Ticking Clock To $200K: Bitwise CIO Predicts Bitcoin’s Price Explosion

Bitcoin hovered around $102,600 today after briefly touching $105,000. The dip didn’t shake everyone. Many still bet on a major rally. According to Bitwise CIO Matt Hougan in an interview yesterday, there’s a path for Bitcoin to hit $200,000 by December 31. He points to growing ETF inflows, more corporate buying, and what he sees as open‑door government policies.

Supply And Demand Gap Widens

Supply is fixed at 21 million coins, with about 165,000 new Bitcoin mined each year. ETF funds, on the other hand, snapped up roughly 500,000 Bitcoin over the past 12 months.

Based on reports, that’s more than three times the annual supply. When fresh coins can’t keep pace with big buyers, prices get pushed up.

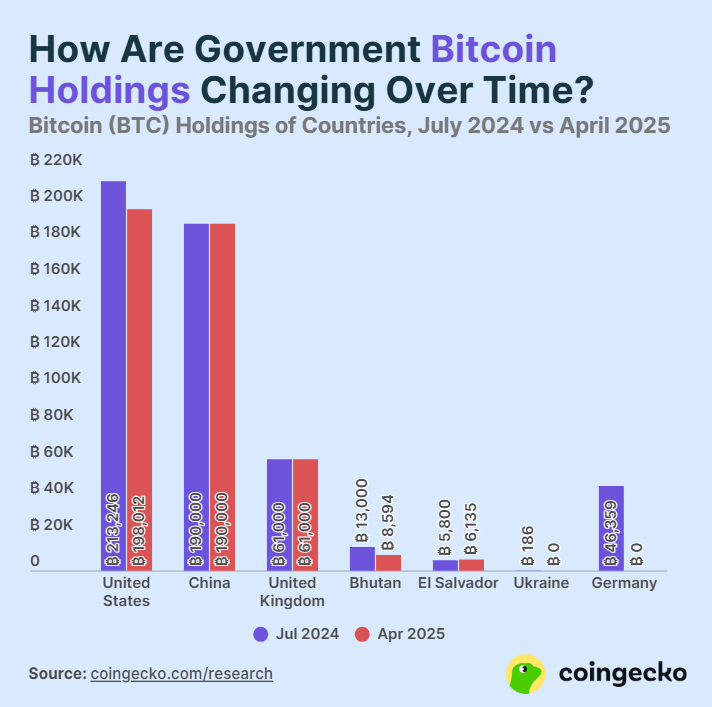

Corporate And Government Holding Rises

Companies such as Strategy continue to add Bitcoin to their balance sheets. Based on reports, the US government already has over $17 billion in seized or held Bitcoin. There’s even talk of an executive order to source more without tapping taxpayers.

Some say that could mean swapping gold reserves or selling other crypto assets. Abroad, Abu Dhabi reportedly paid $460 million for new Bitcoin, and at least 10 other governments may follow this year.

Timing And Economic Volatility

Timing And Economic Volatility

Hougan says Bitcoin’s big run was delayed by a spell of economic turbulence. Stocks have slid, and risk assets all felt the heat. He argues that once volatility eases,

Bitcoin’s momentum will kick back in. It makes sense on paper. Yet markets can surprise. A sudden move by the Federal Reserve or a shift in borrowing costs might slow the climb again.

It’s not just Bitwise calling for $200,000. Bernstein senior analyst Gautam Chhugani has that number on his radar for 2025. And Intuit Trading’s Blockchaindaily team redrew a trendline after Bitcoin bottomed at $74,000 in April.

Their line now points to $200,000 by July 2025. To go from $102,600 to $200,000, Bitcoin needs to climb about 95%. That’s a big leap, even if history shows crypto can move fast.

Looking Ahead With CautionMeanwhile, there are clear risks on the horizon. Changes in tax rules, new trading fees, or a surprise rate hike could push prices down. Still, many believe those hurdles will clear.

If ETF demand stays strong and big holders keep buying, Bitcoin may well break past its old highs. For now, investors will keep one eye on short‑term swings and another on that $200,000 milestone.

Featured image from Gemini Imagen, chart from TradingView

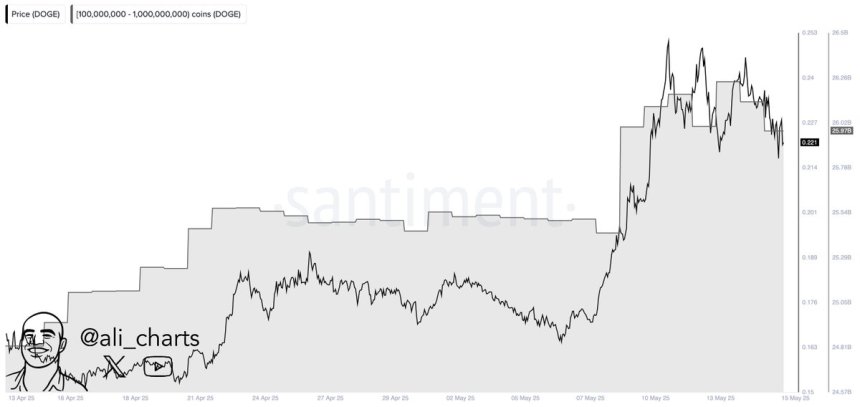

Dogecoin Whales Accumulate 1 Billion DOGE In A Month: Fueling Price Surge Speculation

Dogecoin is back in the spotlight after surging more than 50% in recent weeks, reclaiming bullish mo...

Ethereum Looks Ready To Break Out Of 4-Year Consolidation, Analyst Says Price Will ‘Go Insane’

Ethereum is again looking bullish following its gains of over 17% in the last seven days and the bre...

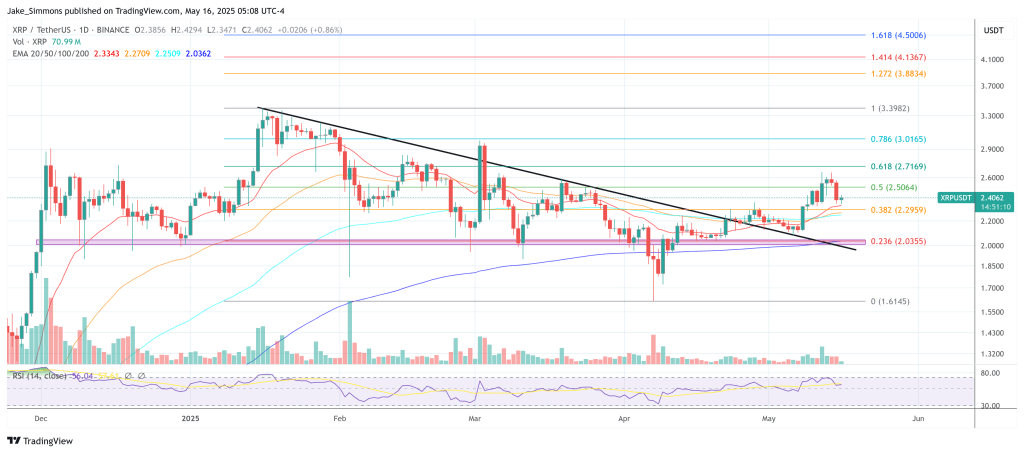

‘What If XRP Is The Next Bitcoin?’ Says Dave Portnoy

Dave Portnoy, the outspoken founder of Barstool Sports, used his debut appearance at CoinDesk’s Cons...