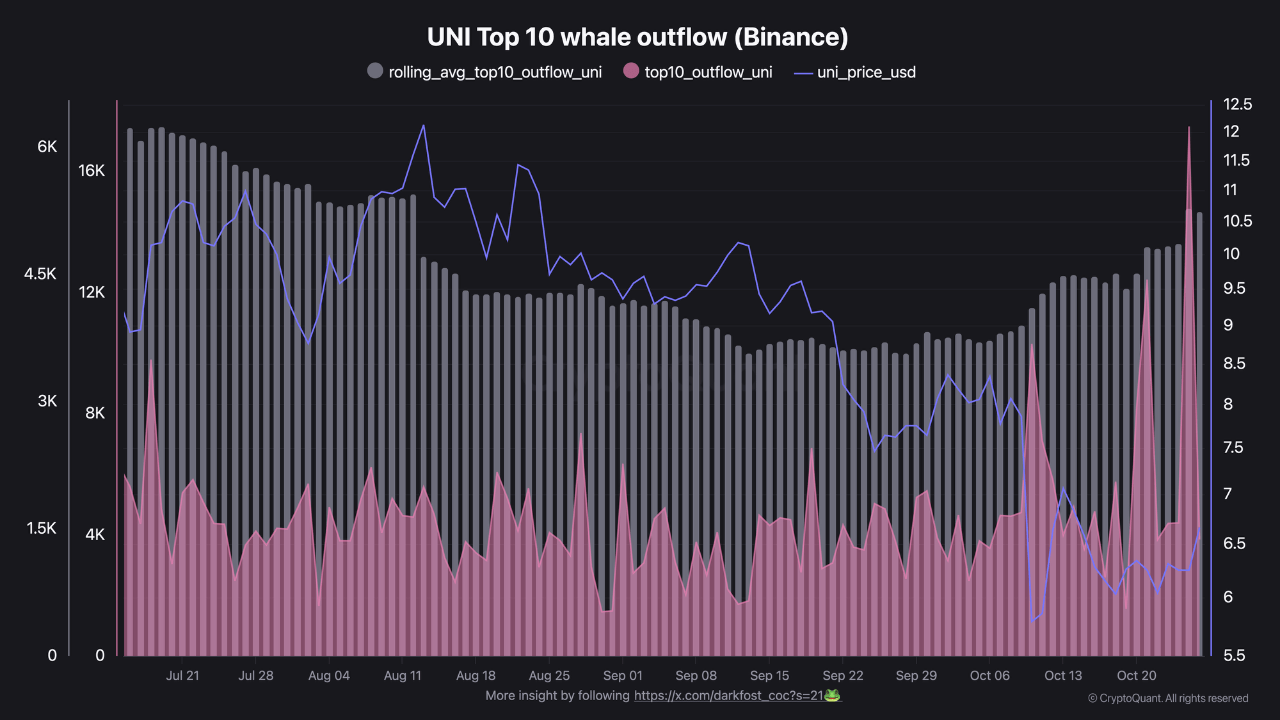

Binance Whales Turn Active On Uniswap As Outflows Hit Multi-Month Highs – Details

Uniswap (UNI) has been consolidating since the October 10 market crash, with price action stabilizin...