Bitcoin Price Slips Below $108,000: Peter Schiff Anticipates ‘Brutal’ Bear Market, CZ Responds

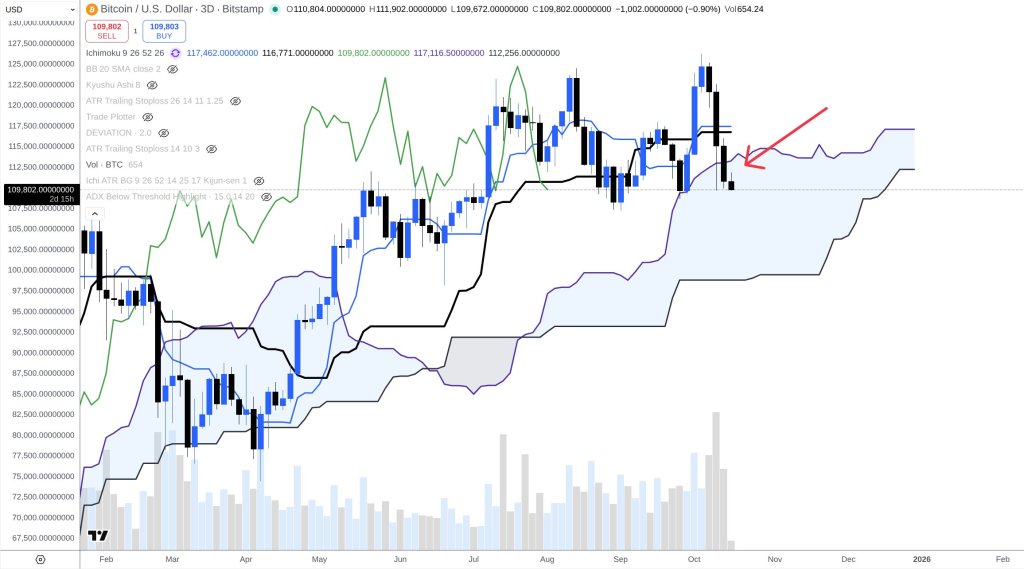

The Bitcoin price continues to face challenges as the cryptocurrency has resumed its downtrend, struggling to maintain momentum above the $115,000 mark. This price point has proven to be a significant resistance level in the short term.

Amid these fluctuations, Bitcoin skeptic Peter Schiff took to social media platform X (formerly Twitter) to declare, “Gold is eating Bitcoin’s lunch.”

Schiff Calls For HODLers To Sell ‘Fool’s Gold

In his post, Schiff highlighted that Bitcoin has experienced a 32% decline when priced in gold since its peak in August, predicting a “brutal” bear market ahead. Schiff urged HODLers to reconsider their investments, suggesting they sell their “fool’s gold” and invest in the tangible asset of gold instead, or risk financial ruin.

In response to Schiff’s assertions, Changpeng Zhao, the former CEO of Binance, offered a sarcastic retort. He noted, “ We should have listened to him, two months ago, out of the 16 years in bitcoin’s existence. About 1% of the time.”

Zhao reminded followers that Bitcoin has surged from a mere $0.004 to approximately $110,000 USD over the years, underscoring the cryptocurrency’s long-term potential despite current challenges.

Expert Predicts Positive October For Bitcoin

Schiff has continued to voice his skepticism about Bitcoin’s viability as a substitute for the US dollar or as “digital gold.” He argues that many HODLers are in denial about the realities of the market, a mindset he believes will lead to significant losses.

Contrasting Schiff’s bearish outlook, experts like Timothy Peterson have offered a more optimistic perspective. Peterson’s updated AI forecast for Bitcoin, suggests there is still a 75% probability that October could be a positive month for Bitcoin, with the potential for prices to close above $114,000.

As of this writing, the market’s leading cryptocurrency is trading at approximately $108,280, having dipped toward $107,500 earlier on Thursday. It currently stands 13% below all-time high levels.

Featured image from DALL-E, chart from TradingView.com

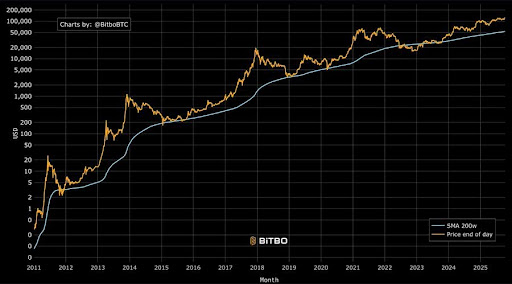

Bitcoin Buy Signal: Why The 200-Week Moving Average Has Been A Flawless Entry Point

The 200-week moving average is one of the most critical macro indicators for Bitcoin, serving as the...

Bitcoin Fate Sealed By October 31? Analyst Says The Clock Is Ticking

Bitcoin slipped below three-day Ichimoku cloud support on Wednesday, prompting market technician Dr ...

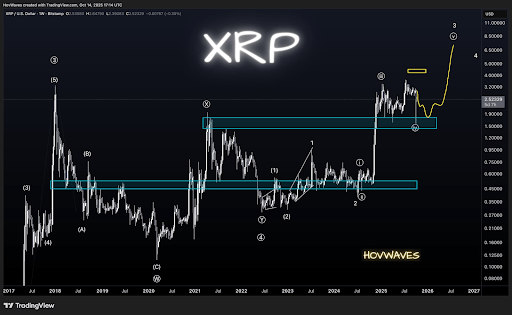

The XRP Price Roadmap To $8: How An Over 50% Bounce Could Materialize

XRP is still looking to confirm a strong bounce in price action after a crash that saw it register a...