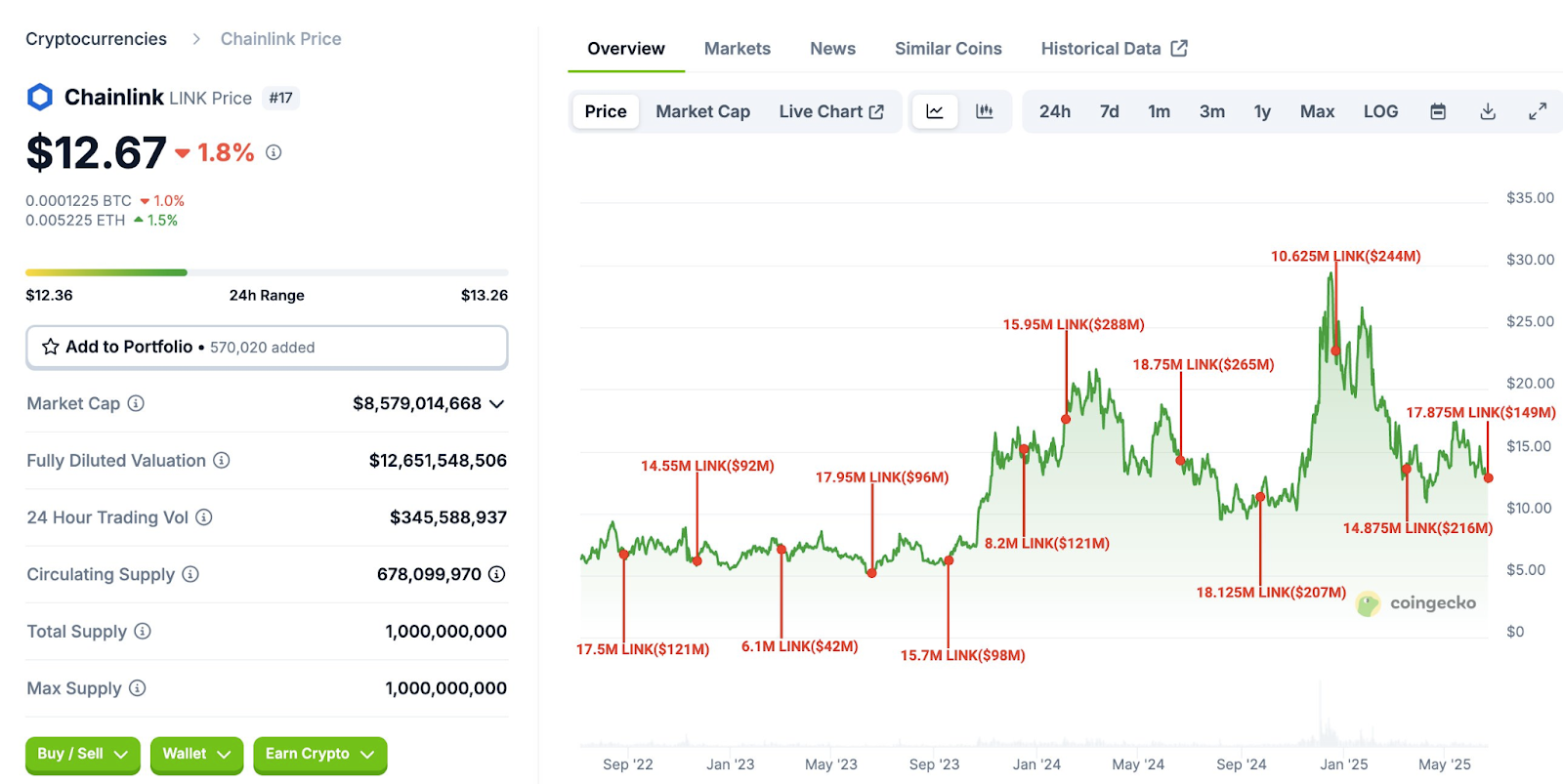

Chainlink Sees Large $LINK Transfers Into Binance Amid Whale Activity

- 17.875M LINK moved to Binance, signaling major token consolidation from non-circulating wallets.

- Chainlink trades near $12.67 with steady market cap and strong $345M daily volume.

- Large LINK inflows to Binance may boost liquidity and impact short-term price movements.

Recent blockchain data shows large movements of Chainlink (LINK) tokens from non-circulating supply wallets to Binance, totaling 17.875 million LINK, equivalent to approximately $149 million. This large transfer shows a continued trend of large-scale token consolidation into major exchange custody. Historically, Chainlink has experienced 11 major unlock events, many of which were followed by price increases.

At the time of the transaction, Chainlink was trading at $12.67, recording a decrease of 1.8% over the past 24 hours. Additionally, the trading pairs recorded a decline of 1.0% against Bitcoin (BTC) and a 1.5% increase against Ethereum (ETH). The 24-hour price range is relatively narrow, between $12.36 and $13.26, indicating limited intraday price fluctuations.

The project maintains a market capitalization of $8.58 billion with a fully diluted valuation of about $12.65 billion. Additionally, the circulating supply stands close to 678 million tokens, out of a capped total supply of 1 billion LINK tokens . The 24-hour trading volume remains strong at around $345.6 million, showing strong market participation.

Large Transactions Highlight Whale Activity

An in-depth review of recent blockchain transactions shows multiple high-volume LINK transfers, primarily directed toward Binance deposit addresses. The transaction values range from several million LINK tokens, such as 4.87 million, 4 million, 3 million, to nearly 3 million tokens in single movements.

The combination of functionality by two methods, Transfer and Exec transaction of the transaction logs, shows direct token transfers and operations of smart contracts. Moreover, the transaction blocks are of a limited order of 6-10 hours, reflecting that the transfers have taken place almost in quick succession.

Implications of Token Movement Into Binance

The consistent inflow of large volumes of the LINK value into Binance , serving as stocking strategies, may indicate an expectation of a high level of liquidity in the exchange in the future or the emergence of huge trading volumes in the future. As one of the largest cryptocurrency exchange platforms, Binance routinely does such token inflows to support market-making, custody and settlement.

This trend of whale activity has been coupled with previous Chainlink unlocks, which, in most cases, have coincided with large trading volume and price action. The huge transfers influence the immediate liquidity and provision of LINK in the market, which results in dynamic impacts on prices.

TAO & SHIB Technical Analysis: No Breakouts in Sight! Web3 ai Presale Breaks Free with $8.3M Raised!

Track Bittensor’s (TAO) technical setup and SHIB technical analysis as their breakout hopes fade. We...

Crypto Market Registers Strong Daily Gains on June 21, 2025

Cryptocurrencies surged on June 21, 2025, led by XEM’s 37.9% gain, with FUN, Aergo, Flock, and Sei a...

Unstaked’s AI Crypto Presale Raises Over $10.2M in Weeks As Ethereum Eyes $3K and Dogecoin Slides 7%!

Track Ethereum’s move toward $3,000, analyze Dogecoin’s 7% crash, and discover how Unstaked’s AI-dri...