Michael Saylor Issues Rally Cry To Bitcoin Army: “Starve The Bears!”

Michael Saylor’s latest push to steady Bitcoin holders arrived as markets wobbled this week. A 15-second clip and a fresh corporate buy were timed closely, and both landed while investors were still digesting a sharp pullback that pushed Bitcoin near $102,000 before a rebound.

Saylor Issues Viral Warning

According to a short cinematic video titled “Don’t Feed The [Bitcoin] Bears,” Saylor used a playful metaphor — “Ursus Bitcoinius, the Bitcoin Bear” — to urge holders not to reward bearish chatter.

Based on reports, Strategy , formerly MicroStrategy, also announced a purchase of 220 BTC for about $27.2 million. That move was presented as proof the company remains committed to its crypto holdings. Strategy’s total was reported at 640,250 BTC, valued at roughly $71.40 billion.

Don’t feed the ₿ears. pic.twitter.com/y57k5XGepj

— Michael Saylor (@saylor) October 15, 2025

Market Moves After Trade Shock

Markets had slipped earlier after renewed US-China trade tensions . The drop forced liquidations and rattled traders. Bitcoin later recovered to about $111,500, but fear lingered.

The broader crypto market cap held near $3.8 trillion. Ether traded past the $4,100, BNB at $1,180 and Solana above $190. Dogecoin outpaced many majors with a 5% gain on the day and a 20% rise for the week.

On-Chain Notes And Sentiment ReadingsOn-chain analysts said the pullback looked orderly. Based on reports from CryptoQuant, the sell-off was a controlled deleveraging rather than a panic exit.

Sentiment trackers offered mixed signals; the Fear & Greed index sat near 37, while some risk measures showed readings closer to 34.

“The bears seem to have had their fill,” FxPro’s Alex Kuptsikevich said. That comment reflected a view that downside pressure may be easing, but it did not mean risk had vanished.

Why The Video And Buy Matter

Why The Video And Buy Matter

The combined message — public morale boost plus a buy — is designed to shore up confidence. Strategy’s purchases act as both an investment and a message to shareholders, who watch company holdings closely.

Reports show many traders now defend the $109,000–$110,000 range as a makeshift base that formed back in August.

Analyst Views And What To Watch NextTraders and analysts are watching headlines tied to geopolitical tensions and any fresh liquidation data. If risk aversion grows again, prices could test lower ranges.

Conversely, steady buying and calmer macro news could support continued gains. Liquidity in futures markets and the pace of new inflows will be key variables.

Public SignalsSaylor’s video won attention. So did the 220 BTC purchase. Both were public signals aimed at pushing sentiment away from fear.

The episode looked like a response to short-term turbulence rather than a definitive end to broader risks.

Investors will likely treat the actions as one piece of information among many as they decide whether to add or wait.

Featured image from Unsplash, chart from TradingView

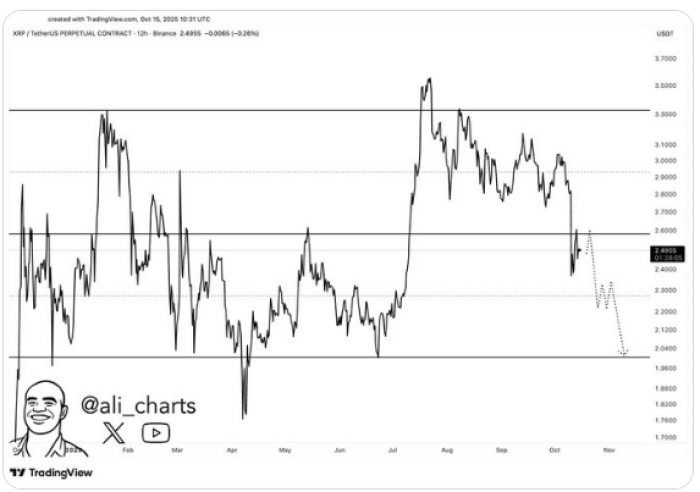

XRP’s Road to $5 Starts With a Dive to $2: $SNORT Presale Ends in 4 Days

What to Know: $XRP is down 20% in the past month, but analysis reveals a path forward to $5. Ripple’...

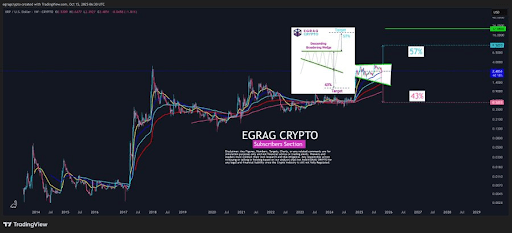

Analyst Reveals The Chances Of The XRP Price Rallying 300% To $9 This Bull Run

Crypto analyst Egrag Crypto has revealed the chances of the XRP price rallying to $9 in this market ...

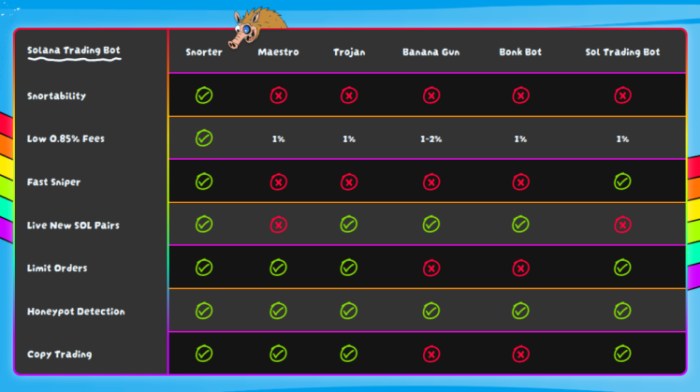

Best Altcoins to Buy as XRP ETF Nears Approval and Institutional Buys Peak

What to Know: $XRP has hit a recent low of $1.8 after the October 10 flash crash Institutional inves...