Stablecoin Performace in 2025 Jan To June

The post Stablecoin Performace in 2025 Jan To June appeared first on Coinpedia Fintech News

Stablecoins have cemented their role in the digital finance revolution as one of the stabilizing forces in the crypto market. These are pegged to stable reserves like fiat currencies, for instance, the US dollar, which helps minimize price fluctuations.

Welcome to Coinpedia’s H1 2025 report. This analysis contains a comprehensive examination of the stablecoin sector from authentic sources.

This report showcases the information needed for market participants and enthusiasts to make well-informed decisions and identify opportunities.

Keep reading to know more.

Stablecoin Market Cap ATH: Prediction Rises to $2 Trillion

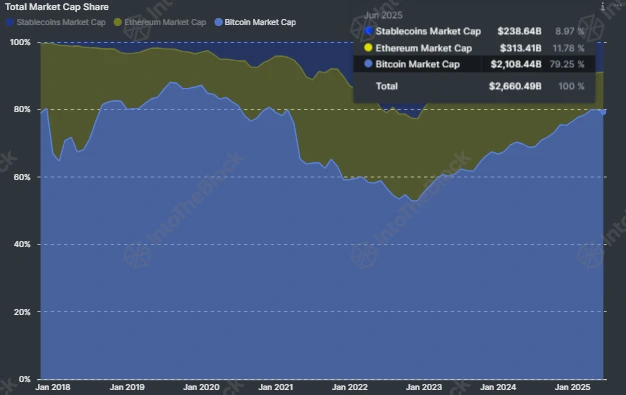

The first half of 2025 marked a historic moment, with the total stablecoin market cap hitting an all-time high of $251.55 billion, up from $204 billion on January 2. This growth pushed stablecoins’ share of the total crypto market cap from 7.9% to 8.9%, reflecting increased investor confidence and usage.

Despite the ATH market cap, the optimism has not subsided one bit; in fact, it has turned more intense with US Treasury Secretary Scott Bessent’s forecast of flipping $2 trillion by the end of 2028 .

Under a more advanced prediction, analysts from Citigroup have also estimated that the market cap could reach as high as $3.7 trillion by 2030 . This shows high expectations for growth and displays how opportunistic this sector has become, supported by analysis from major financial institutions.

Market Composition and Dominance

According to DeFiLlama , there are now 264 stablecoins , out of which 162 have a market cap above $1 million . Tether (USDT) continues to dominate the market, with USDC emerging as a strong second.

| Stablecoin | Dec 2024 Cap ($B) | Jun 2025 Cap ($B) | Dec 2024 Dominance (%) |

June 2025

Dominance (%) |

| USDT | 138 | 154 | 71.06 | 65.64 |

| USDC | 41 | 61 | 21.52 | 26.02 |

| USDe | 5.5 | 5.78 | 2.87 | 2.46 |

| DAI | 3.4 | 3.65 | 1.77 | 1.55 |

| FDUSD | 1.9 | 1.57 | 0.99 | 0.67 |

| FRAX | 0.64 | 0.31 | 0.33 | 0.13 |

| TUSD | 0.497 | 0.494 | 0.26 | 0.21 |

| PYUSD | 0.51 | 0.975 | 0.26 | 0.42 |

| RLUSD | 0.03 | 0.366 | 0.02 | 0.16 |

Notably, USDT’s dominance has declined slightly, while USDC’s share has grown steadily. PYUSD and RLUSD showed positive movement, indicating growing investor interest in newer stables.

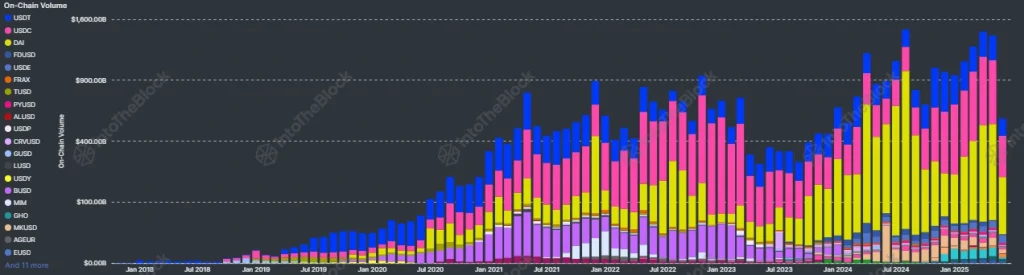

Exchange Activity and On-chain Signals

Exchange flows remained high throughout the first half of 2025. Net inflows were consistent, indicating strong demand. On-chain volume also rose sharply, from $982 billion to $1.394 trillion by May. Additionally, active stablecoin wallet addresses saw a steep rise, signaling a steady influx of users.

Blockchain Preferences by Stablecoin

A look into chain dominance reveals strong preferences among leading stablecoins:

| Stablecoin | Top Chain (%) | Rest (%) |

| USDT | Tron (50.11%) | Ethereum (40.44%) |

| USDC | Ethereum (61.58%) | Solana (13.29%) |

| USDe | Ethereum (96.92%) | others |

| DAI | Ethereum (87.62%) | others |

| FDUSD | Ethereum (80.38%) | Solana (8.28%) |

| RLUSD | Ethereum (83.76%) | XRPL (16.24%) |

| FRAX | Ethereum (48.77%) | Fraxtal (32.85%) |

Clearly, Ethereum remains the central hub for stablecoins, with TRON and Solana gaining notable activity.

Institutional and Corporate Adoption

Meanwhile, the regulatory environment became a catalyst. The GENIUS Act , up for Senate vote on June 17, could reshape the stablecoin landscape. It requires stablecoins to be backed by U.S. dollars or highly liquid assets and enforces annual audits for those over $50 billion in market value.

President Trump’s vocal support for the bill is expected to bolster the dollar’s strength in digital finance. The Trump administration is clearly orchestrating based on a pre-planned long-term strategy, to preserve the supremacy of the dollar amid geopolitical challenges.

Similarly, this bill would clearly change the stablecoin domain, as issuing stablecoins wouldn’t be an exclusive luxury limited to financial tech companies like Circle and Tether. But Santander and Société Générale have entered, raising the hype with a new generation of bank-issued stablecoins.

At the same time, traditional institutions joined the race. Bank of America is fast-tracking its own stablecoin project, awaiting the regulatory green light.

On the corporate front, Circle, the firm behind USDC stablecoin, enjoyed the growing stablecoin market with its latest move this H1 2025 as it went public. Its shares jumped 235% on day one, clearly indicating the strong adoption.

Furthermore, companies like Amazon, Walmart , and Expedia are said to be exploring blockchains and the crypto sector for launching their own stablecoins, possibly to cut card processing fees and streamline payments.

TRON and New Entrants

Apart from giant Ethereum, TRON continues to be a key blockchain for stablecoins. In a major milestone, recently, Justin Sun confirmed that World Liberty Financial Inc. (WLFI) minted its USD1 stablecoin on TRON. Such launches underscore the growing shift toward blockchain-native financial tools.

Moreover, Issuers like Tether are also seeing financial rewards. Recently, Tether reported over $1 billion in Q1 2025 profits , largely from U.S. Treasury yields tied to reserve assets.

End Note: The Stablecoin Era Strengthens

The first half of 2025 showcased a new phase of stablecoin evolution. From rising volumes and dominance shifts to wider institutional use and legislative support. Now, stablecoins are clearly on the path to becoming foundational elements of the global financial system.

As the year continues, the outcome of the GENIUS Act and further corporate moves could define the next leap forward for digital dollars.

Moreover, per the dominance perspective, Tether (USDT) and Circle (USDC) continue to dominate the market, where Ethereum remains the central hub for major stablecoins, while TRON and Solana are also increasing as stablecoin launchpads.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The total stablecoin market cap reached an all-time high of $251.55 billion in H1 2025, up from $204 billion on January 2nd, increasing its share of the total crypto market to 8.9%.

The GENIUS Act, up for a Senate vote on June 17, requires stablecoins to be backed by U.S. dollars or highly liquid assets and mandates annual audits for those over $50 billion in market value, aiming for regulatory clarity.

Yes, traditional institutions like Santander and Société Générale are issuing bank-backed stablecoins, and Bank of America is fast-tracking its own project, signaling growing institutional adoption.

5 Must-Buy Cryptos for June 2025: Explore Beyond Solana (SOL) With These Super Bullish Picks

The post 5 Must-Buy Cryptos for June 2025: Explore Beyond Solana (SOL) With These Super Bullish Pick...

Exploring Solana’s Best Meme Coins and Early Presales Made Simple June 2025

The post Exploring Solana’s Best Meme Coins and Early Presales Made Simple June 2025 appeared first ...

From Zero to Moon: Tiny Crypto Projects With Giant Potential

The post From Zero to Moon: Tiny Crypto Projects With Giant Potential appeared first on Coinpedia Fi...