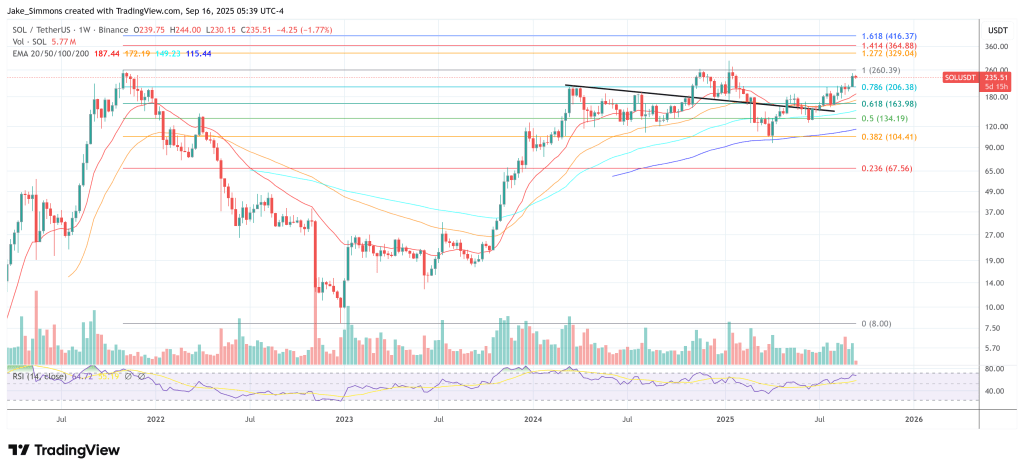

Solana DATs Will Outpace Bitcoin, Says Multicoin Capital Co-Founder

Multicoin Capital co-founder Kyle Samani believes Solana-native Digital Asset Treasuries (DATs) have a structural advantage over Bitcoin-focused vehicles—and that the mechanics underpinning those DATs could become a durable, price-positive flywheel for SOL. Speaking on Blockworks’ Empire podcast days after Forward Industries closed a $1.65 billion PIPE led by Galaxy, Jump, and Multicoin, Samani argued that Solana’s yield, composable DeFi, and on-chain corporate operations create cash flows and optionality that Bitcoin simply can’t match.

Why Solana DATs Beat Bitcoin

“We’re building a new financial system from the ground up,” Samani said, framing Forward as both a proof-of-concept for “internet capital markets” and a scaled balance sheet that can systematically convert Solana’s technical and financial primitives into shareholder value.

The immediate differentiator in his view: yield. “Saylor is paying roughly 9% [on MicroStrategy’s perpetual preferreds], but his core business produces effectively no cash flow… our vehicle will produce cash flow via two mechanisms at a bare minimum. The first… is the native SOL staking yield… roughly 8%. And the second is by doing this credit spread arbitrage,” he said.

By borrowing dollars from traditional lenders at single-digit rates and deploying into on-chain venues yielding “12–20% depending on what you’re doing,” Forward intends to use that spread, plus staking rewards, to service perpetual coupons—something a Bitcoin treasury cannot replicate because BTC is non-yielding. “You can actually objectively show where the profits are coming from to pay the coupons,” he added, suggesting Solana DATs could even secure better terms than Bitcoin vehicles over time.

Samani cast the $1.65 billion raise as a starting gun for a broader re-architecture of corporate finance on Solana. Forward plans to “be the guinea pig” that runs core operations on-chain—“payroll, paying vendors… equity issuance, raising money, dividends, stock splits… shareholder votes”—with the first milestone being tokenizing a portion of the company’s equity.

Notably, he expects a “pretty good chunk” of PIPE participants to “take delivery on-chain,” and said Forward will ultimately lean into real-time transparency: “I am optimistic we will at some point publish all the company’s addresses… so dashboards [can] update in real time.”

Much of the thesis rests on scale and the ability to convert that scale into accretive economics—both within Solana’s DeFi and across the emerging DAT landscape. Galaxy Asset Management will operate staking and DeFi deployments; Jump contributes infrastructure and performance—“all of the nodes that we’re running are running Firedancer”—and proprietary transaction-ordering technology.

Samani was explicit that Forward will not buy locked or liquid SOL from Multicoin, Jump, or Galaxy balance sheets, and that sponsor economics are split one-third each among the three firms, with Multicoin’s share accruing to its hedge fund LPs, not to him personally.

On the DAT market itself, Samani expects consolidation and cross-chain roll-ups, with Solana primed to dominate: “The market’s not going to sustain 20 Solana DATs… I can see a world in which it sustains like three or four.” He called mNAV arbitrage “a very big opportunity,” arguing that vehicles trading at premiums can accretively acquire those at discounts, while Solana’s liquidity, service-provider depth, and credit acceptance put it ahead of smaller ecosystems. “I’m very skeptical that [sub-scale] mNAVs will sustain at all,” he said, singling out non-SOL, non-ETH DATs as most vulnerable.

Solana DATs Vs. ETFs

Samani also contends that pending US spot ETFs for SOL—especially with staking enabled—would amplify the Solana DAT advantage rather than dilute it. “I am very optimistic” staking appears in SOL ETFs “soon… sometime by the end of the year,” he said. In his telling, interchangeable wrappers—spot on exchanges, ETFs for brokerage rails, and corporate-wrapper DATs—expand the investor base while leaving Solana’s intrinsic yield engine intact. Forward, for its part, “expects the [vehicle] will be staking the substantial majority” of its SOL.

Underpinning the price angle is Samani’s view that Solana DATs manufacture persistent demand for SOL while routing cash flows back to equity holders. Locked-token acquisitions at discounts, systematic staking, bank-line funded DeFi strategies, and bespoke liquidity deals with leading protocols together create what he describes as structural accretion.

The contrast with Bitcoin is stark in his framework. Without native cash flows, BTC-based treasuries rely on external financing and price appreciation; Solana DATs, he argued, can fund themselves. “Bitcoin can’t compete” in this dimension because it lacks staking yield and composable on-chain markets to arbitrage credit at institutional scale. That gap broadens, he maintained, if banks increasingly accept staked SOL as collateral and if ETF structures normalize staking.

Forward is already “talking with a bunch of counterparties” about routing through banks with access to the Fed window to secure the cheapest possible dollar financing against SOL collateral, though he cautioned that none of this is guaranteed.

For now, the scoreboard is concrete. The raise closed “in about two weeks,” with Samani estimating a roughly 40/60 crypto-native to TradFi split among participants. He personally invested $25 million; Multicoin contributed “$114–115 million.” Galaxy’s distribution pulled in “a lot” of PIPE orders; Jump’s technical edge targets incremental yield. Forward plans to be an active consolidator of DATs “both SOL and non-SOL,” while building out a dedicated executive team to run the Solana treasury line alongside the company’s legacy business.

The implication for price, Samani insisted, is straightforward: Solana’s yield engine plus institutional credit and ETF rails create sustained, programmatic demand for SOL. “In retrospect it was inevitable,” he said of the consortium behind Forward. Whether that inevitability translates into Samani’s headline claim—Solana DATs “beating” Bitcoin vehicles and setting SOL up to surge—will depend on execution, market liquidity, and the pace at which banks, ETF issuers, and regulators bless staking-based structures.

Notably, Forward Industries completed the massive purchase of 6,822,000 SOL tokens worth $1.58 billion at $232 average yesterday. The company has only $67 million left to purchase additional SOL. At press time, SOL traded at $235.

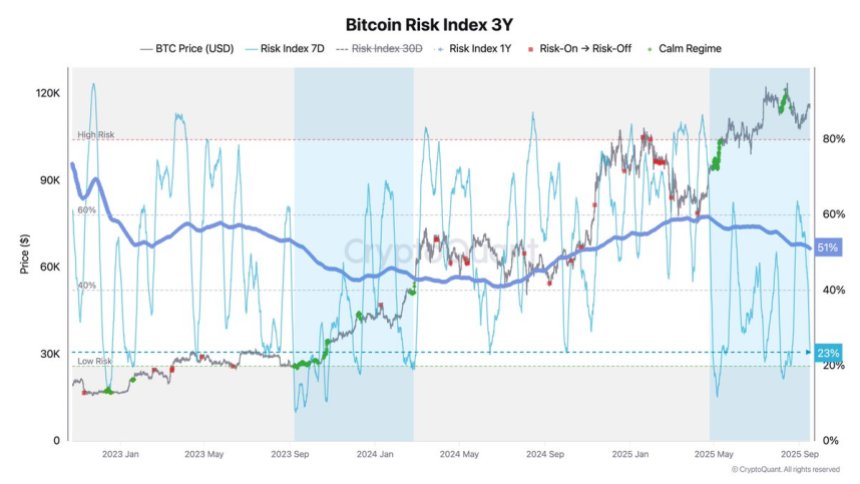

Bitcoin Risk Index Signals Stability: All Eyes On Fed Decision

Bitcoin is trading above the $115,000 mark as markets brace for tomorrow’s critical decision from th...

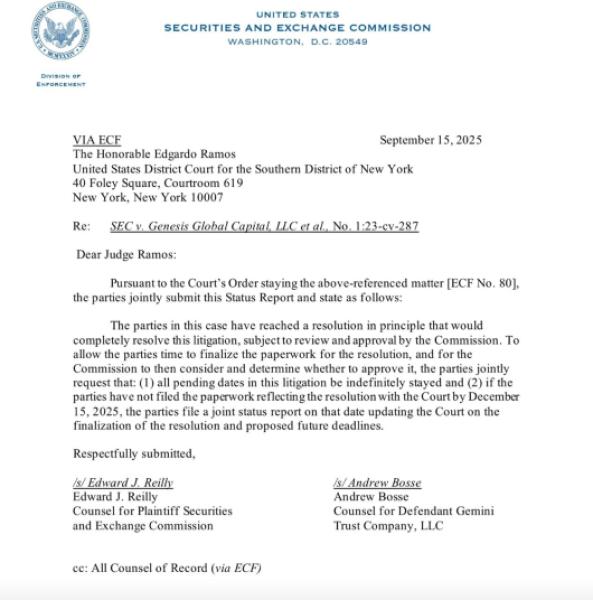

Gemini and SEC Settlement Sparks Buzz Around the Next Crypto to Explode

The crypto world just got some rare good news. After years of fighting, Gemini and the SEC have fina...

$XRP Flashes Massive Buy Signal — Could These Be the Best Altcoins to Explode?

Crypto analysts found a strong ‘buy signal’ in $XRP’s recent market performance, indicating a potent...