Ethereum’s Rally Isn’t What It Seems — Here’s What’s Really Driving It

Ethereum has extended its upward momentum this week, climbing over 20% in the past seven days and pushing past $3,600 for the first time in months. As of the time of writing, ETH trades at $3,617, marking a 5.4% increase within the past 24 hours.

This rally has been drawing attention from analysts who are examining whether the price movement is being driven by sustainable investor demand or short-term speculative activity.

Ethereum Futures Market Leads, But Spot Demand Lags Behind

Data from on-chain analytics firm CryptoQuant suggests the recent uptrend in Ethereum’s price is primarily fueled by the derivatives market. Contributor Avocado Onchain noted that while ETH continues to move higher, the underlying source of momentum appears to be leverage-heavy futures positions rather than sustained buying in the spot market.

This distinction raises questions about the durability of the current rally and whether follow-through demand from spot buyers will emerge. Avocado further highlighted in his QuickTake analysis titled “Ethereum’s Rally Driven by Futures Market — Will Spot Demand Follow?” that the Ethereum Futures Volume Bubble Map is signaling an overheated state in specific zones, indicated by surging volumes .

This increase in futures volume, marked by yellow circles on the map, has coincided with ETH’s price gains, implying leveraged positions are largely responsible for the rise.

In contrast, the spot market data shows relative stability , with no equivalent spike in volume, suggesting that buying pressure from traditional investors has yet to catch up.

The analyst also pointed out that Ethereum’s Open Interest (OI) in futures has reached new all-time highs, which strengthens the idea that the current movement is speculative in nature.

The question moving forward, according to Avocado, is whether momentum from the derivatives market will eventually be matched by genuine spot market demand . If such demand materializes, it could contribute to broader altcoin market activity, he added.

Institutional Interest and ETF Inflows

In a separate insight , another CryptoQuant analyst, Crypto Dan, noted increasing signs of institutional participation in Ethereum accumulation. According to his analysis, ETH is trading at a premium on Coinbase, a platform frequently used by US-based institutions and large investors, indicating heightened buying interest from whales.

The premium, described as rare in recent times, aligns with a broader trend of capital inflows into Ethereum-focused spot ETFs, which have recently reached record daily highs.

Dan stated that while current metrics do not indicate overheating , investors should remain aware of potential risks should the strong upward activity repeat in the second half of 2025.

For now, however, the combination of rising institutional demand and growing ETF allocations may provide structural support for Ethereum, especially if the spot market begins to reinforce the momentum sparked in the futures space.

Featured image created with DALL-E, Chart from TradingView

Solana Near Last Major Resistance Amid 10% Surge – Analyst Says ‘Real Bull Run’ Is Close

Solana (SOL) has recorded a significant rally over the past week, reclaiming the $160 area and attem...

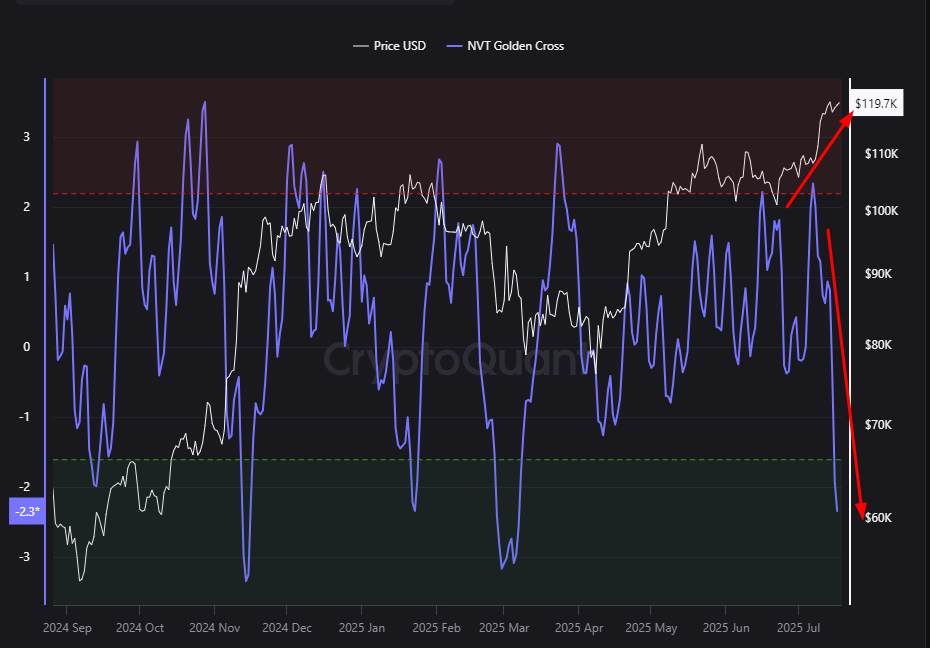

Bitcoin Climbs, But NVT Indicator Sends a Surprising Signal

Bitcoin’s recent price action has continued its upward trajectory, with the asset trading as high as...

This Ethereum Metric Called The Bottom Ahead Of Rally, Says Analytics Firm

The on-chain analytics firm Glassnode has revealed an Ethereum indicator that reliably flagged the p...