Ethereum Could Be Mirroring Bitcoin’s 2018-2021 Cycle Amid Record Selling

Crypto analyst The Cryptagon has raised the possibility of the Ethereum price mirroring Bitcoin’s 2018 to 2021 cycle, which he indicated was bullish ETH. This development comes amid record selling among ETH investors, which continues to exert downward pressure on the crypto.

Ethereum Could Be Mirroring Bitcoin’s 2018-2021 Cycle

In a TradingView post , the Cryptagon stated that Ethereum has been repeating Bitcoin’s 2018 to 2021 cycle very closely. He remarked that ETH’s long-term holders may remain bullish just by looking at this BTC cycle , seeing as ETH could achieve a similar end result like the flagship witnessed in that cycle.

The analyst admitted that Ethereum has been under heavy pressure since early December last year and almost touched the 12-month falling support this week. However, despite this development, the Cryptagon suggested that this is not the time to be bearish on ETH, as it could still reach new highs as it mirrors Bitcoin’s 2021 cycle .

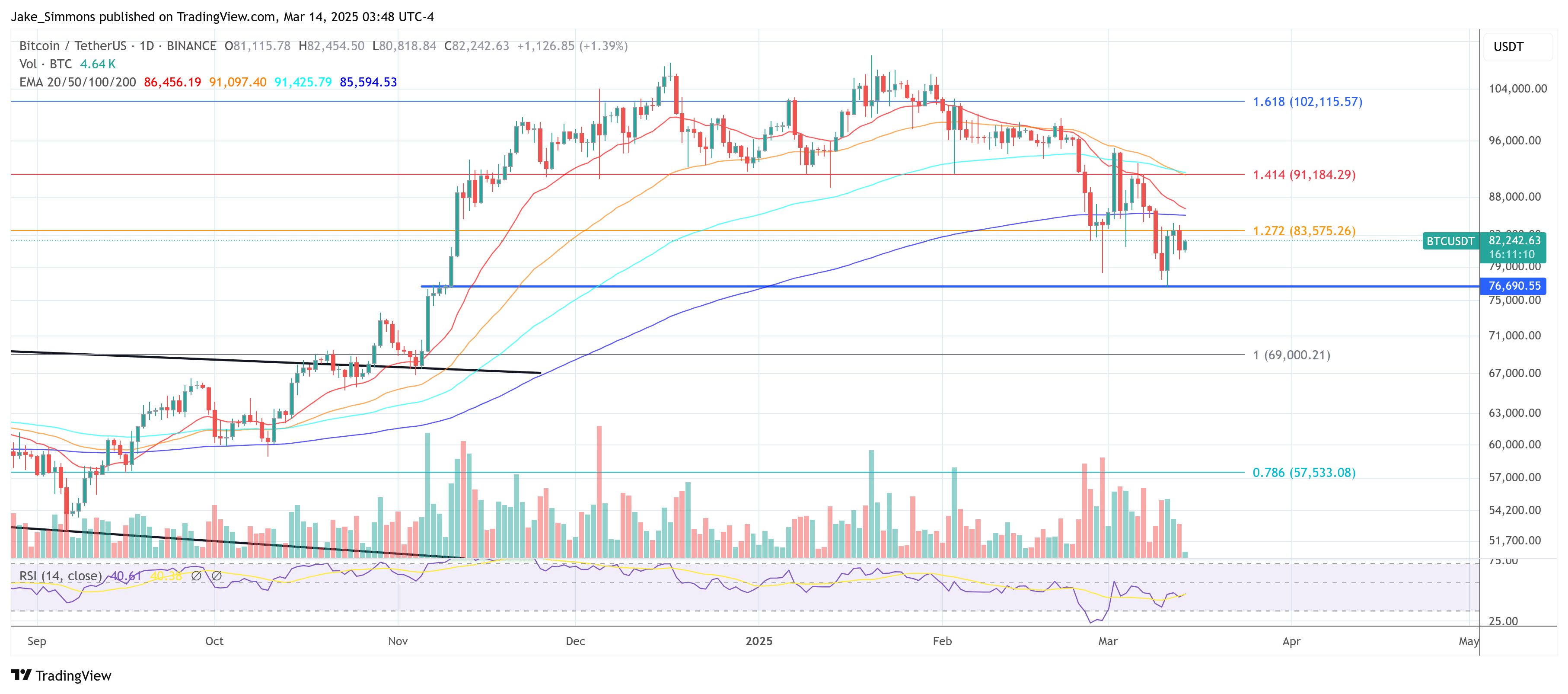

He noted that in the 2021 cycle, a rebound on the falling support caused a massive breakout above the falling resistance and the Bitcoin price rallied to the 1.618 Fibonacci extension. In line with this, the Cryptagon predicted that Ethereum could at least reach $8,000 in this market cycle as it repeats a similar price action.

This bullish outlook for Ethereum comes amid record selling, which threatens any bullish reversal for ETH. In an X post, Cryptoquant founder Ki Young Ju revealed that Ethereum has faced record active selling over the past three months.

This has contributed to ETH’s underperformance, with the altcoin being outperformed by other major altcoins like XRP and Solana over this period. While XRP touched its current all-time high (ATH) and SOL hit a new ATH, ETH has yet to come anywhere close to its current ATH.

The Most Important Price Level For ETH At The Moment

In an X post, crypto analyst Ali Martinez, revealed that $1,887 is the most important support level for Ethereum at the moment. At this level, investors bought 1.63 million ETH. A drop below this level could lead to another massive crash for the second-largest crypto by market cap, with many of these investors possibly selling off their coins in order to cut their losses.

Martinez has already raised the possibility of Ethereum crashing to as low as $800. He noted that the $4,000 price level had been holding a strong horizontal resistance trendline. However, ETH recently broke out of this trendline, which has significantly increased the probability of a 70% price drop to this $800 target.

At the time of writing, the Ethereum price is trading at around $1,893, up over 1% in the last 24 hours, according to data from CoinMarketCap.

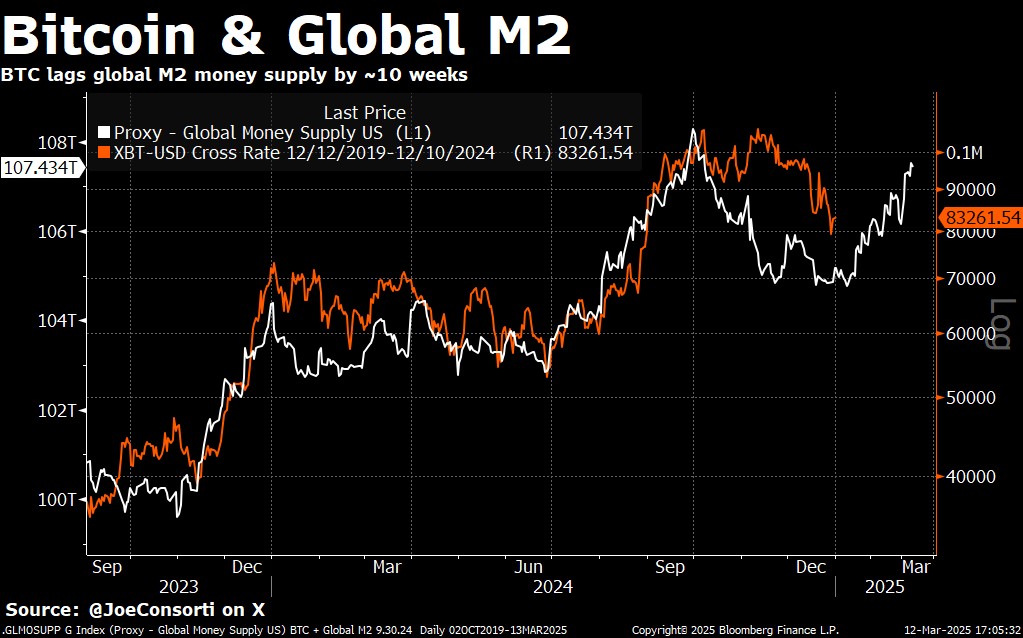

Global M2 Tightens Grip On Bitcoin—What’s Next?

Bitcoin’s tight correlation with global M2 has returned to the spotlight, suggesting that broader mo...

Crypto Faces Uncertain Future As Trump’s ‘Short-Term Pain’ Plan Unfolds

US President Trump’s outspoken acceptance of near-term economic hardship has placed risk assets—incl...

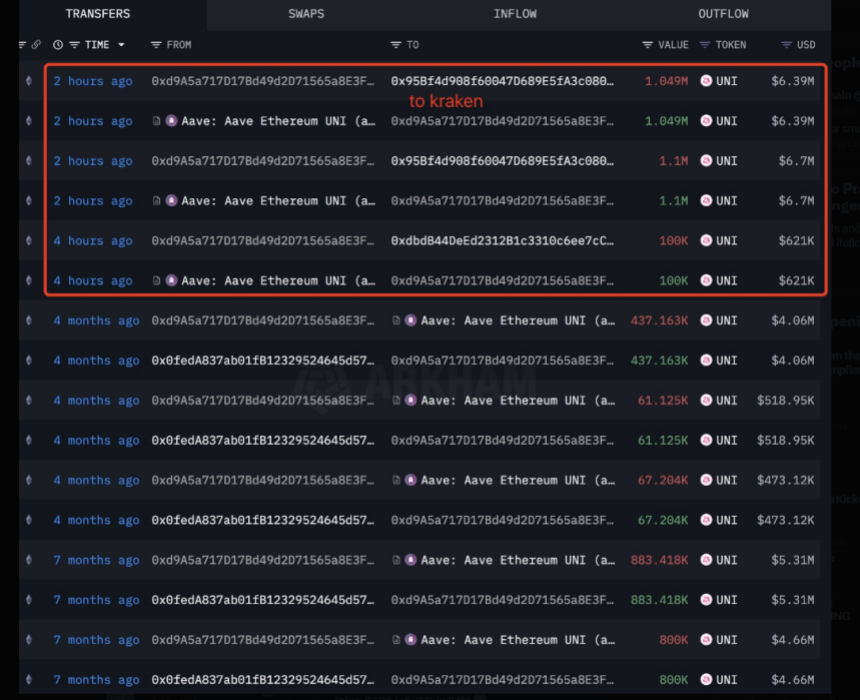

Uniswap Bleeds 20%—Is This Whale Behind The Drop?

One crypto exchange’s loss is another crypto exchange’s gain. This holds true with cryptocurrency ex...