Not Even Bitcoin Is Safe: Kiyosaki Warns Of Massive Market Collapse

Veteran investor Robert Kiyosaki has sounded a stark warning for markets that have just seen Bitcoin hit a fresh all‑time high of $123,000.

According to Kiyosaki, long‑running bubbles in the US economy are primed to burst, and Bitcoin could slide right along with stocks and bonds.

The cryptocurrency is already off its peak, trading past the $118,000 mark after profit‑taking by long‑term holders.

Major Debt And Sticky Inflation

Based on reports, the US national debt has climbed to over $36 trillion, a level few would have imagined a decade ago. At the same time, June’s Consumer Price Index shows inflation isn’t cooling as fast as hoped.

Those figures have left many investors on edge. Kiyosaki, who has championed Bitcoin as a hedge against currency weakness, believes these pressures will trigger a broad market pullback.

He warned that gold , silver and Bitcoin may see sharp corrections when the wider “bubbles” finally burst. Still, he made it clear he views any drop as a chance to buy more.

BUBBLES are about to start BUSTING.

When bubbles bust odds are gold, silver, and Bitcoin will bust too.

Good news.

If prices of gold, silver, and Bitcoin crash…. I will be buying.

Take care.

— Robert Kiyosaki (@theRealKiyosaki) July 21, 2025

Whales Move To Exchanges

On‑chain data tell a similar story of caution. According to Glassnode, the 7‑day simple moving average of whale‑to‑exchange transfers is approaching 12,000 BTC—the highest level seen in 2025 so far.

That surge mirrors activity from November 24, 2024, when large holders began shifting coins onto trading platforms to lock in gains. Bitcoin has already climbed over 50% since its April lows, so some pullback was almost inevitable. Miners have also started moving coins, suggesting they too are taking profits.

Institutional appetite remains strong, even amid talk of a crash. Twenty‑one firms added roughly $810 million of Bitcoin to their balance sheets last week alone as part of their treasury plans.

Spot Bitcoin ETFs are still drawing steady inflows, offering a regulated path for investors to gain exposure. Those continued purchases could soften the blow if a bigger sell‑off takes hold.

Market observers see a tug‑of‑war playing out. On one side, big holders are cashing in after a historic rally. On the other, companies and funds are piling in, betting that any dip will be short‑lived.

Short‑term traders may try to ride the volatility. Long‑term backers, like Kiyosaki, are eyeing deeper discounts before they pull the trigger on new buys.

The coming weeks could test Bitcoin’s resilience. If debt concerns and stubborn inflation dominate headlines, volatility may spike. Yet the ongoing institutional support and Kiyosaki’s buy‑the‑dip stance hint that any slide could set the stage for a fresh rally.

Featured image from Meta, chart from TradingView

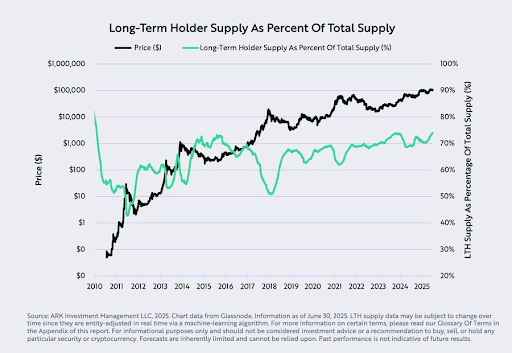

Hold On For Dear Life: This Bullish Bitcoin Metric Just Touched A 15-Year High

The percentage of Bitcoin’s long-term holders’ supply has reached a 15-year high, providing a bullis...

Too Pricey? Expert Says XRP Beats Bitcoin And Ethereum Right Now

In 2025, many first‑time crypto buyers could be hunting for an affordable entry point. Bitcoin is ne...

Dogecoin Rally On Thin Ice: Analyst Predicts Sudden Shakeout

Dogecoin begins the new trading week in an unusually precarious spot on its higher‑time‑frame chart:...