Peter Brandt Predicts When Bitcoin Price Might Reach $150,000, Technical Signals Show Where Market Is At

Bitcoin’s price action has broken above $96,000 in the past 24 hours, strengthening the case for a sustained move into six-figure territory. This recent price action is particularly significant as it marks a clean breakout above a key on-chain resistance zone stretching from $93,000 to $95,000, which many analysts believe could determine whether Bitcoin’s next leg takes it into six-figure territory.

Supporting this momentum is a long-term technical outlook by renowned trader Peter Brandt, who projected that Bitcoin remains on course to set new all-time highs, with a potential price peak exceeding $150,000 on his projected timeline.

Peter Brandt Maps Timeline For $150,000 Bitcoin Top With Parabolic Structure

Veteran trader Peter Brandt shared a weekly candlestick Bitcoin price chart on social media, highlighting a path toward $150,000 by late summer 2025. According to Brandt’s post on social media platform X, Bitcoin is currently trading below a parabolic trendline that is key to the final leg of the current bull cycle. Interestingly, this parabolic trendline has served as an upper resistance for Bitcoin’s price peaks and all-time highs since 2021.

Related Reading: Bitcoin Price Prediction: The Last Leg-Up That Confirms A Resounding Rally To $150,000

Brandt’s chart captures a variety of classical technical formations, including multiple head and shoulders patterns, expanding triangles, and consolidation wedges. The breakout from the recent wedge pattern serves as his basis for suggesting that the bull market is structurally intact.

According to his projection, the parabolic slope that Bitcoin needs to overcome currently sits around the $120,000 mark. A decisive breakout above this threshold would set the stage for a run-up to a cycle top. Brand noted that this cycle top would be between $125,000 and $150,000, and the timeline is by August or September 2025.

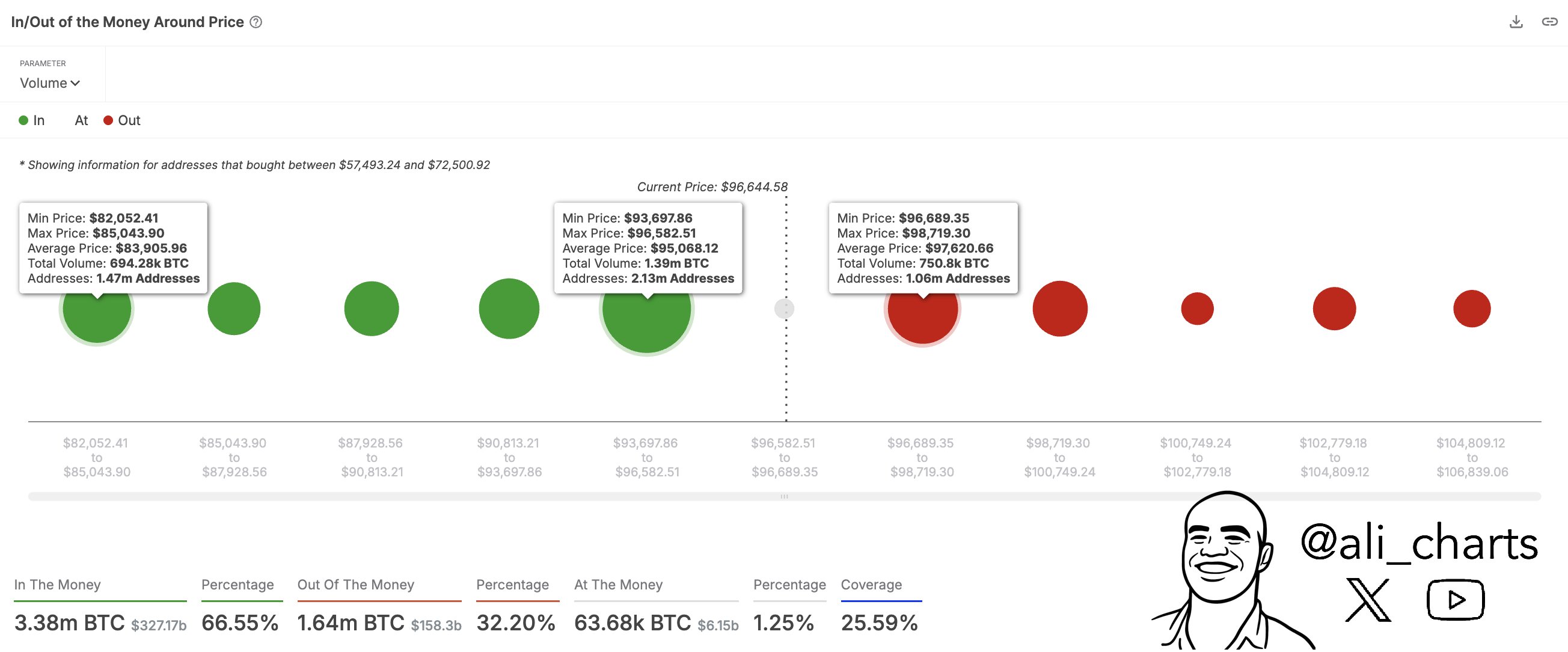

On-Chain Indicators Reveal Pressure Points Around $93,000 To $95,000

On-chain data from on-chain analytics firm Glassnode shows that Bitcoin is currently testing the convergence of two critical resistance points: the 111-day simple moving average, which now sits at $91,300, and the short-term holder cost basis, which sits at $93,200.

Related Reading: Bitcoin Price: Analyst Peter Brandt Says BTC Still Bearish Unless This Happens

Notably, Bitcoin’s price structure has confirmed a higher high relative to a high of $94,000 in early May, effectively breaking the downtrend from early April. This suggests that the market may be shifting into a more aggressive accumulation phase. However, this region also represents a significant cluster of previously bought coins, meaning investors underwater during earlier pullbacks now find themselves near break-even. This could cause increased sell-side pressure if some traders take profit or exit at breakeven.

Meanwhile, long-term holders continue to exhibit strong HOLDling behavior, with realized profits exceeding 350% for many. In fact, over 254,000 BTC have crossed the 155-day threshold since Bitcoin’s recent local bottom, indicating that a significant portion of the supply is maturing into long-term holdings. Many of these coins were acquired at prices above $95,000.

Although current momentum clearly favours the bulls , the $93,000 to $95,000 range is a major battleground that could define Bitcoin’s trajectory in the months ahead of reaching Peter Brandt’s target of $150,000.

At the time of writing, Bitcoin is trading at $96,635.

Bitcoin Sandwiched Between Major Support & Resistance Levels—Can Bulls Win Out?

On-chain data shows the Bitcoin spot price is currently sandwiched between two zones where a large n...

Bitcoin Could See A Weekend Rally To $100,000 – Is BTC Ready For New Highs?

As Bitcoin (BTC) attempts to break out from its weekly range, its price eyes the crucial $99,000-$10...

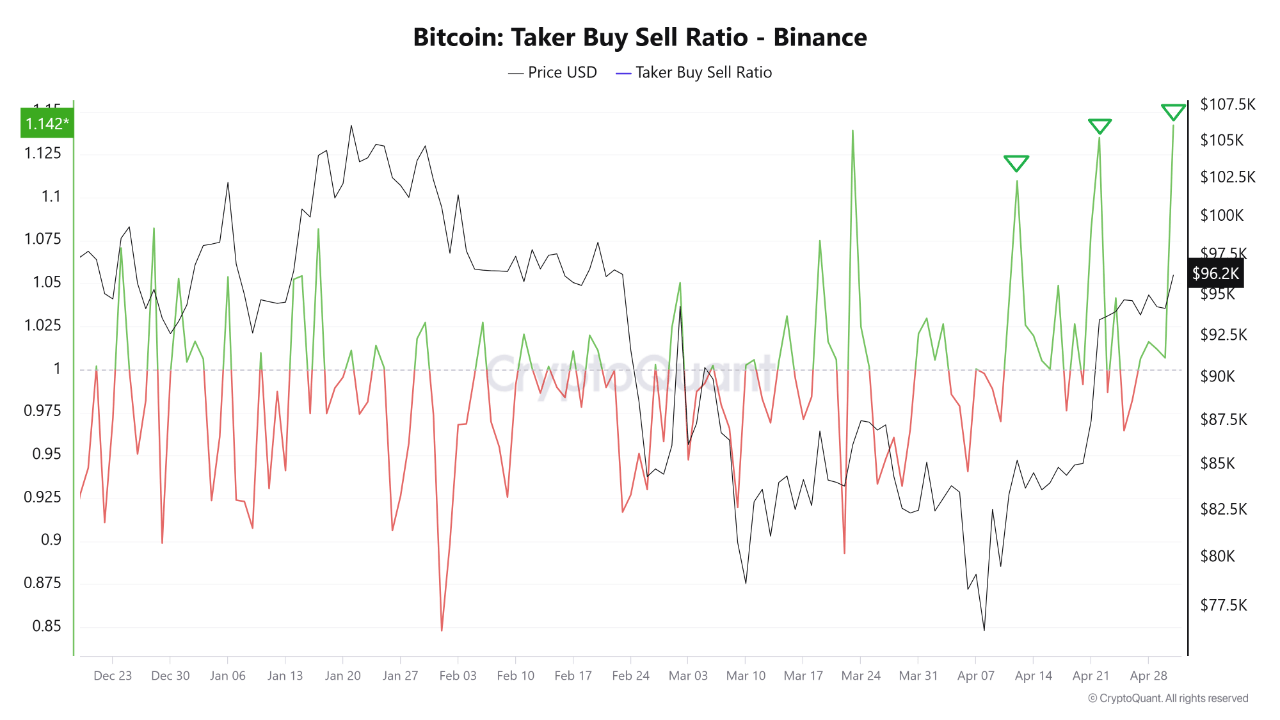

Bitcoin Sees Sharp Increase in Taker Buy/Sell Ratio on Binance—What Does It Signal?

Bitcoin continues to edge closer to the $100,000 psychological price mark, trading at $96,857 at the...