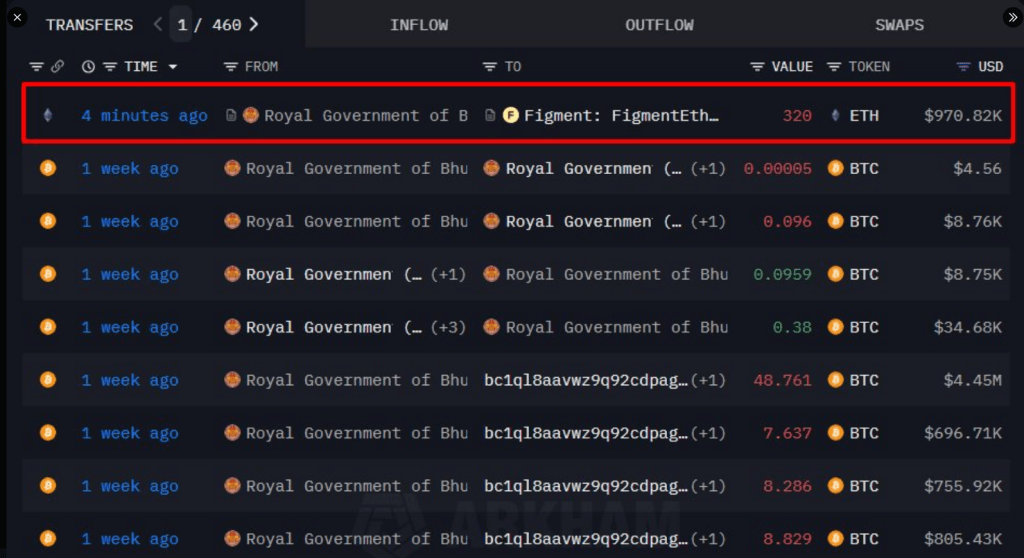

According to reports, the government of Bhutan moved 320 Ethereum (ETH) into staking on November 27, 2025. The transaction was routed through Figment.io, an institutional staking provider.

At the time of the move, the Ether was valued at about $970,000. The transfer is being watched in both crypto and policy circles because it links a sovereign treasury to active participation in a public blockchain.

Details Of The Staking Move

Onchain Lens say the 320 ETH created 10 new validators, matching the network rule that each validator requires 32 ETH. The payment and validator setup were recorded onchain and were visible to blockchain trackers shortly after the move.

This is Bhutan’s largest ETH action since May 2025, when the nation moved 570 ETH to a Binance wallet, based on earlier disclosures.

The Royal Government of Bhutan sent 320 $ETH , worth $920.8K, for staking into #ETH2 .0 @Figment_io . https://t.co/q4dW3qJBT5 pic.twitter.com/qo0evHxthf

— Onchain Lens (@OnchainLens) November 27, 2025

Beyond Treasury Management

Observers note Bhutan is not only holding crypto as an asset. By staking ETH, the country is helping to secure the Ethereum network and earning rewards that come from validator participation.

Reports have disclosed the move also ties into national plans to shift parts of its digital identity project from Polygon to Ethereum. That plan would make the chain more than a place to park funds; it could become part of public infrastructure.

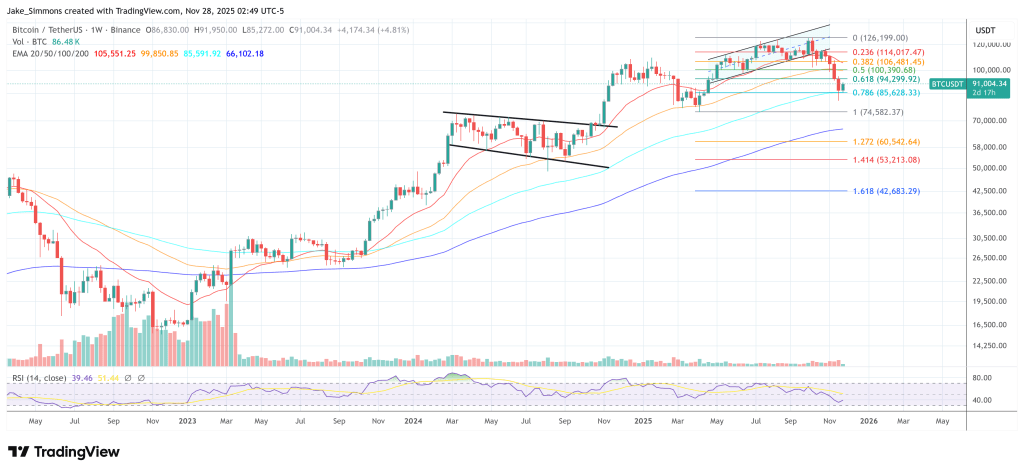

Bhutan is already known to hold a sizeable amount of Bitcoin. Public data and media reporting put the country’s Bitcoin reserves at about 6,154 BTC, making Bitcoin the primary reserve asset.

Staking ETH, even at a smaller scale compared with those holdings, signals that Bhutan is experimenting with using crypto not just for investment but as a tool for state services and network involvement. The action was described by some analysts as an example of a small state testing new financial and technical models.

On Liquidity And Rewards

On Liquidity And Rewards

When ETH is staked it becomes illiquid for a period tied to network rules. That means the staked tokens cannot be used for immediate spending or trading. At the same time, validators earn rewards that may add modest income to a state treasury.

The trade-offs are clear: more participation in protocol security, less short-term flexibility in asset use. Several commentators asked whether sovereign staking will affect how other small nations treat crypto reserves.

Broader Crypto ContextOn the world stage the amount is modest, but the move is symbolic. Sovereign actors rarely operate validators on major smart-contract chains. This step was noticed because it ties public services and reserve management to one blockchain.

Regulators, market watchers, and blockchain developers have been monitoring the transaction and related policy moves to see whether similar steps might follow elsewhere.

Featured image from Unsplash, chart from TradingView