Tom Lee Picks Ethereum Over Bitcoin, Says Ether Is the Biggest Macro Trade for the Next Decade

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Tom Lee, the co-founder and CIO of Fundstrat, has doubled down on Ethereum, picking the altcoin as his best bet over Bitcoin in the next decade.

Lee was put in the spotlight when “Coin Stories” host Natalie Brunell

asked

if he would put all his money on either Ethereum or Bitcoin in the next 10 years. In response, he noted that he would pick Ethereum.

The Fundstrat CEO shared that

Ethereum

is the next big thing and is currently having its 2017 momentum. He further noted that widespread adoption would hit the Ethereum market as Wall Street converges after the stablecoin ChatGPT moment in crypto.

Ethereum: The Biggest Macro Trade Of The Next Decade

Meanwhile, Lee called Ethereum the “biggest macro trade” of the next decade. This suggests an explosive traction and parabolic expansion for Ether owing to its growing use case in the hot stablecoin market.

Furthermore, he highlighted that Wall Street would now take tokenization seriously, and Ethereum is at the center of this push. Notably, BlackRock believes that every asset will be tokenized in the future, making a first-mover push with its launch of the BUIDL on Ethereum and Solana, among others.

Recently, Bitwise CIO Matt Hougan

identified

that XRP and Ethereum are the cleanest forms of exposure to tokenization. As a result, Ether could record massive upside if the expected tokenization impact comes to fruition.

Interestingly, this aligns with Lee's earlier outlook for Ethereum, where he

projected

a rally to $15,000 before the end of the year. His recent chairman’s report as the Bitmine head further raises the bar for Ethereum, predicting that Ethereum would reach an

ambitious $60,000 price

.

Ethereum Superior to Existing Financial System

Nonetheless, Brunell highlighted a few risks closely tied to Ethereum. Some of which include centralization claims due to the consensus model and attack vulnerability on Ethereum bridges and layer 2.

She also mentioned the competition for Ethereum over the possible DeFi debut on Bitcoin and classification uncertainties. In response to that, Lee noted that these downsides are smaller risks compared to the fragility of the existing traditional financial system.

The Bitmine chairman insisted that the existing traditional system is more vulnerable to fraudulent activities. He noted that the system cannot prevent infiltration or offer the security that Ethereum could provide.

Ethereum Not a Competition to Bitcoin

Despite his bullish Ethereum stance, Lee emphasized that Ethereum is not competing against Bitcoin. He noted that Bitcoin paved the way for other cryptocurrencies, proving to Wall Street that one does not need tangible assets to create value.

Lee also projected higher prices for Bitcoin, predicting $1 million per coin in the long term. He also noted Bitcoin’s real rival is gold. According to him, BTC would

replace gold

soon, a sentiment that many industry leaders share.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520958.html

Related Reading

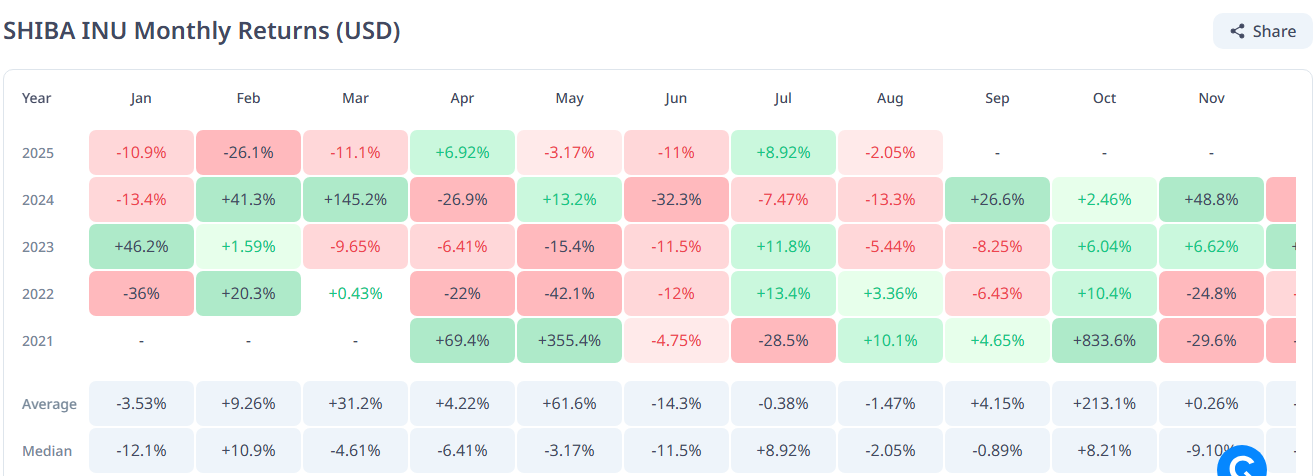

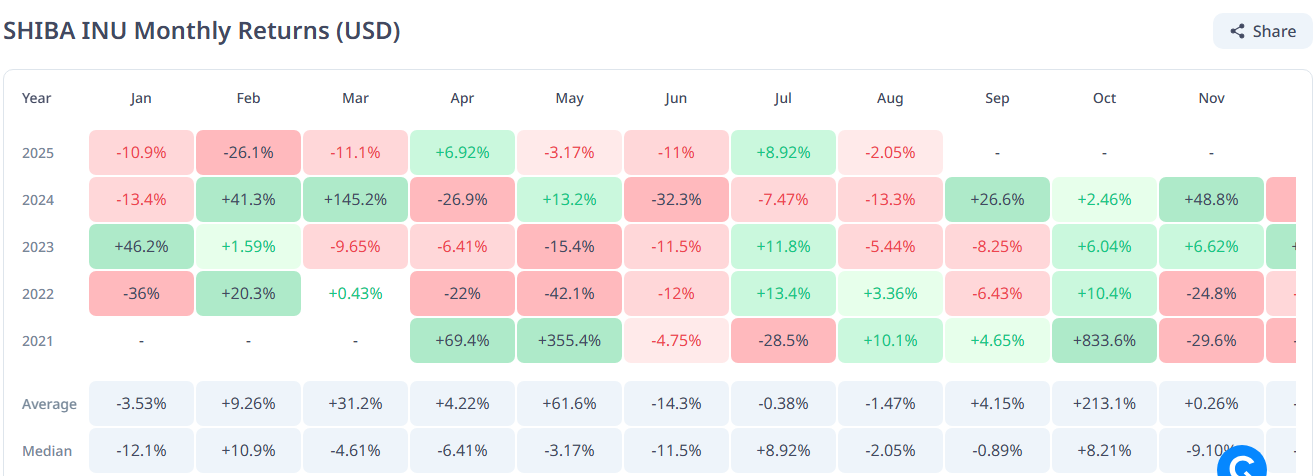

Here’s Potential Price for Shiba Inu if Dogecoin Hits $1.50

A veteran crypto investor has predicted that Shiba Inu could clinch a new all-time high (ATH) if Dog...

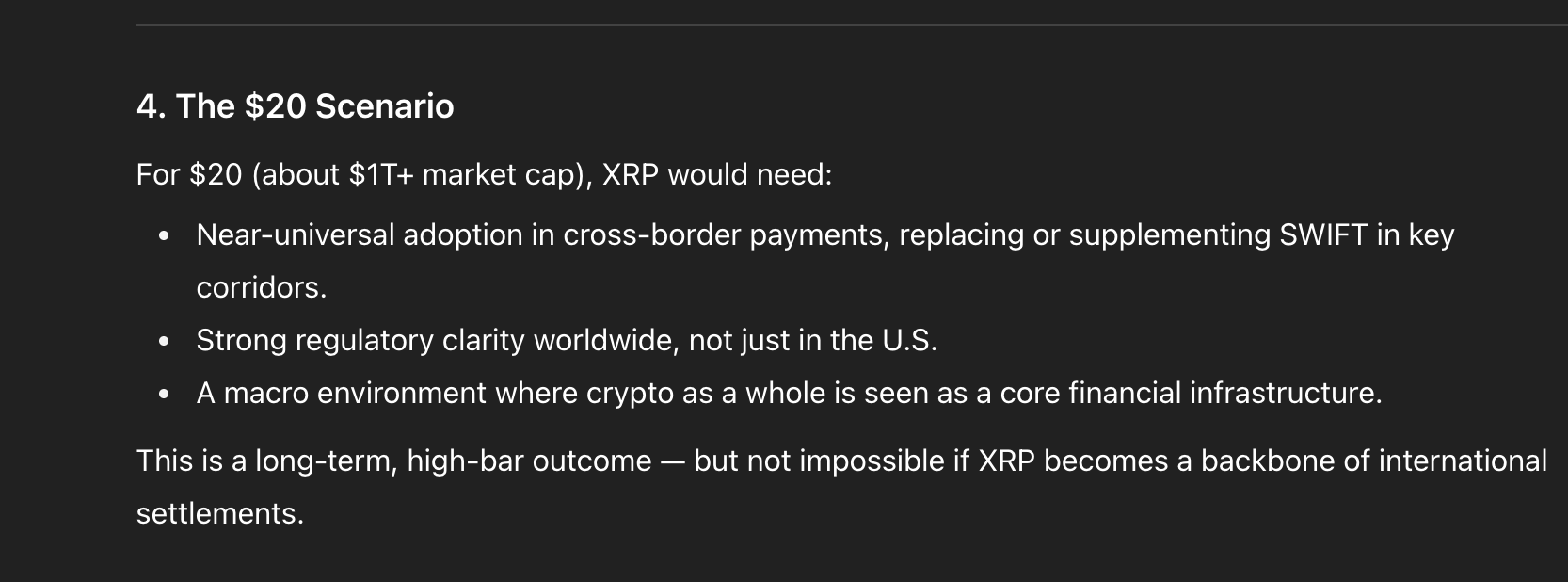

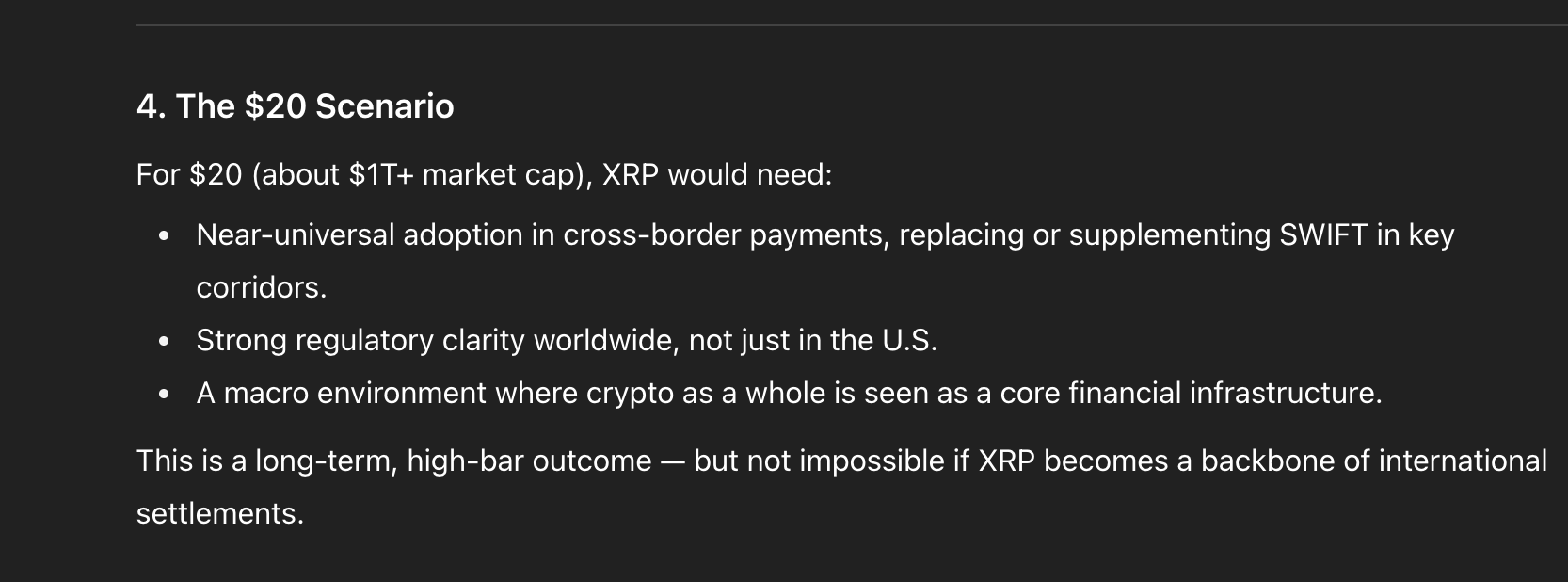

XRP Price News: With SEC Battle Over, Can XRP Hit $5, $10, or $20

The nearly five-year legal battle between Ripple and the U.S. SEC is officially over, and attention ...

Donald Trump-Inspired World Liberty Financial Exploring $1.5B Crypto Vehicle to Hold WLFI Tokens

The Donald Trump-inspired World Liberty Financial is exploring plans to create a publicly traded cry...