Finance Coach Slams Bitcoin Investors Who Bought at $100K But Made This Rookie Move

Favorite

Share

Scan with WeChat

Share with Friends or Moments

A Bitcoin maximalist has criticized investors who entered the market at peak prices but exited hastily at the first sign of volatility.

This sharp criticism came from Rajat Soni, a Chartered Financial Analyst (CFA) and self-acclaimed personal finance coach, amid the ongoing Bitcoin market struggles. For context, BTC has continued to dance to the tune of the bears as macroeconomic headwinds from the tariff war take shape.

Bitcoin's Rollercoaster Ride Since November 2024

Particularly, Bitcoin collapsed from $83,000 on April 4 to a five-month floor price of around $75,000 three days later. Despite an impressive 8.33% gain on April 9 on the back of easing tensions, Bitcoin is still down 1.46% this month, and by a more substantial 12.86% year-to-date.

Amid the ongoing downturn, Soni

took to X

to slam investors who sold too early at the first sight of volatility. His latest commentary suggested that there were buyers who entered into the market when Bitcoin hit the psychologically significant $100,000 price milestone.

Notably, BTC first crossed $100,000 in early December 2024. Despite occasional pullbacks, the asset persistently recovered the $100,000 mark throughout that month, hitting a new all-time high above $109,000 in January. However, it's been downhill since then, with February, March and now April introducing intense bearish pressure.

Notably, a previous report from

The Crypto Basic

confirmed

this selloff campaign from investors who entered the market during the latest uptrend. In February, data from Glassnode indicated that the 7-day SMA of assets sold by these investors at loss rose to 5,500 BTC in early February but later subsided.

Finance Coach Slams Bitcoin Buyers Who Sold at $75K

In addition, as the price collapsed to the $75K mark on April 7, the selloff campaign resumed. Soni had some harsh words for these investors who took to their heels, branding them "idiots." This comment is largely due to the finance analyst's conviction that Bitcoin will claim much higher prices.

Interestingly, in a separate disclosure, Soni stressed that he discusses Bitcoin often because he wishes to prepare investors for what's coming. According to him, it is his desire that the average investor amasses enough Bitcoin before governments start buying, a development that could lead to a supply shock.

https://twitter.com/rajatsonifnance/status/1910132018987278353

Besides his constant advocacy for investors to accumulate Bitcoin, a campaign that

Strategy Chairman Michael Saylor

has also championed, Soni also has wild predictions for BTC. In January, he suggested that investors who are at most 20 years old this year will be able to see Bitcoin hit $100 million in their lifetime. With BTC currently trading for $81,050, this would mark a 123,380% increase.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/499458.html

Previous:比特币/以太坊先多后空的思路再次完美验证

Related Reading

Here’s How high Dogecoin Price May Reach by 2030 if DOGE Rises 10% Per Month

Dogecoin holders could see a cumulative gain of 228X by 2030 if DOGE stages a consistent 10% monthly...

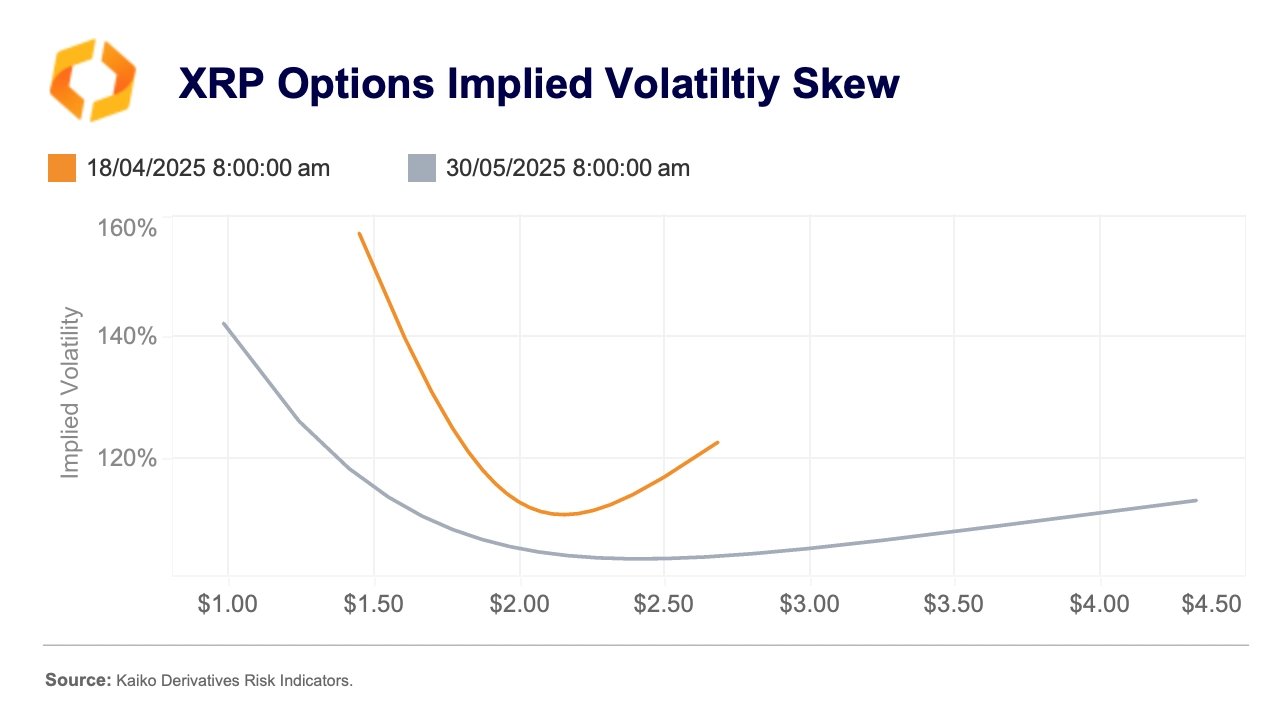

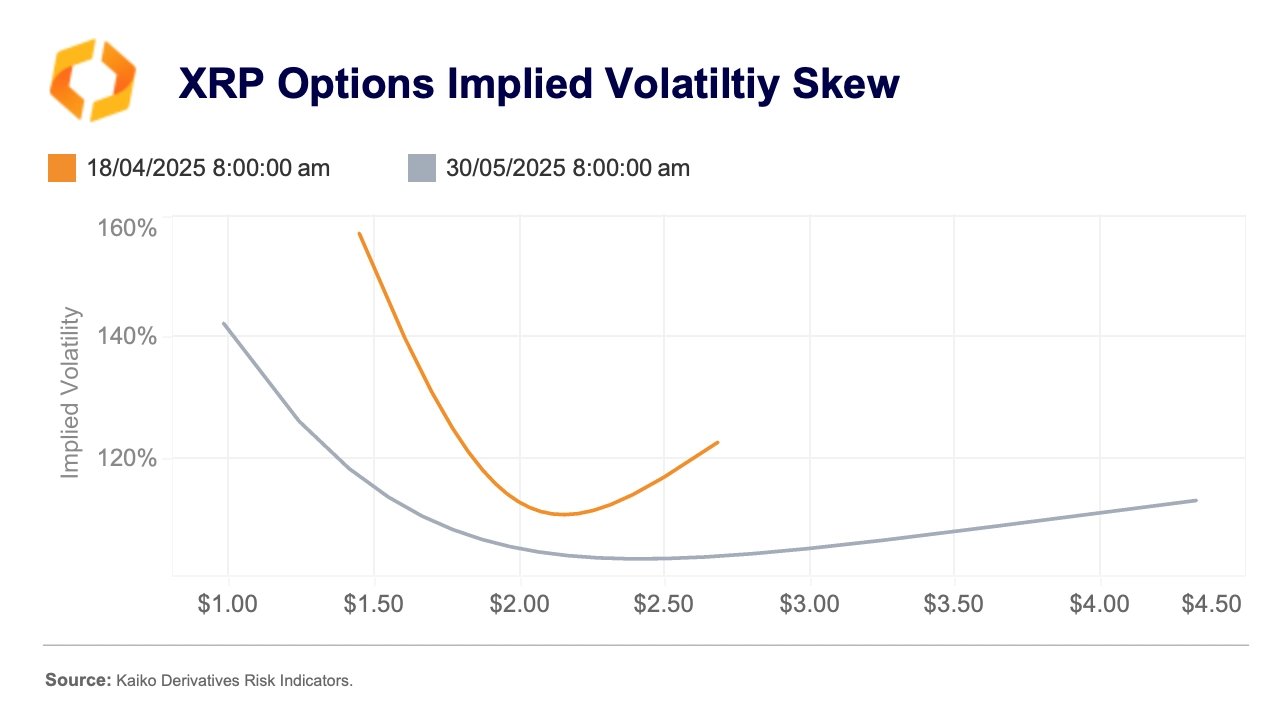

XRP Options Market Skewed Bearish Despite Positive Tailwinds

Despite a wave of bullish developments surrounding XRP, options traders on Deribit are pricing in ca...

Elliott Wave Setup Signals Shiba Inu May Skyrocket 741% Above $0.0001, Says Top Analyst

A notable market analyst has provided an update on Shiba Inu path to a new all-time high using the E...