Active Address Growth and Derivatives Trends in TON and Avalanche Networks

- TON and Avalanche active addresses more than doubled in the past month.

- TON derivatives show mostly bullish trader sentiment despite slight short dominance.

- Avalanche trading volume dropped but open interest and bullish sentiment remain high.

Recent data shows a large increase in active user addresses on the TON and Avalanche blockchain networks, reflecting heightened engagement over the past month. Both networks have seen their active addresses more than double, signaling a resurgence of activity in these ecosystems. This trend is part of a broader overview of active addresses across major digital currencies spanning mid-2023 to mid-2025.

Among leading blockchains, Tron (TRX) maintains the highest number of active addresses, fluctuating between 1.5 million and 3.5 million throughout the period. The network experienced a spike in activity from August to October 2024 and currently holds above 2.5 million active addresses.

Bitcoin (BTC) has displayed stable user activity, with active addresses consistently ranging from 800,000 to 900,000. Ethereum (ETH) has shown steady growth in active addresses, rising from approximately 400,000 in mid-2023 to nearly 600,000 by mid-2025, placing it second in user engagement behind Tron.

Other networks such as Litecoin (LTC) and Cardano (ADA) display more variability, with active addresses fluctuating between 100,000 and 400,000. Cardano peaked in early 2025 before experiencing a decline toward mid-2025. Bitcoin Cash (BCH), Avalanche (AVAX), Ton, Algorand (ALGO), and Dogecoin (DOGE) have recorded lower and more volatile active address counts, mostly remaining below 200,000.

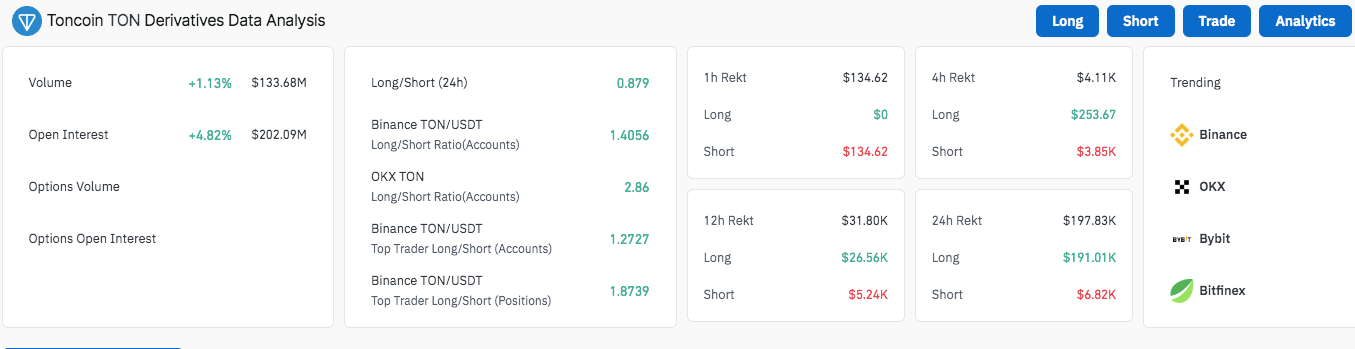

TON Derivatives Market Shows Bullish Positioning

Derivative metrics for Toncoin show a cautious yet optimistic trader sentiment. Trading volume increased by 1.13%, reaching $133.68 million, while open interest rose by 4.82% to $202.09 million. The 24-hour overall long-to-short ratio is 0.879, indicating a slight predominance of short positions.

However, account-level data from Binance’s TON/USDT market reveals a long/short account ratio of 1.4056, and OKX reports an even higher bullish ratio of 2.86. Top traders on Binance maintain a balanced but confident stance, with a long/short account ratio of 1.2727 and a position ratio of 1.8739.

Liquidation figures over the past four hours show greater losses on short positions, with $134.62 lost in the last hour and $3,850 over four hours. Long positions experienced higher liquidation totals over 24 hours, totaling $191,010, compared to $6,820 for shorts.

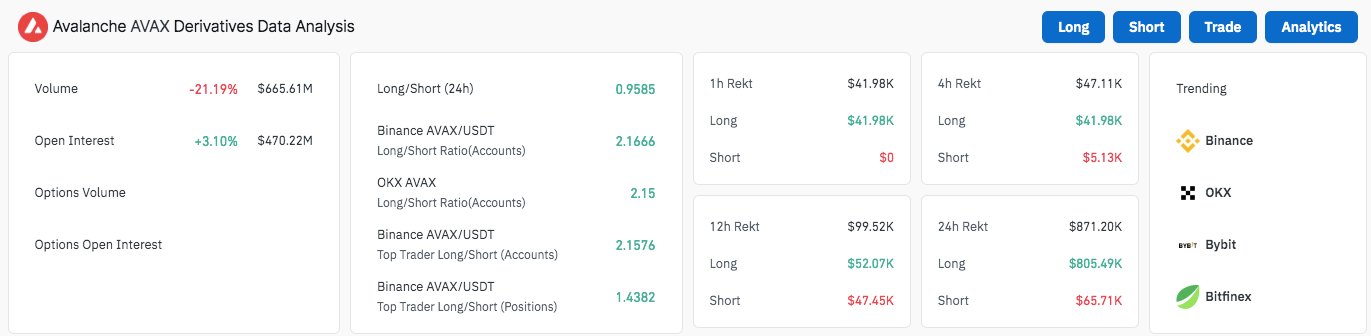

Avalanche Derivatives Reflect Mixed Signals

In the derivatives market of Avalanche, the negative trends are observed, as the volume of trades has decreased by 21.19% and amounted to $665,61 million, which testifies to a decrease in trading activity. Although this is the case, the open interest has grown up 3.10% to be at a value of $470.22 million as a sign of continued accumulation and interest among traders.

The 24-hour long/short ratio stands nearly balanced at 0.9585 overall. Nevertheless, account data points to bullish sentiment: Binance’s AVAX/USDT market shows a long/short account ratio of 2.1666, while OKX’s stands at 2.15. Top Binance traders maintain a long/short account ratio of 2.1576 and a position ratio of 1.4382.

Moreover, new data on liquidation indicate long positions are at the frontline absorbing the loss. In the past hour, long liquidations totaling $41,980 were liquidated versus no short liquidations. Over the last 24 hours, long liquidations totaled 805,490, more than 12 times compared to shorts at 65,710.

Ethereum Price Eyes $3,500! Analysts Predict AAVE and Remittix Could Deliver Huge Gains in 2025

Ethereum ($ETH) eyes $3,500 amid record ETF inflows, but analysts say AAVE and Remittix ($RTX) could...

DeFi Enters New Era as Injective Debuts High-Speed Testnet Making it the Only L1 With Unified VM Layer

Injective, a super-high-performance Layer 1 blockchain, has officially launched its greatly anticipa...

Moca Chain Integrates zkMe as Chief Issuer for Financial and Demographic Credentials

This latest Moca Chain and zkMe collaboration is devoted to strengthening users with private and sea...