MicroStrategy Goes All-In Again on Bitcoin, Adds 13,390 BTC to Its Massive Reserve

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Renowned Bitcoin firm Strategy is maintaining its weekly BTC acquisition strategy, announcing a fresh billion-dollar purchase today.

Specifically, Strategy has

added

13,390 BTC tokens worth $1.34 billion to its expansive Bitcoin portfolio. The acquisition came at an average cost of $99,856 per coin. Following this latest addition, Strategy now holds a massive Bitcoin war chest totaling 568,840 BTC tokens.

Notably, the firm's Bitcoin portfolio accounts for 2.864% of BTC's circulating supply. This sizable holding further strengthens its position as the largest corporation with Bitcoin on its balance sheet.

While

Bitcoin

is trading above $103,300, Strategy’s average purchase price of $99,856 suggests the acquisition occurred several days ago, prior to today's public disclosure by Michael Saylor, the company's chairman.

https://twitter.com/saylor/status/1921898712801874273

Continued Bitcoin Acquisition

Strategy, formerly known as MicroStrategy, has been accumulating BTC since September 2020. During this period, the firm mostly followed a monthly purchasing schedule until the last quarter of 2024, when it transitioned to primarily weekly acquisitions.

Last week, it announced the purchase of 1,895 BTC worth $180.3 million at an average cost of $95,167. This week, the company disclosed an acquisition over seven times larger, committing more than $1 billion.

Strategy's largest single Bitcoin purchase was announced on November 25, 2024, when it took custody of 55,500 BTC tokens worth $5.4 billion at the time.

To date, Strategy has invested $39.41 billion in Bitcoin over the past four years. With the overall portfolio now valued at $58.82 billion, based on BTC’s current price above $103,000, the company is sitting on an unrealized profit of $19.39 billion.

Notably, the company funded the latest purchase of 13,390 BTC using proceeds from its

ongoing $42 billion

at-the-market (ATM) equity offerings, which include both common stock (MSTR) and preferred stock (STRK).

Critics Warn of Market Risk

While the company’s bold strategy of raising capital through ATM offerings to purchase Bitcoin has earned praise, critics are also expressing concern. In response to the latest move, long-time Bitcoin skeptic Peter Schiff remarked that Strategy’s next buy could push its average cost above $70,000 per coin.

Schiff warned that a significant downturn in Bitcoin could send its market price below Strategy’s average cost basis. He argued this could be problematic, given how much the company has borrowed to accumulate Bitcoin. “When Saylor sells,” Schiff cautioned, “small paper losses will become huge real losses.”

However, Strategy founder Michael Saylor has made it clear he has no plans to sell. He previously stated that he would continue buying Bitcoin, even if the price climbs to $1 million per coin.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/505398

Previous:大饼以太空单止盈!多单需观察进场!

Related Reading

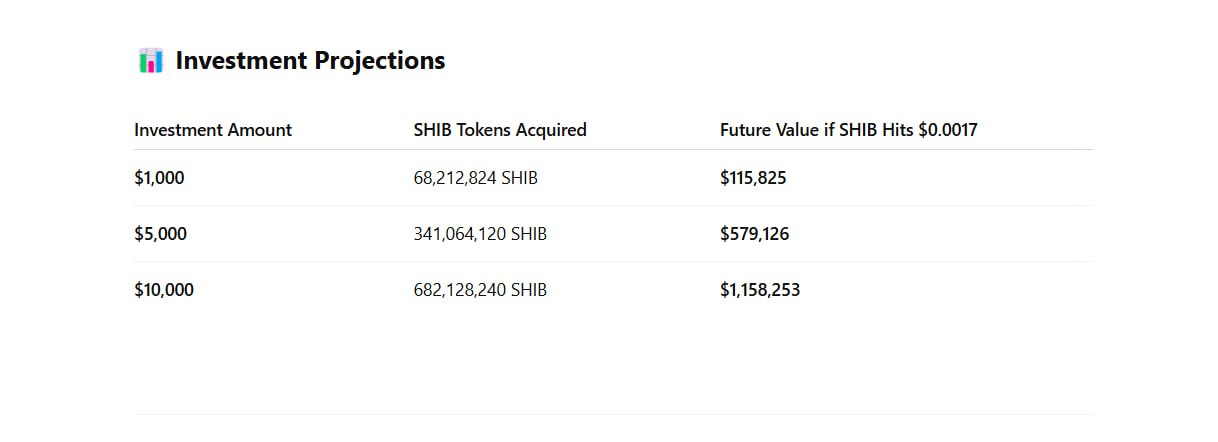

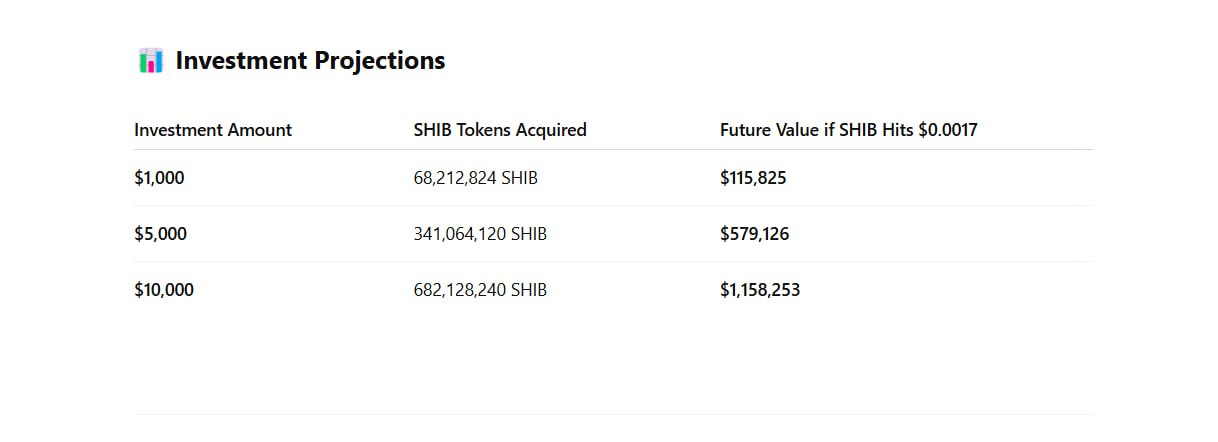

Here’s When $1K, $5K, and $10K in Shiba Inu Could Turn Into $115K, $580K, and $1M

Shiba Inu investors with $1K to $10K could grow into six figures if the token cancels more zeros and...

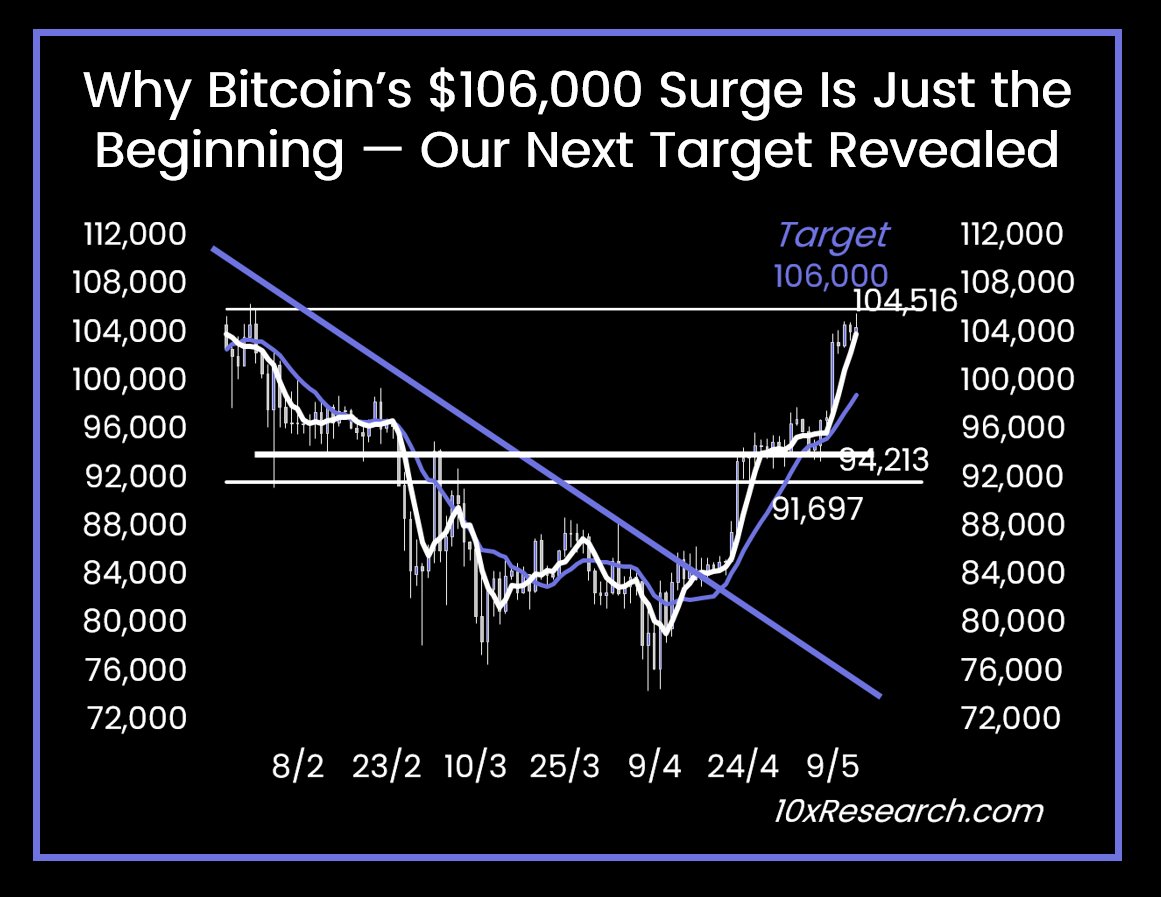

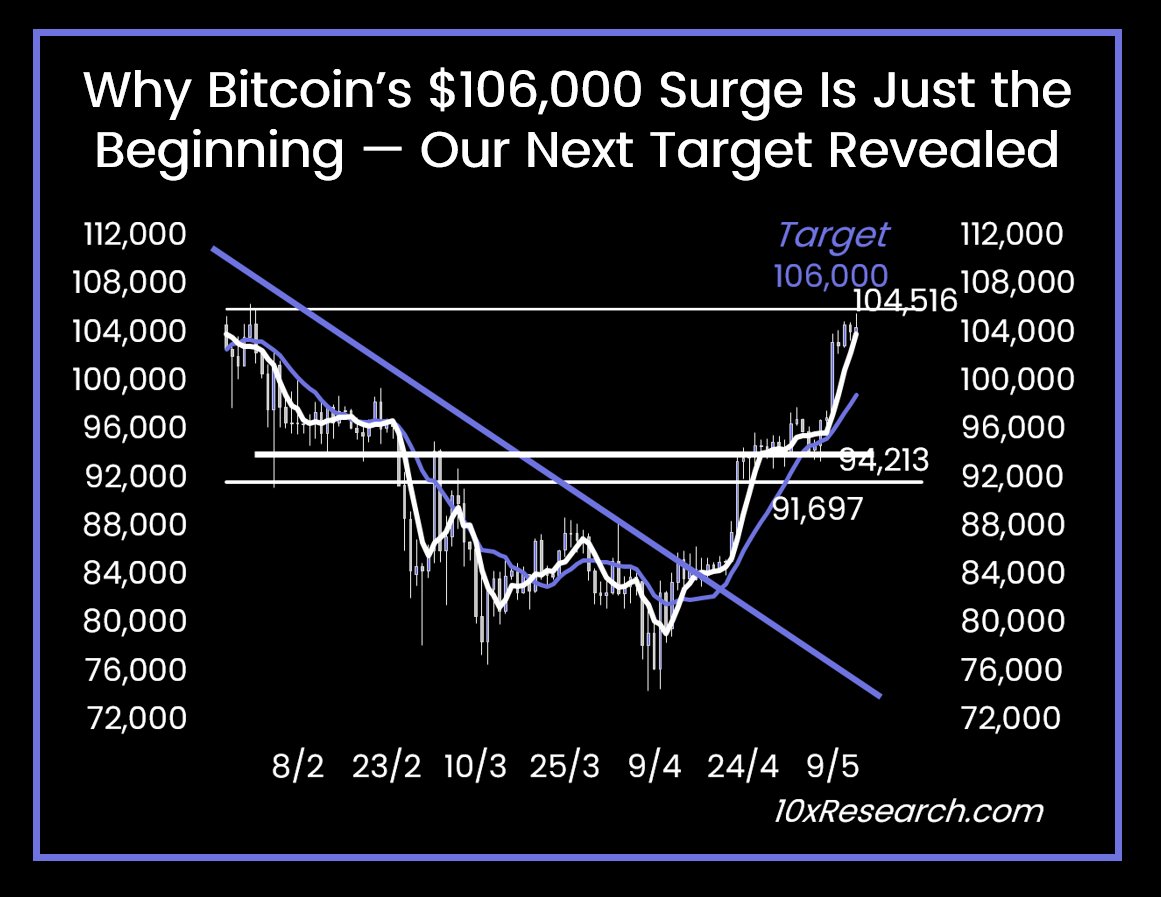

10x Research Updates Its Bitcoin Target, Predicts Further Upside as BTC Hits $106K

Bitcoin has moved closer to the $106,000 mark, prompting fresh attention from analysts at institutio...

Bitcoin Leads as Crypto Inflows Hit $882M in Fourth Straight Week of Growth

Digital asset investment products continued their positive momentum, recording a fourth straight wee...