Bitcoin Funding Dynamics Shift As Binance Premium Signals Aggressive Longs

As Bitcoin (BTC) continues to remain range-bound between $110,000 – $115,000, data from crypto exchanges seems divided toward the leading cryptocurrency. While Binance traders are exhibiting a bullish stance, traders from other exchanges are still showing a degree of hesitation.

Binance Traders Expecting Bitcoin Price Surge

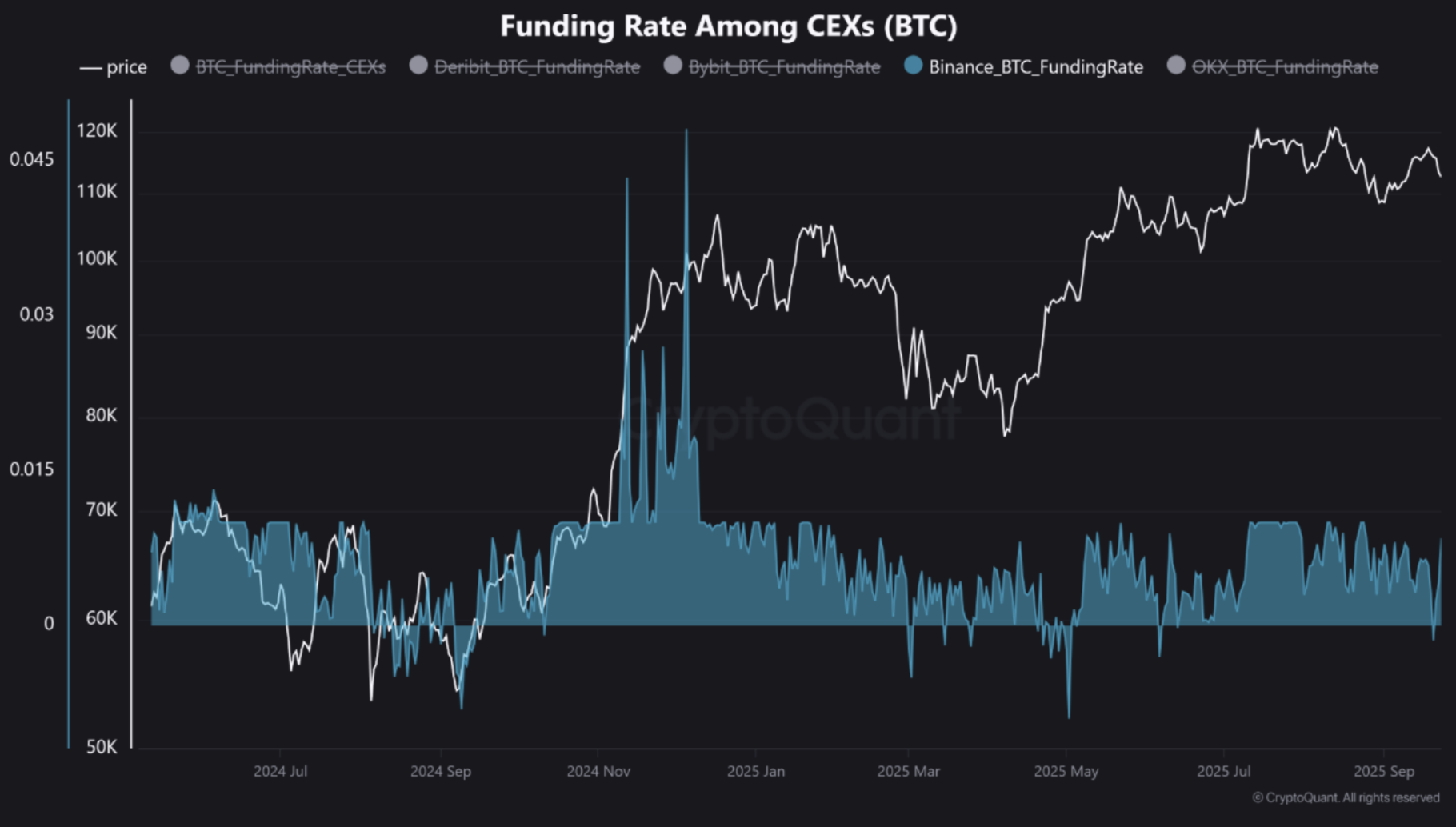

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, fresh derivatives data from Binance is signaling shifting market dynamics – specifically, the recent BTC funding rate on Binance points toward traders taking a bullish stance.

On the contrary, the BTC funding rate from other exchanges, such as OKX, Bybit, and Deribit, suggests that traders on these platforms are still uncertain about taking any directional bet.

As of September 23, the BTC perpetual funding rate on Binance climbed to +0.0084%, suggesting that the long positions are dominant and traders are willing to pay a premium to maintain their bullish bets.

It is worth highlighting that the increase in funding rate is not an isolated event, as it suggests a positive seven-day change, indicating strengthening conviction among Binance traders.

For comparison, the BTC funding rate on OKX is currently hovering at -0.0001%, while on Bybit it sits at 0.0015%. Finally, Deribit shows a funding rate of 0.0019%. The analyst added:

This isn’t just a difference in numbers; it’s a difference in narrative. While funding rates on OKX and Bybit have actually decreased over the last seven days, Binance’s rate has climbed.

For the uninitiated, funding rates can be viewed as a real-time gauge of trader sentiment in the perpetual swaps market. A strong positive rate like that of Binance, which diverges from the rest of the market, points toward aggressive bullish speculation.

Is BTC About To Make A Move?

In a separate CryptoQuant post, contributor XWIN Research Japan noted that Bitcoin’s implied volatility has dropped to its lowest level since 2023. Back then, the lull in the market was followed by an explosive rally of 325%, which propelled BTC from $29,000 to $124,000.

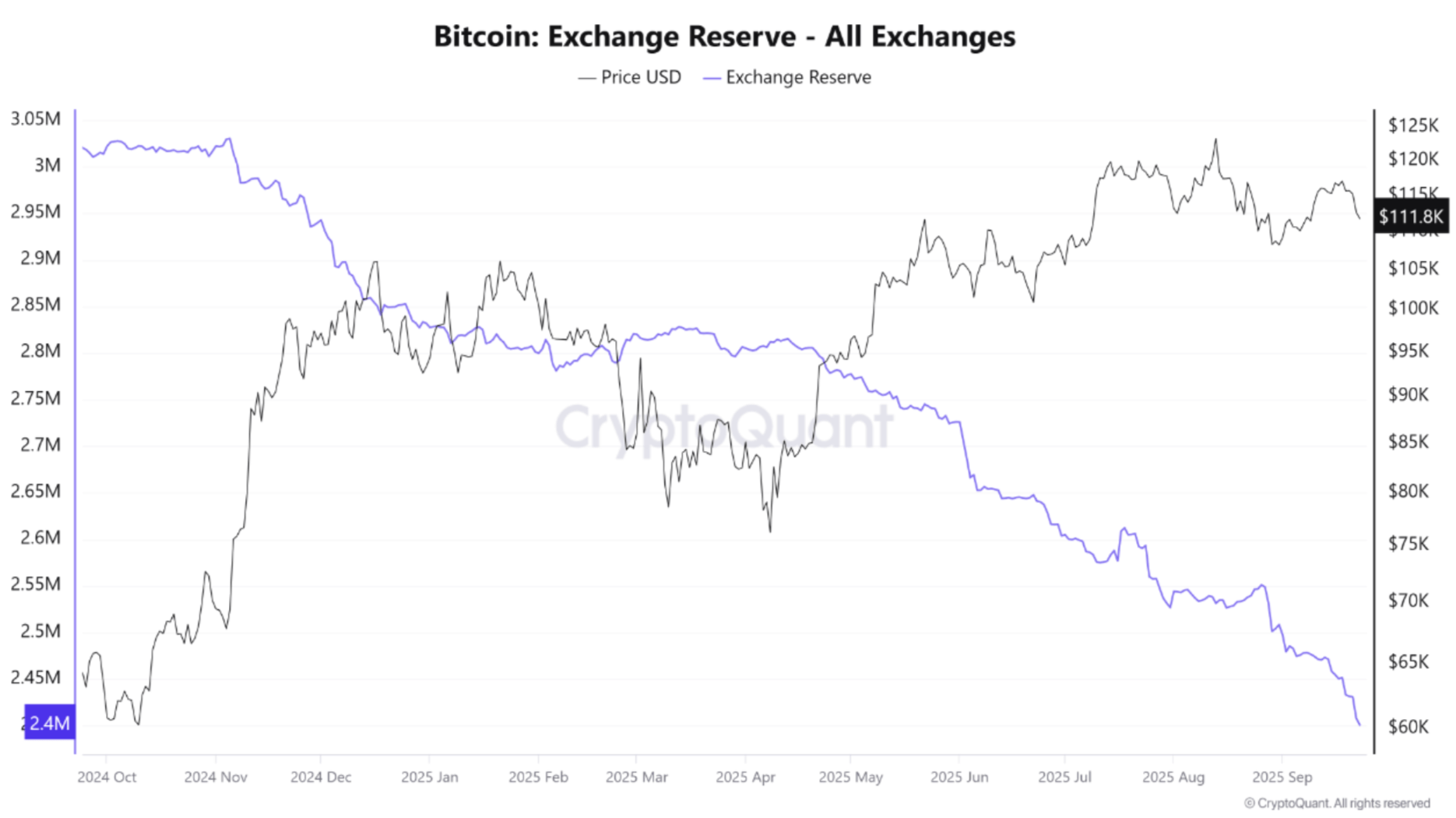

The analyst added that the total Bitcoin exchange reserves continue to deplete at a rapid pace, hitting new multi-year lows. Historically, such a fall in BTC exchange reserves has preceded supply squeezes , leading to a dramatic rise in demand.

That said, the overall sentiment toward BTC appears to be cold at present. The Bitcoin Fear & Greed Index suggests that investors are fearful of entering the market, which may offer a good opportunity to accumulate BTC at current market prices.

However, fresh data from BTC wallets confirms that new wallets – those that are less than a month old – are starting to buy the top digital asset. At press time, BTC trades at $113,796, up 1% in the past 24 hours.

Bitcoin HODLers Booked $120 Million In Profits During Price Crash: Data

On-chain data shows the Bitcoin long-term holders locked in a significant amount of gain around the ...

Dogecoin (DOGE) Struggles Again – Is Market Preparing For Another Sharp Drop?

Dogecoin started a fresh decline below the $0.250 zone against the US Dollar. DOGE is now consolidat...

Stellar (XLM) Shows Signs of Strength: Analysts See $0.5 Target in Play

Stellar (XLM) is showing signs of resilience after weeks of consolidation, with the cryptocurrency d...