SharpLink Preps Big ETH Buy with $145M Transfer and New BlackRock Co-CEO

The post SharpLink Preps Big ETH Buy with $145M Transfer and New BlackRock Co-CEO appeared first on Coinpedia Fintech News

SharpLink is making bold moves to ramp up its Ethereum treasury. According to data from Lookonchain, SharpLink transferred $145 million USDC to Galaxy Digital’s OTC wallet, which means that another big Ethereum buy is likely on the way.

SharpLink Taps BlackRock Veteran as Co-CEO

Sharplink also made a bold executive move recently , as it appointed Joseph Chalom, the former digital assets strategist of BlackRock, as Co-CEO. With his deep expertise in crypto markets, Chalom will now lead the company’s $1.3 billion Ethereum treasury strategy.

Chalom played a key role in launching the iShares Ethereum Trust (ETHA), now the world’s largest ETH exchange-traded product with over $10 billion in assets. At BlackRock, he led major digital asset partnerships with firms like Coinbase, Nasdaq, and Circle, and held top roles including interim Deputy COO and COO of BlackRock Solutions.

Sharplink now has 360,807 ETH worth $1.33B, in its holdings, with 95% of it staked or deployed via liquid staking.

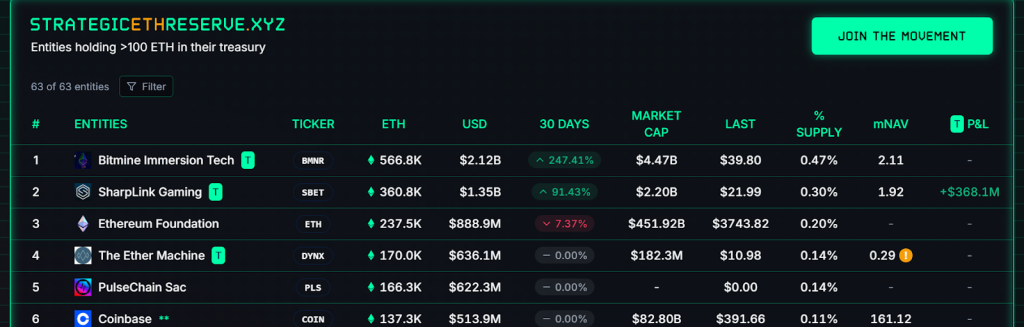

BitMine Immersion recently announced a massive Ethereum purchase, 566,776 ETH worth over $2 billion. It has now overtaken SharpLink’s ETH stash , claiming the top spot among corporate ETH holders.

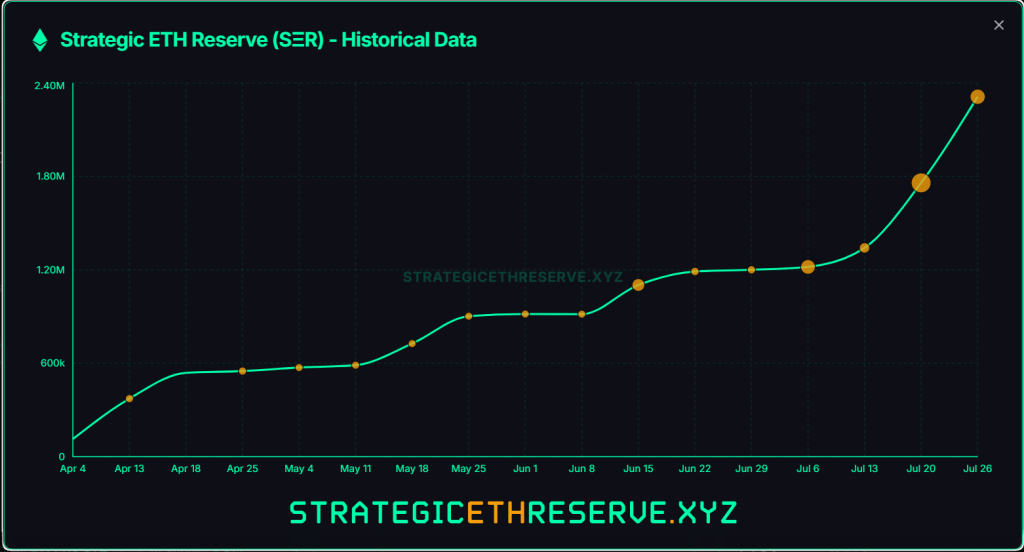

A total of 2.31 million ETH, worth $8.65 billion, is now held in strategic reserves by 63 participants, accounting for 1.92% of Ethereum’s total supply. Ethereum treasuries have skyrocketed from $23 million to $8.6 billion in just a few months. BitMine and SharpLink are leading the charge, backed by crypto heavyweights Tom Lee and Joseph Lubin.

Ethereum ETF inflows have also been doing great lately. BlackRock’s Ethereum ETF (ETHA) is on a tear, adding 120K ETH worth $430 million on Friday alone, pushing total holdings to nearly 3 million ETH. Spot ETH ETFs have posted 16 straight days of inflows and outperforming Bitcoin ETFs by a huge margin.

Whales and Fresh Wallets Drive ETH Surge

Fresh wallets are on a buying spree as 42,788 ETH worth $159 million were added today alone. Since July 9, eight new wallets have scooped up a massive 583,248 ETH worth $2.17 billion. Analyst Ali Martinez also notes that whales have been loading up over the past two weeks as they have snapped up 1.13 million ETH, worth a staggering $4.18 billion. He also shared that 170 new whales holding over 10,000 Ethereum have joined the network in the past month.

Is $5,000 Next?

Ethereum whale-held supply is dipping, but prices keep climbing. This is a key shift since June 2025. Unlike February’s pump, this trend points to healthier, sustainable growth, and not a pump by a few big players.

Ethereum is up 24% this week and 56% this month. With strong institutional inflows, major treasury buys, and record ETF demand, analysts note that if TH flips the $3,800–$4,000 zone into support, $5,000 is not far.

XRP, Sui, and Pudgy Penguins Set to Hit New All-Time Highs Next Week: Top Altcoins to Watch

The post XRP, Sui, and Pudgy Penguins Set to Hit New All-Time Highs Next Week: Top Altcoins to Watch...

Finding The Next Pepe Coin – What Cryptos Might Have The 10,000x Factor?

The post Finding The Next Pepe Coin – What Cryptos Might Have The 10,000x Factor? appeared first on ...

Cardano Price Drops But ADA Remains A Hugely Bullish Bet For Experts, Along With RTX and SUI

The post Cardano Price Drops But ADA Remains A Hugely Bullish Bet For Experts, Along With RTX and SU...