Over $689M in Crypto Positions Liquidated as Traders Face Heavy Losses

- Over $689M liquidated in 24h as 267K traders hit by leveraged crypto sell-off.

- BTC and ETH led liquidation losses with $153M and $125M wiped out respectively.

- Longs dominated liquidations on Binance and Bitrue, revealing failed bullish bets.

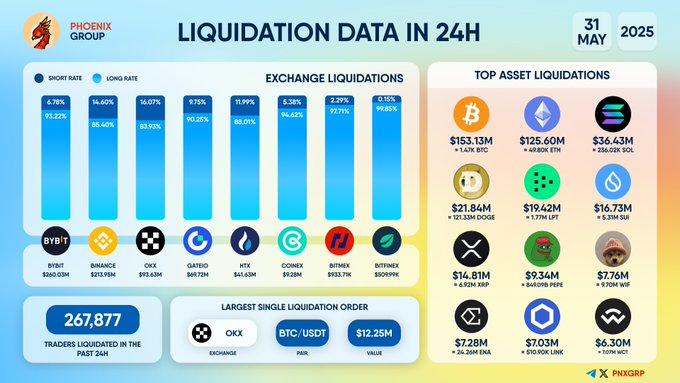

A wave of forced liquidations surged through the crypto market on May 31, 2025, wiping out more than $689.68 million in positions within a 24-hour window. According to data from Phoenix Group, a total of 267,877 traders were affected as a result of sharp price movements and excessive leverage across major exchanges. Bitcoin led the liquidation charts, with losses totaling $153.13 million, followed closely by Ethereum and Solana.

Bitcoin accounted for the largest share of liquidations, reflecting its high trading volume and leverage exposure. Ethereum followed with $125.60 million in liquidated positions. Other major tokens impacted included Solana, which saw $36.43 million in losses, and Dogecoin, which recorded $21.84 million in liquidations. Livepeer (LPT) also made the top five with $19.42 million in wiped-out positions.

The data further shows losses in highly speculative tokens. Meme coins like PEPE and FLOKI registered $7.76 million and $6.30 million in liquidations, respectively, showing that retail traders with exposure to volatile assets faced severe losses during the price downturn.

Bybit, Binance, and OKX Lead Exchange Liquidation Totals

Bybit emerged as the exchange with the highest liquidation activity, recording $260.03 million in total losses. Binance followed with $213.59 million, and OKX saw $195.45 million in liquidated positions. GATEIO and HTX reported smaller yet significant figures, with $62.74 million and $41.64 million, respectively.

The largest single liquidation order occurred on OKX, involving a BTC/USDT trade worth $12.25 million. This individual liquidation underscores the scale of exposure some traders carried during the volatile session.

Exchange-Specific Position Trends

Short and long position imbalances varied greatly by platform. On Bybit , 78.75% of liquidations came from short positions. Meanwhile, Binance and HTX saw the majority of liquidations from long positions, with 85.40% and 91.62% respectively. This shift reflects conflicting expectations among traders across different exchanges, some of whom were caught on the wrong side of rapid market movements.

Among all exchanges, Bitrue showed an overwhelming bias, with 99.85% of liquidated positions being long. As a result, there was increased bullish enthusiasm among altcoins, but this evidently could not hold in the face of higher volatility.

The data points out that leverage is high and risk controls are insufficient among market participants. Traders who owned too much of smaller-cap and meme tokens suffered significant drops since the prices fell and their margin calls led to quick liquidations.

James Wynn Returns to High-Stakes Perpetual Trading With Nearly $100M Bitcoin Long

Just 2 hours after declaring a break from perpetual futures trading, James Wynn has reentered the ma...

Crypto Market Presents Mixed Signals While Entering June’s 1st Week

Crypto market enters June with mixed signals as Bitcoin ($TC) rises slightly, Ethereum ($ETH) dips, ...

Metaplanet Enhances Bitcoin ($BTC) Holdings with $1088 More $BTC

As per Lookonchain, with this fresh Bitcoin acquisition today, the cumulative holdings of Metaplanet...