Twenty One Capital CEO Says Firm Aims to Make Investors Rich in Bitcoin

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Jack Mallers has announced joining Twenty One Capital, a new venture that aims to provide exposure to Bitcoin as no company has ever done.

In a Bloomberg

appearance

, the Strike founder disclosed that he is joining Twenty One Capital, a new crypto firm focused on buying Bitcoin, as the new CEO. He also revealed the dynamics that his latest venture offers, including making users rich in Bitcoin terms, not just in fiat currency.

Twenty One Capital Debuts New Dynamics

Notably, the new Bitcoin-focused firm has its majority shares owned by prominent stablecoin issuer

Tether

. Furthermore, financial market titans Cantor Fitzgerald and SoftBank Group have also backed Twenty One Capital, which will launch with 42,000 BTC ($3.6 billion) in its balance sheet.

Meanwhile, the new CEO, Mallers, has vowed to expose Bitcoin enthusiasts to the asset, through owning shares of the venture, in ways not yet seen. He mentioned some of the metrics the firm will launch, including the Bitcoin per Share (BPS) and Bitcoin Return Rate (BRR).

Interestingly, Maller stressed that, unlike other Bitcoin investment vehicles, such as exchange-traded funds (ETFs), which offer static shares and earnings in fiat, Twenty One Capital is taking a whole new approach to incentivizing holders.

One of which is growing holders’ Bitcoin per share. Maller noted that this presents investors with more exposure to Bitcoin through its shares, providing them with wealth in Bitcoin terms rather than in fiat currency.

Remarkably, Twenty One Capital would pursue this venture using the

MicroStrategy

playbook. It would raise capital through several equity and debt instruments, all aimed at buying more Bitcoin. For context, the firm has already announced plans to raise $585 million, with $350 million in convertible note sales and $200 million in private placements.

Prominent Institutions Backing New Bitcoin Venture

Interestingly, Maller's new initiative has already gained traction, with Tether owning a majority of the crypto business, thanks to a $1.5 billion Bitcoin contribution. SoftBank also contributed $900 million worth of Bitcoin for a minority stake in Twenty-First Capital, with Tether’s Bitfinex also remitting $600 million.

Furthermore, the firm will merge with

Fitzgerald’s SPAC

, Cantor Equity Partners (CEP), and rebrand to XXI. This collaboration boosts its $3.6 billion valuation, with its balance sheet already making it the third-largest public company holding the premier asset, after Marathon Digital (MARA) and Strategy.

Meanwhile, Maller will maintain his status as CEO and founder of Strike while managing Twenty One Capital. He founded the crypto platform in 2020, leveraging the

Bitcoin Lightning Network

to allow users to buy, send, and hold the pioneering cryptocurrency.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/502126.html

Previous:彭博社:美国国债真的失去避险吸引力吗?

Related Reading

Tether Releases First Gold Token Attestation: 7.7 Tons of Gold Back $770M XAUT Supply

The world’s largest stablecoin issuer, Tether, has released its first formal attestation for its gol...

Coinbase to Launch Bitcoin Yield Fund for Non-US Investors

Coinbase Asset Management is preparing to introduce a new investment product that will generate stea...

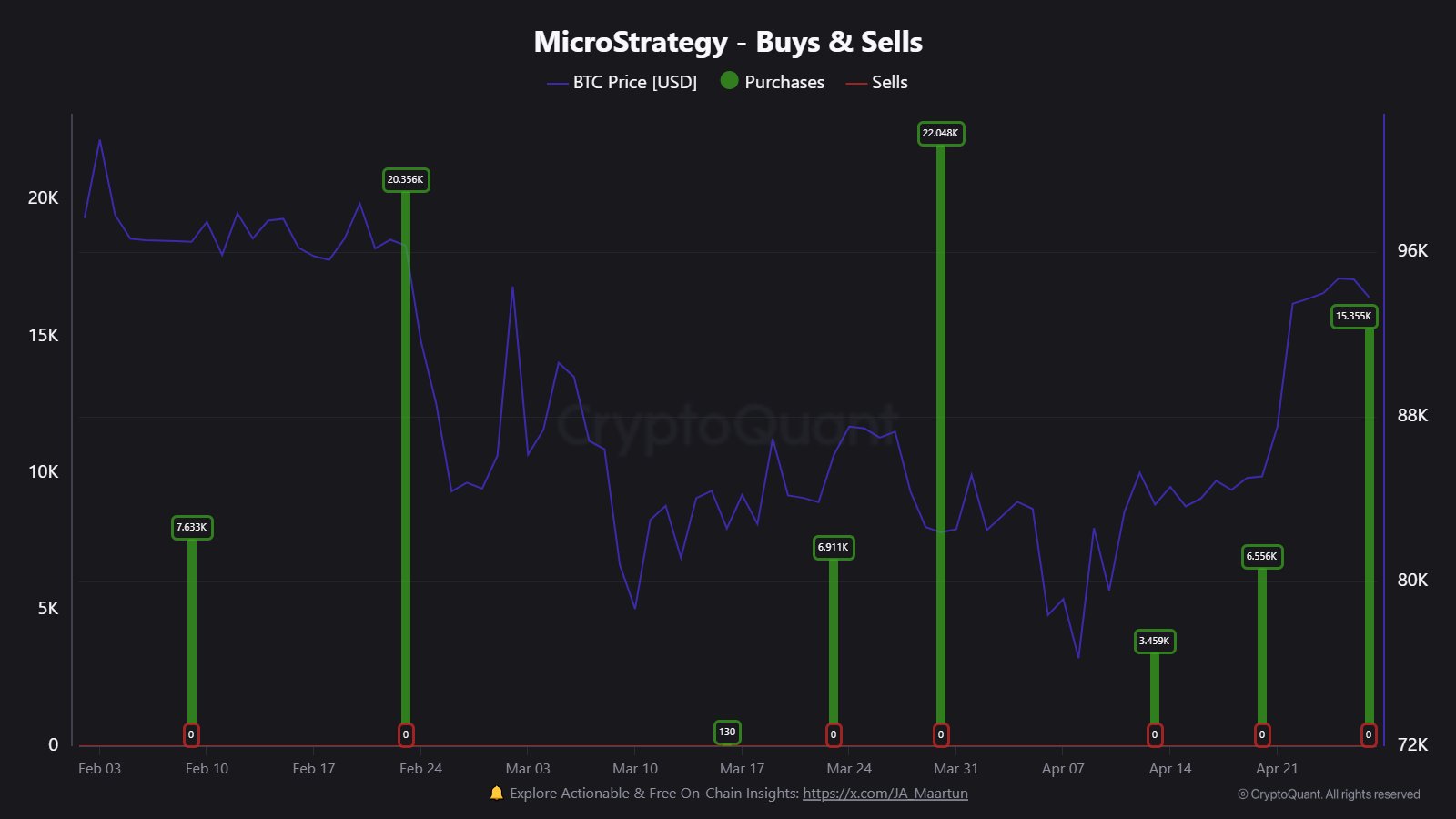

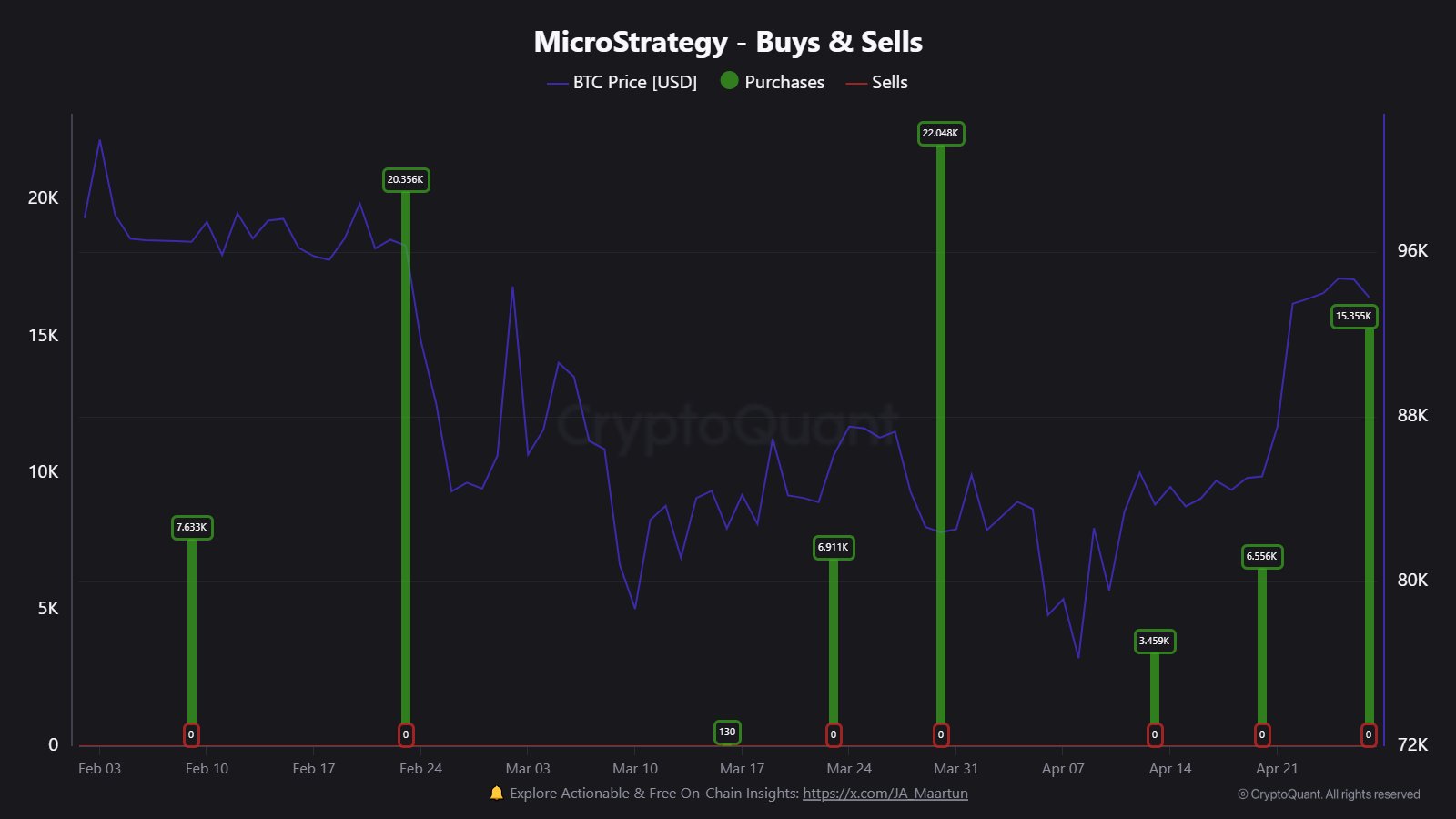

Michael Saylor’s Strategy Further Deepens Bitcoin Holdings with Latest Acquisition of 15,355 BTC

Strategy is back in the headlines after splashing massive cash to secure a new batch of Bitcoin toke...