Crypto ETF News: Bitcoin and Ethereum ETFs Bleed $244 Million

The post Crypto ETF News: Bitcoin and Ethereum ETFs Bleed $244 Million appeared first on Coinpedia Fintech News

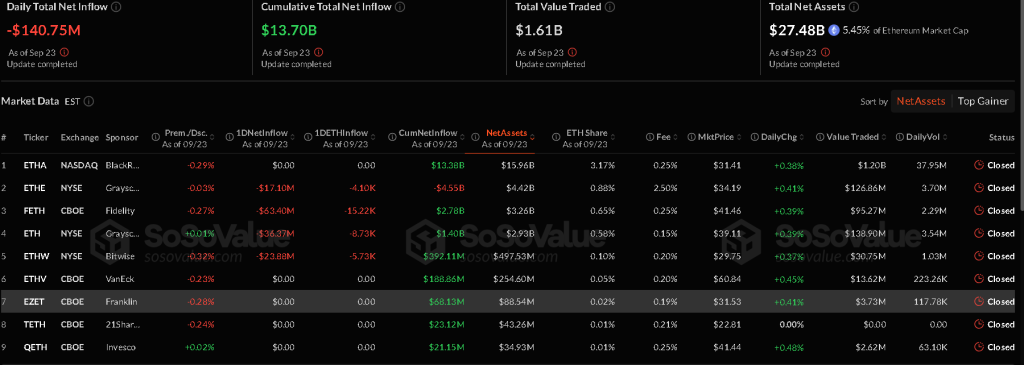

On September 23, both spot Bitcoin and Ethereum ETFs recorded a second straight day of net outflows. Data from SoSoValue shows Bitcoin ETFs lost $103.61 million, while Ethereum ETFs saw outflows of $140.75 million.

Bitcoin ETF Breakdown

Bitcoin ETF s posted a total outflow of $103.61 million. Fidelity’s FBTC led withdrawals at $75.56 million. Ark & 21Shares’ ARKB followed with $27.85 million, and Bitwise’s BITB shed $12.76 million.

Only two products managed to attract inflows. Invesco’s BTCO added $10.02 million, while BlackRock’s IBIT brought in $2.54 million.

Trading activity in Bitcoin ETFs reached $3.16 billion, with total net assets of $147.17 billion, representing about 6.6% of Bitcoin’s market cap. This reflected a decline from the prior day.

Ethereum ETF Breakdown

Ethereum ETFs recorded heavier outflows at $140.75 million. Fidelity’s FETH led selling pressure with $63.40 million. Grayscale’s ETH fund withdrew $36.37 million, followed by Bitwise’s ETHW at $23.88 million and Grayscale’s ETHE at $17.10 million.

None of the nine Ethereum ETFs reported inflows. Total trading volume dropped to $1.61 billion, while net assets fell to $27.48 billion, equal to 5.45% of Ethereum’s market cap.

Source: SoSoValue

Market Context

Bitcoin is trading at around $112,348, signalling a 3.4% drop compared to a week ago. Its market cap is also experiencing a dip, and fell to $2.238 trillion today, along with its daily trading volume, which descended to $48.874 billion.

Ethereum is priced at around $4,155.29, with a market cap of $502.099 billion. Its trading volume marked a sharp decrease of $38.585 billion, reflecting a slow market sentiment.

Despite dominating the crypto market, both Bitcoin and Ethereum are showing negative momentum in ETF flows and trading activity. Analysts expect Ethereum to face short-term bearish pressure through late September, while Bitcoin is forecast to stabilize in the $112,000–$119,000 range.

This downturn has led market watchers to label the current pullback “Red September 2025.”

Michael Saylor Urges U.S. to Treat Bitcoin as a National Digital Reserve

The post Michael Saylor Urges U.S. to Treat Bitcoin as a National Digital Reserve appeared first on ...

PancakeSwap Price Breakout – Can Bulls Push it Beyond $3?

The post PancakeSwap Price Breakout – Can Bulls Push it Beyond $3? appeared first on Coinpedia Finte...

XRP, Solana, and Pepeto: What Analysts Are Saying Ahead of January

The post XRP, Solana, and Pepeto: What Analysts Are Saying Ahead of January appeared first on Coinpe...