If these tokens were live today, would their economics hold up under real usage?

By 2026, crypto presales are all about structure, execution, and whether a project can survive contact with real users and real governing bodies.

If you’re comparing IPO Genie ($IPO) , Bitcoin Hyper ($HYPER), and Nexchain ($NEX), you’re already past the curiosity stage. This is commercial investigation territory, sorting through upsides, trade-offs, and the kind of risks that don’t show up in launch threads.

What follows isn’t a pitch. It’s a grounded comparison.

Why 2026 Presales Feel Different

A few cycles ago, a whitepaper and a Telegram group were enough. That’s no longer the case.

Today, every presale interest tends to revolve around projects that show Presale Tokenomics Analysis clarity, audited contracts, and at least a plausible path to revenue or usage. From a practical standpoint, investors are paying closer attention to Regulatory Compliance Signals and whether teams understand the jurisdictions they’re operating in.

That shift matters when you’re trying to assess risk-adjusted upside rather than chasing momentum.

Direct Comparison Overview

| Feature | IPO Genie ($IPO) | Bitcoin Hyper ($HYPER) | Nexchain ($NEX) |

| Presale Price Level | Very low (~$0.0001) | Mid (~$0.013–$0.03) | Higher (~$0.116) |

| Public Allocation | ~50% | Public presale (private data unclear) | ~20% |

| Core Utility | Private market & pre-IPO access | Bitcoin Layer-2 payments & DeFi | Cross-chain infrastructure |

| Revenue Link | Deal fees, carry, platform services | Transaction fees, node rewards | Transaction fees, staking |

| Team & Vesting | Public track record, locked tokens | Partial transparency | Limited visibility |

| Liquidity Reserve | ~20% | ~10% | ~8% |

| Adoption Dependency | Deal flow & compliance execution | Merchant & user adoption | Developer and protocol uptake |

| Risk Profile | Regulatory & execution heavy | UX and adoption risk | Competition and scale risk |

ALERT! This table doesn’t tell you what to buy. It helps narrow what to research further.

IPO Genie ($IPO): Structured, but Not Simple

IPO Genie is in its Stage 33 presale at $0.00011240, built on Ethereum, with participation available via ETH, BTC, BNB, USDT, or card.

IPO Genie stands out among the top cryptos in 2026 because, from the start, it leans into compliance, custody, and a revenue model. That which looks closer to traditional finance than DeFi experimentation.

At its core, the project tries to lower the barrier to private market participation, something historically reserved for insiders and large cheques. That narrative tends to appeal to investors looking for Utility-Driven Demand rather than short-term narratives.

A few things working in its favor:

-

Analysed by SolidProof, with CertiK review underway.

-

Clear vesting and a large public allocation matter when evaluating

Token Distribution Transparency

.

- Revenue tied to actual activity, deal fees, secondary trades, and licensing creates a visible Platform Revenue Linkage .

That said, complexity cuts both ways. Supervisory overhead can slow expansion, and private market liquidity is never guaranteed. Even with institutional partners, execution will matter more than marketing.

From a speculative standpoint, the very low entry price creates a wide range of possible outcomes. That doesn’t make it safer; it just means outcomes are more dispersed.

Nexchain ($NEX): Infrastructure Is a Long Game

Nexchain (NEX) is in its presale at around $0.12, running on its native Nexchain AI Layer‑1 blockchain, with participation available via ETH, USDT, BNB, or BTC. The smart contracts have been evaluated by CertiK and SolidProof.

Nexchain lives in a crowded neighborhood. Cross-chain infrastructure is essential, but it’s also dominated by established names with deep integrations.

The value proposition is straightforward: if multi-chain usage keeps growing, infrastructure that enables secure interoperability becomes more valuable over time. The $NEX token underpins validator incentives, fees, and governance.

Strengths tend to show up if:

-

Developers actually build on it.

-

Validators commit capital and uptime.

- Performance metrics hold up under load.

But this is where caution creeps in. Infrastructure projects often take longer to show traction, and ROI tends to be adoption-dependent rather than narrative-driven. For investors prioritizing Real-World Adoption Signals , this means watching testnet data and developer activity closely, not presale momentum.

Bitcoin Hyper ($HYPER): Familiar Idea, Hard Problem

Bitcoin Hyper (HYPER) is currently priced at $0.013545 in its presale. It runs on Ethereum and accepts ETH, BTC, BNB, USDT, and card payments. Verified by SolidProof, Coinsult, and SpyWolf,

Bitcoin Hyper trades on a simple insight: Bitcoin is widely held but not widely used for everyday payments. Layer-2 solutions try to bridge that gap.

Bitcoin’s popularity draws early interest, especially from payments-focused investors. Transaction fees and node rewards create a usage-linked demand loop, at least in theory.

Where things get tricky is execution. Bitcoin scaling has a long history of partial solutions and slow adoption. Convincing merchants and users to adopt a new layer-2 isn’t just a technical challenge; it’s a behavioural one.

This tends to attract investors focused on Early Entry Price Advantage , but don’t forget that any crypto gains talked about here are speculative and uncertain.

Two Practical Risk Filters Worth Using

When comparing these crypto presales, two filters tend to separate signal from noise:

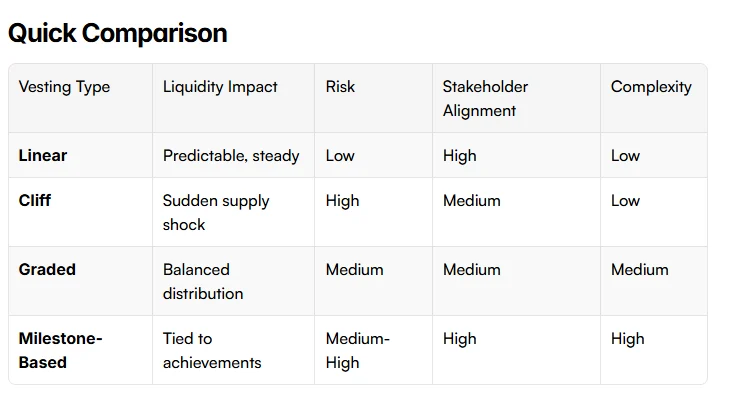

-

Vesting Schedule Impact

and liquidity design. Longer team lockups and meaningful liquidity reserves reduce early sell pressure.

- Community Engagement Metrics that reflect actual discussion, not just follower counts. Technical questions and roadmap scrutiny matter more than hype.

Quick snapshot: how different vesting types impact risk and liquidity.

These aren’t guarantees. They’re ways to avoid obvious pitfalls.

2026 ROI Strategy: How Analysts Tend to Think About It

Rather than asking “which one will win?”, a more useful question is what kind of outcome you’re underwriting .

Some investors look for projects where tokenomics suggest big upside if execution goes well. While others prefer safer infrastructure plays, and factors like liquidity reserves and compliance help guide those choices, especially now that regulation is very much real.

Summary Positioning (Not Financial Advice)

Taken side by side:

-

IPO Genie ($IPO)

comes across as the most structurally mature, with a clear utility and revenue narrative. If execution matches ambition, speculative upside could be wider, but potential outcomes vary depending on execution.

-

Bitcoin Hyper ($HYPER)

offers exposure to Bitcoin’s ecosystem evolution. The idea is easy to grasp; adoption is the hard part.

- Nexchain ($NEX) looks like a slower-burn infrastructure bet. Returns depend heavily on developer uptake and differentiation in a competitive field.

None of these are obvious winners. Each reflects a different bet on where value might accrue in 2026.

For readers evaluating next steps, the sensible move isn’t urgency; It’s diligence. Read the Report. Track On-Chain Activity Metrics once available. Spend time in technical channels. Presales reward preparation far more reliably than enthusiasm.

If the comparison helps you decide what to research deeper or what to skip entirely, it’s done its job.

Official Channels:

Telegram X Channel Instagram

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct independent research before investing.

Frequently Asked Question

1: How do IPO Genie, Bitcoin Hyper, and Nexchain differ in 2026 presales?

A:

IPO Genie focuses on

private market

access and structured revenue. Bitcoin Hyper targets Bitcoin payments via

Layer-2 scaling

.

Nexchain builds cross-chain infrastructure. Each has different risk profiles, adoption dependencies, and upside potential.

2: How should I evaluate these presales before investing?

A:

Check token utility, audits, team transparency, vesting schedules, liquidity, and real adoption signals. Focus on preparation and research rather than hype or price speculation.

Token Metrics Blog

This article is not intended as financial advice. Educational purposes only.