UNI Price Recovery Gains Traction – Will It Smash Through Resistance?

Uniswap price is gaining traction as it rebounds from the $6.7 level, sparking renewed optimism among traders. After a period of consolidation , bulls are strongly attempting to reclaim control, aiming for a breakout beyond key resistance levels. However, the road ahead is not without obstacles. A critical resistance zone looms, and whether UNI can push past it or face another pullback remains the big question.

Market sentiment is shifting as buying pressure increases, but the presence of strong resistance could determine the next phase of price action. If UNI breaks through, it could open the doors for a sustained rally, while failure to do so might lead to another retest of lower levels.

Price Targets: How High Can Uniswap Go?

Uniswap’s recent recovery from $6.7 has sparked bullish optimism, but how far can the price climb if it successfully breaks through resistance? The first key target lies at $8.7, a crucial resistance level that has previously acted as support and rejection. A decisive move above this zone could pave the way for $10.3, a level that may determine whether UNI can sustain further upside.

If buying momentum remains strong, the next major hurdle is around $12.3, a psychological barrier and a key resistance from past price action. Beyond this level, the rally is expected to extend, potentially opening the door for $15.7 and beyond.

However, UNI’s ability to reach these targets depends on broader market conditions, trading volume, and bulls countering selling pressure. A rejection at resistance might lead to a retest of lower levels, making it crucial for traders to monitor price action closely.

Lastly, the Relative Strength Index (RSI) formation indicates that UNI still has more room for upward movement, as the RSI line has risen above the 50% threshold. This suggests that buying momentum is increasing, signaling a possible continuation of the bullish trend.

Support Zones To Watch If UNI Faces A Pullback

Several key supports may prevent UNI’s struggles to maintain its bullish momentum against further decline. The first major support level is around $6.7, which recently acted as a strong demand zone. A bounce from this level could indicate that buyers are still in control, keeping the uptrend intact.

Should selling pressure intensify, UNI might drop toward the $5.5 range, a key area where buyers have previously stepped in to defend against more drops. Furthermore, a breakdown below this zone might shift sentiment to bearish, exposing UNI to a potential drop toward $4.8, a level where the token may stabilize or extend its losses.

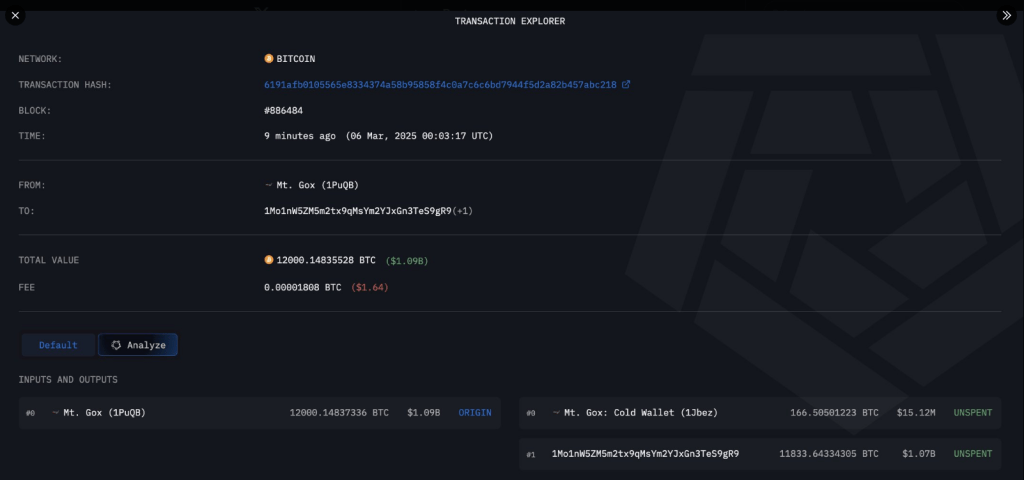

Mt. Gox Stirs The Market With $1 Billion Bitcoin Transfer—What’s Going On?

Bitcoin took center stage again as Mt. Gox moved 12,000 BTC, valued at over $1 billion, to an unknow...

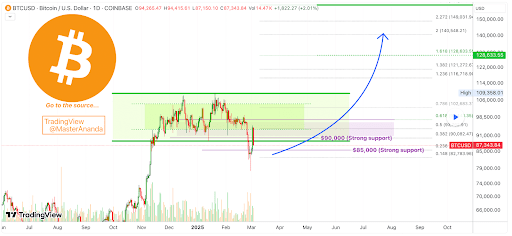

Bitcoin Could Could Gain Momentum For A Move To $150,000 If Bulls Reclaim This Level – Details

Bitcoin is currently trading at $90,800 after a strong 13% rebound from the $81,000 level, as bulls ...

Bitcoin Price Action Says Bottom Is In, Analyst Reveals What’s Coming

Crypto analyst Master Ananda has asserted that the bottom is in for the Bitcoin price following its ...