Chainlink Primed For Takeoff: Liquidity Sweep Strengthens Bullish Outlook

Chainlink (LINK) is building momentum as bullish signals begin to align, strengthening the case for an upcoming breakout. After sweeping liquidity and testing resistance levels , the price action now suggests growing buyer confidence, indicating that LINK may be poised for its next major upward move.

Impulsive Price Action Suggests Building Momentum

More Crypto Online, a respected crypto analyst on X, recently provided an update on Chainlink, highlighting that the price is currently testing a critical micro-resistance level. This area is seen as a short-term hurdle for LINK, and the way the price reacts here could set the tone for its next major move.

The analyst emphasized that the latest push higher looks impulsive, a sign that buyers are stepping in with strength. Such moves often precede larger rallies if supported by continued volume and market participation. However, despite the positive signs, caution remains as the breakout has yet to be confirmed.

Importantly, a decisive break above the $25 resistance level will be the key trigger for bulls . Such a move would not only reduce the probability of the bearish “yellow scenario” but also open the door for higher price targets in the sessions ahead. Until then, LINK remains in a delicate position where the market’s response will dictate whether a stronger rally unfolds or if sellers attempt to push it back down.

Chainlink Ready To Rip Higher

In his analysis , Crypto Patel highlighted that Chainlink is showing signs of a bullish breakout, with price action positioning itself for a potential strong move higher. He noted that the setup is supported by several technical factors, suggesting that buyers are gaining control.

One of the main elements driving this setup is the price respecting the Orderflow Block, serving as a confirmation of demand strength. This indicates that buyers are consistently defending this area, preventing LINK from falling lower and creating a strong foundation for an upward push.

Patel also pointed out that there was a liquidity sweep just below last week’s low at $22.229, which trapped late short sellers in the market. Such a move often strengthens the bullish case, as trapped shorts are forced to cover their positions, further adding buying pressure to the market .

Adding to the bullish picture, Patel emphasized a Market Structure Shift (MSS), showing a clean bullish order flow in LINK’s price action. Finally, Patel highlighted that the risk-to-reward ratio looks highly attractive, particularly with the option of placing tight stops, allowing traders to minimize downside exposure while maximizing potential gains if Chainlink confirms its breakout . Altogether, the key factors create a compelling case for LINK’s next bullish leg.

MetaMask’s Long-Rumored Token May Arrive ‘Sooner Than Expected’, CEO Says

Consensys chief Joe Lubin has told reporters that MetaMask’s long-awaited native token, widely known...

FTX Recovery Trust Set To Disburse $1.6 Billion By Month-End, FTT Price Skyrockets

The FTX Recovery Trust is gearing up for its third distribution to creditors affected by the exchang...

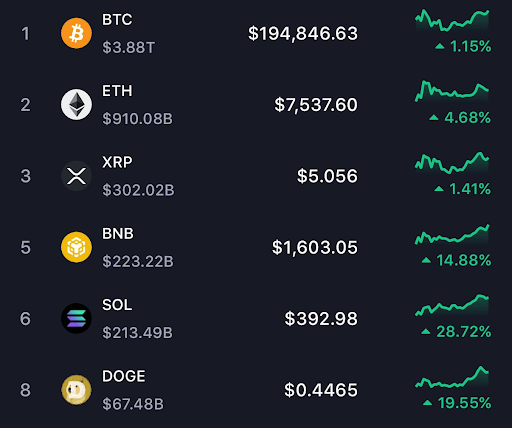

Analyst Unveils 3-Month Prediction For Bitcoin, XRP, And Dogecoin – It’s Very Bullish

A pseudonymous crypto analyst, known as Borovik on X, has released a bold set of three-month predict...