Ethereum Whales Just Accumulated 640K ETH, Is a Bigger Rally Coming?

Ethereum’s price has recently mirrored broader trends in the cryptocurrency market, rising to above $1,800 before retracing as part of a wider market correction.

At the time of writing, ETH is trading at $1,754, showing a 3.3% decrease in the past 24 hours, while the total crypto market cap slipped by 3.6% during the same period.

Although short-term price movements reflect shifting momentum, on-chain metrics signal deeper changes that may have broader implications for Ethereum’s network health and investor sentiment.

Ethereum Long-Term Holders Accumulate as Inflows Hit Multi-Year Highs

Recent data from CryptoQuant reveals that long-term Ethereum holders are increasing their activity . These wallets, known for never selling their ETH, have seen one of their highest inflows in recent years.

This coincides with rising network activity, including a notable uptick in active addresses and transactional volume. Together, these developments suggest that behind the surface-level volatility, there may be a quiet phase of accumulation and user engagement building within the Ethereum ecosystem.

CryptoQuant contributor OnChainSchool reports a significant development among Ethereum’s long-term holding addresses. In the last 48 hours, over 640,000 ETH flowed into wallets that have maintained a strict accumulation pattern without any recorded selling behavior.

This marks the largest inflow to such wallets since 2018, suggesting that entities with a long-term outlook are increasing their exposure during the current price range.

The behavior of these accumulation-only wallets is often viewed as a proxy for investor conviction, particularly among participants who are not influenced by short-term volatility .

According to OnChainSchool, this activity during a period of price drawdown may reflect strategic positioning ahead of potential future developments.

It’s also notable that these inflows come at a time when Ethereum fundamentals such as its transition to proof-of-stake, L2 adoption, and evolving staking mechanisms continue to advance. If sustained, this trend could help establish a support zone around current price levels.

Network Activity Rises as Active Addresses See Double-Digit Growth

Complementing the rise in long-term holder activity is a surge in Ethereum network usage. Another CryptoQuant analyst, Carmelo Alemán, highlights that the number of active Ethereum addresses grew by nearly 10% between April 20 and April 22, jumping from around 306,000 to over 336,000.

This metric counts unique wallet addresses that were involved in transactions as either senders or receivers over a given period. While active addresses alone do not capture the full picture, Alemán notes that the metric should be viewed alongside others such as exchange volume , gas fees, transaction count, and Layer 2 activity.

The rise in address activity, especially when paired with a simultaneous price increase, is often taken as a sign of broader user engagement and growing application-layer demand.

Featured image created with DALL-E, Chart from TradingView

Six of the Best Crypto Market Makers Supplying Liquidity in 2025

Crypto market makers: always essential, occasionally controversial, frequently misunderstood. It’s a...

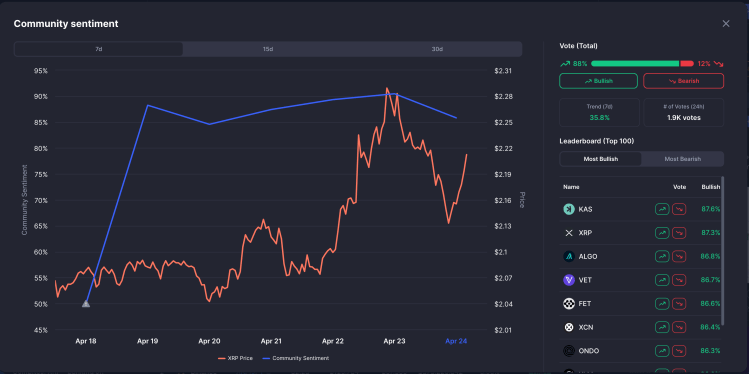

Is The XRP Price Rally Over At $2.22? New Developments Suggest Major Pump Is Coming

The XRP price rallied again to $2.22 after a relief rally rocked Bitcoin and the crypto market. This...

New Crypto to Follow Bitcoin as 21Capital Establishes $3.9B $BTC Treasury, Swiss Central Bank Weighs $BTC National Reserve

After the news of Cantor Fitzgerald’s partnership with SoftBank and Tether, the shares of Cantor Equ...