Crypto Whales On Watch As Over $3 Billion In Tokens Unlock Next Month

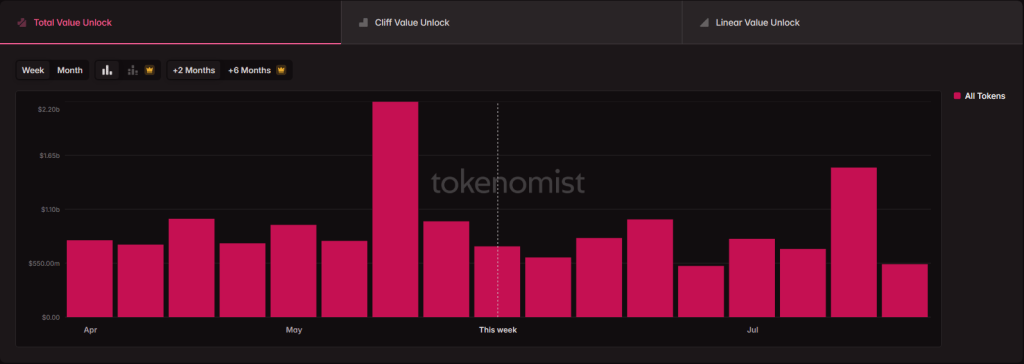

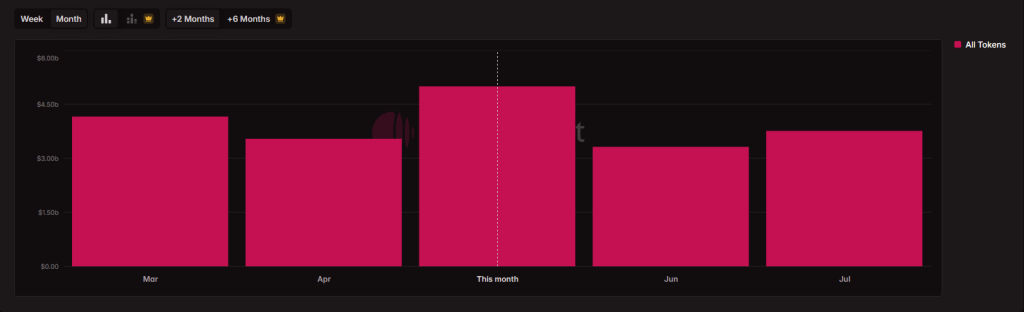

Crypto assets to the tune of over $3 billion are heading into circulation in June. That marks a 32% drop from May’s haul of $4.9 billion. According to crypto vesting tracker Tokenomist , investors and traders will face new supply pressure again this month.

Total Token Unlocks Dip In June

June’s release of $3.3 billion is down sharply from May’s nearly $5 billion. A lot of that change comes from projects finishing earlier vesting schedules. But $3.3 billion is still a heavy weight on token prices. Markets usually wobble when billions of dollars suddenly become tradable.

Cliffs Versus Gradual Releases

About $1.4 billion of June’s tokens will hit wallets all at once in what’s called a cliff unlock. That means a lump sum becomes liquid on a set date. The rest— nearly $2 billion—will drip into the market bit by bit with linear unlocks. A slow trickle of new supply can soften the blow, but it still adds up over time.

Several major projects lead the pack in June. Metars Genesis ( MRS ) will drop over $190 million worth of tokens on June 21 to back an AI partnership. Since March, MRS has unlocked 10 million tokens each month, pushing nearly $1 billion into circulation so far.

On June 1, SUI will unlock 44 million coins—about $160 million in value. Over $70 million of that goes to Series B investors. To date, SUI has released more than 3 billion tokens valued at roughly $12 billion, or about 33% of its total supply. Another 5.22 billion tokens, worth nearly $20 billion, are still locked without a set date.

Other Projects To Watch

Other Projects To Watch

A handful of well-known tokens also have vesting dates in June. Fasttoken will hand out 20 million tokens—around $88 million—to its founders. LayerZero plans to unlock 25 million tokens worth over $70 million for core contributors and strategic partners.

Aptos will release 11.30 million tokens, about $60 million, to its team, backers and community fund. ZKsync sets free over 760 million tokens valued at almost $50 million to investors and staff. Even Arbitrum joins the list, adding to the pressure on Layer-2 markets.

What This Means For TradersBased on reports, big unlocks tend to spark price swings. Cliff events often trigger fast sell-offs as holders gain full access. Gradual releases can drag on prices over weeks. Those who trade around these dates should be ready for volatility.

For long-term holders, dips caused by fresh supply might offer a chance to add to positions. Either way, tracking vesting calendars could help time moves and spare traders from nasty surprises.

Featured image from Unsplash, chart from TradingView

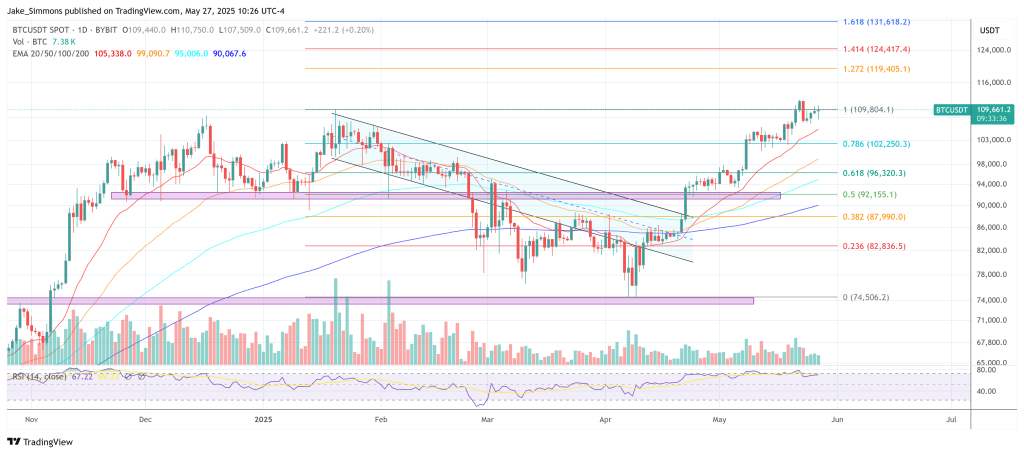

Bitcoin’s Calm Feels Dangerous—All Eyes On Vegas And June Reversal

Bitcoin hovers between $107,000 and $111,000, a deceptively narrow range that masks an options marke...

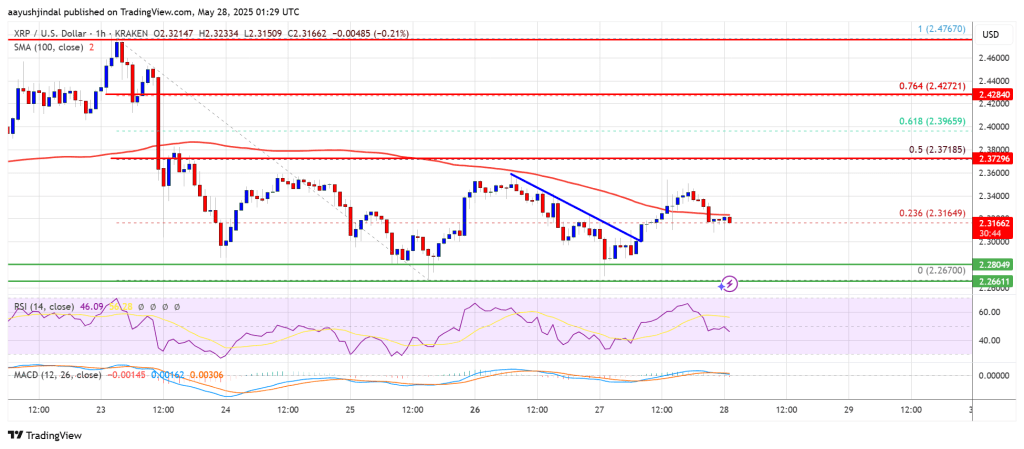

XRP Price Struggles to Stay Afloat — Is a Breakdown Coming?

XRP price started a fresh decline from the $2.380 zone. The price is now moving lower and is current...

Bitcoin Sees Massive 7,883 BTC Outflow From Coinbase – Are Institutions Loading Up?

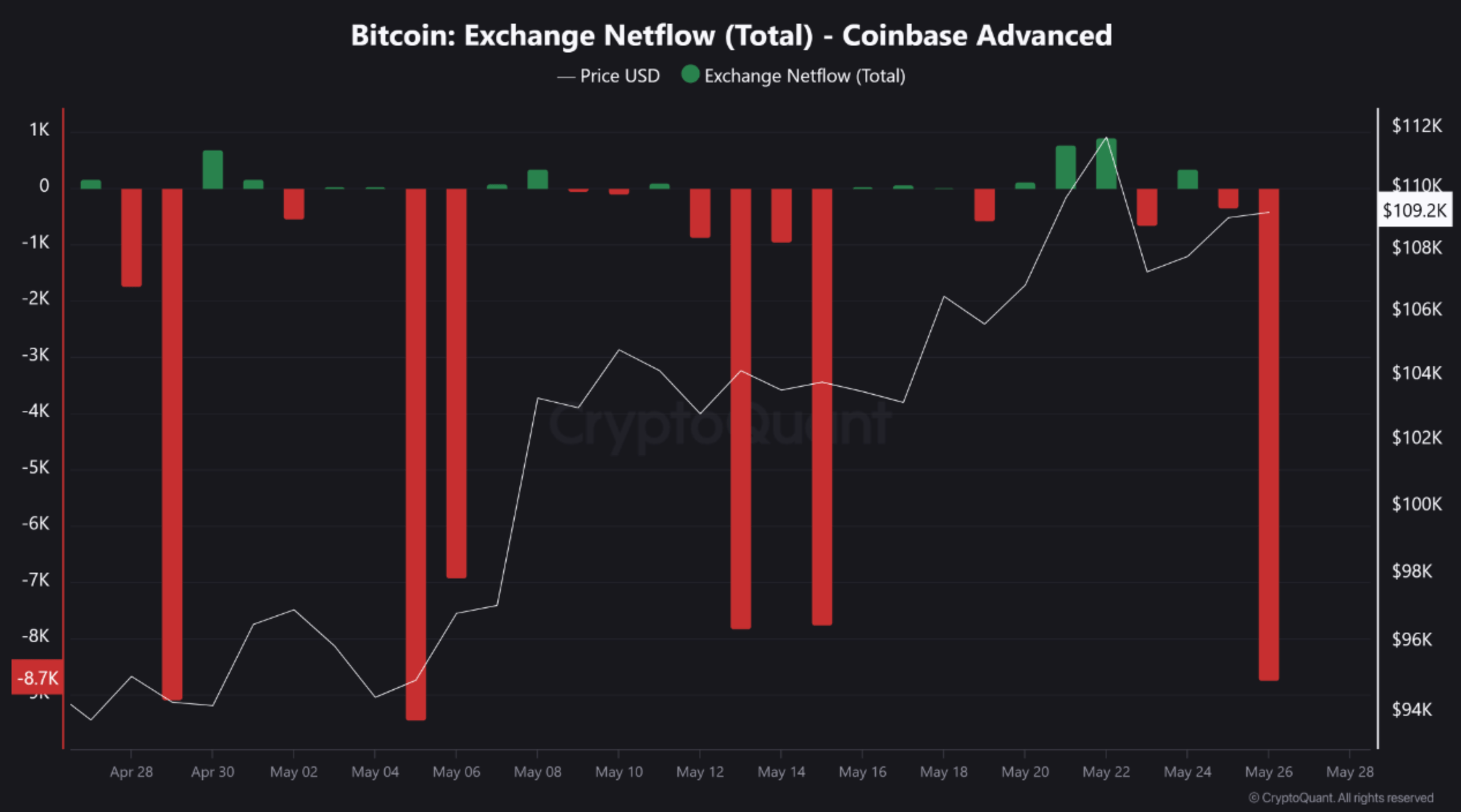

As Bitcoin (BTC) continues to trade near its recent all-time high (ATH) of $111,980, activity on maj...