Top Altcoins To Watch This Week: HYPE, Bitcoin Cash, and OKB Poised for Breakout

The post Top Altcoins To Watch This Week: HYPE, Bitcoin Cash, and OKB Poised for Breakout appeared first on Coinpedia Fintech News

Recent uncertainty in the crypto sector has eased as the Bitcoin price increased nearly 2%. After a concerning doji on June 15th, BTC was exchanging hands near $107K, providing a relief rally for several altcoins.

This hints that investors are not panicking over geopolitical tensions between Israel and Iran, as well as ongoing tariff disputes with the U.S.

Data from coinglass proves the point, as U.S. Bitcoin ETF inflows exceeded $380 million on June 12th and 13th, contributing to total weekly inflows of $1.37 billion.

Despite it trading below its ATH, investor optimism remains strong, with a short-term target set at $120K in June.

As a result, the altcoins are gaining momentum, and risk appetite is returning. Many are now asking, “Could a Bitcoin rise pull select altcoins higher?”

This article explores these altcoins and explains why crypto experts could be looking into our top picks for June 2025.

Hyperliquid Price Prediction ( HYPE)

In June, it gave an asymmetrical triangle breakout and flipped the previous ATH of $39 and reached $42.50. Many thought the supply was about to be activated, as for 4 days it struggled at its high.

Then, a neat intraday breakout appeared with a neat 12% spike pushing it to a new ATH of $44.80, fueled by a whale that made over $13 million. The altcoins have become extremely important in the crypto sector lately, as it has become the top DEX among other DEXs and are also giving a tough competition to Binance CEX despite being a DEX.

Its utility is driving its users crazy. This love of investors and traders could be seen in HYPE’s price action of Q2 so far, which has been parabolic.

Similarly, the potential to rally further next week is higher. In a bullish scenario, the price could target the $50 round level. However, profit-taking could prompt bulls to defend key support levels at $39 and $30

Bitcoin Cash Price Prediction (BCH)

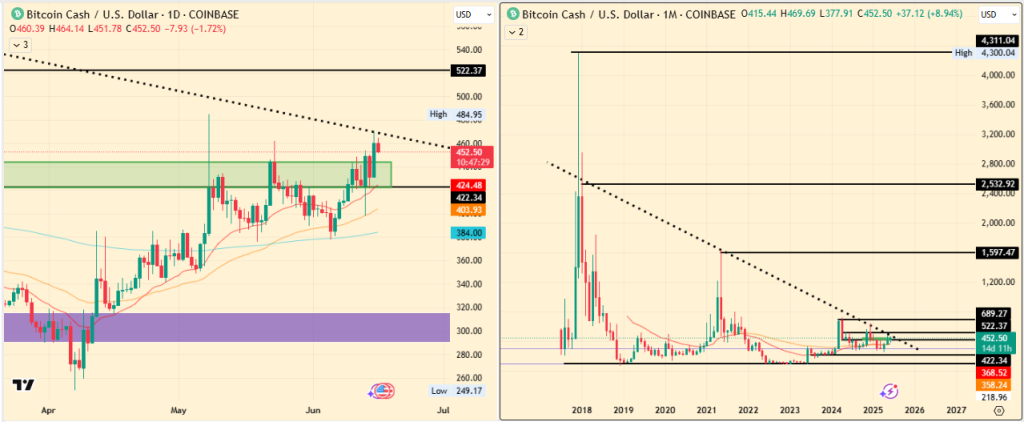

BCH’s price action has shown that, over the long term, it follows a multi-year trendline of resistance, and in 2025, it retested it in mid-June.

In the past, the price lacked the strength to break above the multi-year trendline and faced rejection before, but this time the momentum seems strong.

When writing, the BCH price has jumped nearly 17% from an important resistance zone after a liquidity wick from the 50-day EMA band. Where intraday gains were over 9%, which pushed it to $469.

If next week it manages to break above this trendline and pushes new gains, then $522 could be the target. Flipping this would be a breakout from a multi-year descending triangle formation, and the breakout could come big.

On the other hand, if the breakout fails, the $300 support is expected to absorb the downside once again.

OKB Price Prediction (OKB)

On the daily chart, OKB price is near a critical supply level, which strongly aligns with the falling channels’ upper border resistance, too.

In this, it has been trading inside for several months. This week, buyers tried but fell short of strength, as bears were strong this week.

However, the upper border has been tested several times, and this phenomenon makes the trendline weaker, raising the likelihood of breaking the upper border.

If bulls renters and clears the resistance, then next week is crucial to monitor as a break would easily give a target of $60 or $63 in the short term.

But if bears become dominant, then the 200-day EMA band support becomes vital, breaching this would shake its foundation.

Furthermore, its long-term perspective remains optimistic, as in March 2025 it took support from the lower border of the ascending wedge, and bullish momentum could give higher targets that go upto $100 under bullish conditions.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The crypto market is showing recovery, with the global market cap at $3.34T (up 2.32%). Bitcoin is trading near $107K (up 1.93%), and many altcoins are gaining momentum, including Solana (up 9.5%) and XRP (up 6.1%).

Bitcoin is trading near $107K, up almost 2%, indicating investor calm despite geopolitical tensions. US Bitcoin ETF inflows exceeded $380 million on June 12-13.

Altcoin Season (or Altseason) is a period when non-Bitcoin cryptocurrencies (altcoins) significantly outperform Bitcoin in terms of price gains. It’s characterized by capital flowing from Bitcoin into altcoins, increased altcoin trading volumes, and a decline in Bitcoin’s dominance in the overall crypto market.

The current market shows Bitcoin stabilizing and some altcoins gaining momentum, potentially signaling increased risk appetite. However, altcoin investments are volatile. It’s crucial to research individual projects, understand their utility, and consider the overall market sentiment and your personal risk tolerance before investing.

Bitcoin Price Rebounds Above $108k on Heightened Institutional Demand: Is It a Dead-Cat-Bounce?

The post Bitcoin Price Rebounds Above $108k on Heightened Institutional Demand: Is It a Dead-Cat-Bou...

Big Breaking: Canada Approves First XRP Spot ETF, Set to Debut June 18

The post Big Breaking: Canada Approves First XRP Spot ETF, Set to Debut June 18 appeared first on Co...

Ripple vs SEC Lawsuit Update: XRP Price Gains 13% as Deadline Closes In

The post Ripple vs SEC Lawsuit Update: XRP Price Gains 13% as Deadline Closes In appeared first on C...