收藏

分享

微信扫一扫

分享到朋友或朋友圈

Vinny Lingham

@VinnyLingham

RT

@infraa_: The Global Reserve Currency Curse: “Dollar Dutch Disease" and the Hollowing Out of America One of the very interesting developments in the past few days is the nomination of JD Vance- a guy from a dirt poor Appalachian town in the Rust Belt. An eyewitness to decades of disastrous trade, industrial and monetary policy. One of his most controversial positions is in the area of monetary policy. He even pressed Jerome Powell on the downsides of ‘King Dollar’, a foundational policy position of the neoliberal globalists who have comprised both major parties for the past 50 years. The Rustbelt and the Forgotten America As I covered in February, there is a crisis-level event that has been playing out in slow motion over the past decades (and absolutely no one is talking about it). Millions of Americans are dying of ‘deaths of despair’. Suicide rates in America have increased 37% since 2000 and are at the highest level since the Great Depression

@infraa_: The Global Reserve Currency Curse: “Dollar Dutch Disease" and the Hollowing Out of America One of the very interesting developments in the past few days is the nomination of JD Vance- a guy from a dirt poor Appalachian town in the Rust Belt. An eyewitness to decades of disastrous trade, industrial and monetary policy. One of his most controversial positions is in the area of monetary policy. He even pressed Jerome Powell on the downsides of ‘King Dollar’, a foundational policy position of the neoliberal globalists who have comprised both major parties for the past 50 years. The Rustbelt and the Forgotten America As I covered in February, there is a crisis-level event that has been playing out in slow motion over the past decades (and absolutely no one is talking about it). Millions of Americans are dying of ‘deaths of despair’. Suicide rates in America have increased 37% since 2000 and are at the highest level since the Great Depression

@infraa_

The Global Reserve Currency Curse:

“Dollar Dutch Disease" and the Hollowing Out of America

One of the very interesting developments in the past few days is the nomination of JD Vance- a guy from a dirt poor Appalachian town in the Rust Belt. An eyewitness to decades of disastrous trade, industrial and monetary policy.

One of his most controversial positions is in the area of monetary policy. He even pressed Jerome Powell on the downsides of ‘King Dollar’, a foundational policy position of the neoliberal globalists who have comprised both major parties for the past 50 years.

The Rustbelt and the Forgotten America

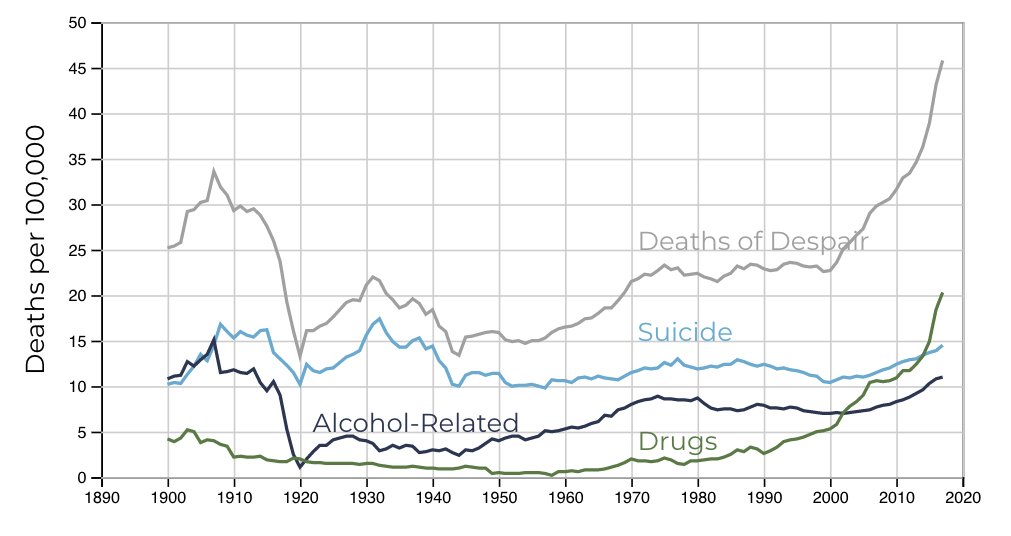

As I covered in February, there is a crisis-level event that has been playing out in slow motion over the past decades (and absolutely no one is talking about it).

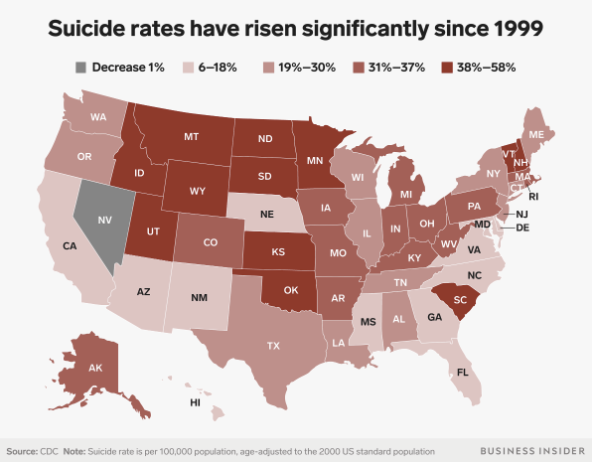

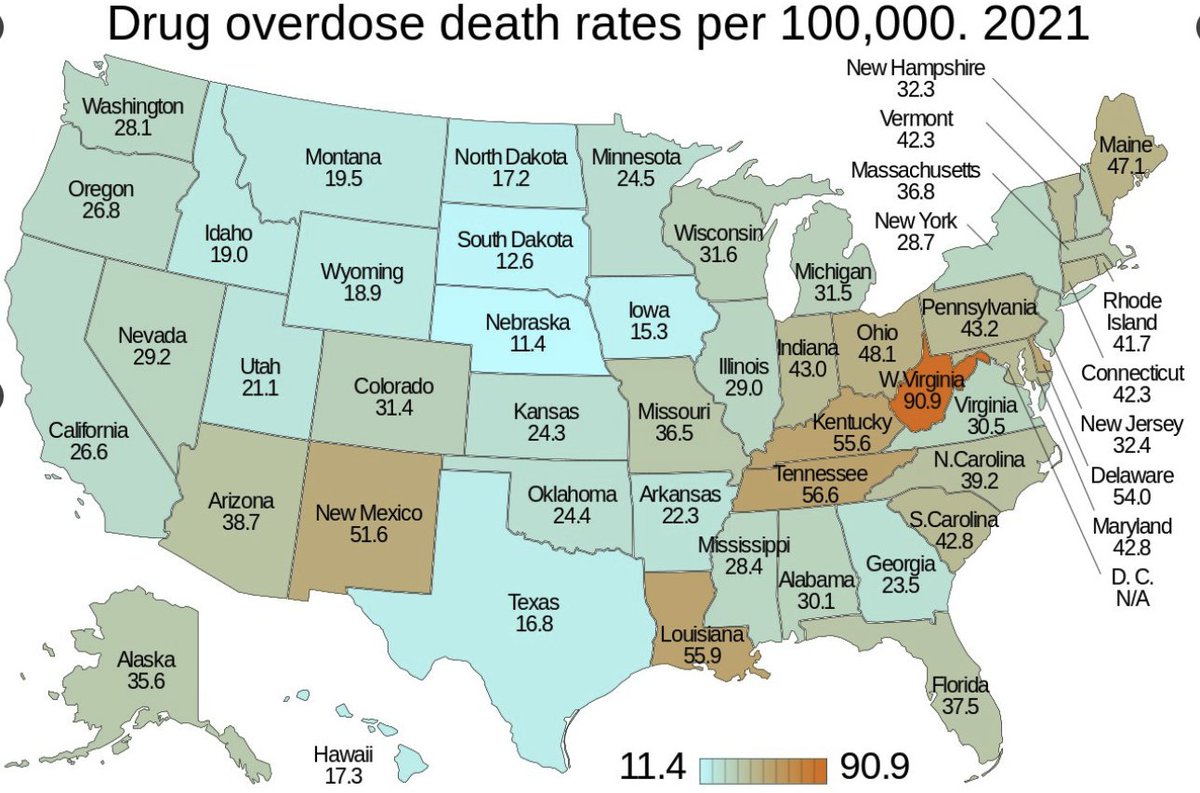

Millions of Americans are dying of ‘deaths of despair’. Suicide rates in America have increased 37% since 2000 and are at the highest level since the Great Depression. Drug overdose deaths are parabolic and now, the leading cause of death for young people.

Both drug overdose data and suicide rates show that the rustbelt, the former industrial heart of our nation, to be suffering an outsized impact.

So, the question is: why?

A Short History on the Dollar

Following World War 2, the dollar displaced the British Pound as the global reserve currency under the Bretton Woods system. Each dollar was supposed to be backed by a fixed amount of gold. This monetary policy allowed for the rebuilding of Europe. America served as the world’s factory and this powered the US to become the global hegemony that it is today.

This all ended in 1971 when Nixon removed the US from the gold standard. It’s always important to note that the reason that Nixon ended the gold standard was the immense cost of the Vietnam war. The US could not afford the war without debasing the currency, which everyone started to notice (this broke the ‘rules’ under Bretton Woods).

Now, the dollar was backed by nothing more than faith (“fiat”).

How Currency Affects an Economy

Currencies and their relatives, bonds, tend to confuse most normal people. This is an oversimplification, but hopefully will help deconstruct some very complicated mechanisms:

When we talk about a “strong dollar”, this has absolutely nothing to do with the purchasing power of an average American family within the US. In the currency world, everything is a relative game. The dollar versus the Yen and the Euro. This is what the DXY measures- the dollar’s strength versus a basket of currencies (namely the Euro, Pound and Yen).

Now, when we have a “strong dollar”, this means that the dollar is strong relative to the others. This means that the average American family’s dollars will purchase more goods from other countries than they did before.

A short example:

Say $1.00 gets you 1 Euro (parity).

Now, imagine the dollar strengthens, and each dollar gets you 2 Euros

This means that, if you are buying goods from a European country, your dollar now gets you twice as much. This is also why Americans have had the benefit of low-cost international travel for many years.

However, this also has the inverse effect, too:

If you are an American business, your items now cost twice as much to a European

Essentially, a strong dollar makes imports cheaper, but exports more expensive. A weak dollar makes exports cheaper (to the rest of the world) and imports into the US more expensive.

What is a Global Reserve Currency

Put very simply, the global reserve currency means that the rest of the world depends on dollars for international trade and settlement. This is where the “petrodollar” stems from: since oil trades are denominated in dollars, the rest of the world must purchase dollars if they want to buy oil. This places an artificial floor of demand under the dollar, causing it to remain “strong” (versus other currencies).

Say you’re a European, and you need to buy oil. Since oil is denominated in dollars, you must obtain dollars. Since you cannot print dollars, you must sell your Euros and buy dollars. This causes the Euro to weaken, and the dollar to strengthen.

Triffin’s Dilemma

When you have a global reserve currency, the rest of the world depends on you to supply that currency since they themselves cannot print it- only the US can. Their trade, their oil, cotton and corn purchases are denominated in dollars, as is a lot of debt (‘Eurodollar system’)

What this means is that, when you have the global reserve currency, you wield massive influence over the rest of the world. This has been the goal of many (from both parties) for decades. Whenever we want, we can squeeze the rest of the world, and whenever we want, we can alleviate their pain with dollar liquidity. @LukeGromen talks extensively about this.

[I will not even dare to touch the topic of the financial terrorism that the US has inflicted on the world, since it’s so vast, but I would highly recommend reading @_whitneywebb and @markgoodw_in and their great work on the issue. If you are not familiar with the Eurodollar system, I would highly recommend @SantiagoAuFund and @JeffSnider_EDU’s stellar work on deconstructing the highly complex Eurodollar market.]

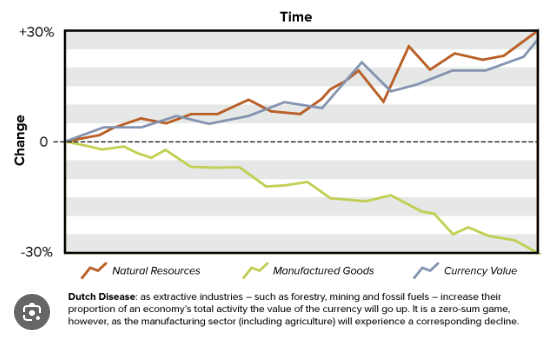

Dutch Disease

In the 1960s, the Netherlands discovered a huge natural gas field. This was a massive economic opportunity because Europe is largely, reliant on energy imports.

When you have an economy that is centered on agriculture and/or manufacturing, and then you suddenly have a massive boom in some new sector like energy, this causes an increased demand for labor and capital for that new booming sector. Money that used to be invested in the farms, factories, farm equipment, industrial tools, fertilizer, etc.- now that labor and capital is sucked away into the new booming sector. This is the “resource movement effect”.

Now that you have a booming energy sector causing higher wages, government revenues coupled with a sucking of labor from the old sector to the new, services labor is in shorter supply (with a constant demand). This means higher wages and higher costs (inflation). This is the “spending effect”

However, because that natural gas is priced based on international trade, this effectively changes the exchange rate of your currency. Because there is a huge increase in international demand for the natural gas and assorted sector, more foreign money flows into your country, causing the currency to appreciate (again, relative to other currencies).

Remember though, a “strong currency” means exports are more expensive for the rest of the world. This means all those factories from the old lagging sector become more expensive as the currency appreciates. This new sector, essentially, chokes out the old/original sectors of the economy.

It also means that imports become cheaper, so your citizens are now incentivized to buy manufactured goods from the rest of the world, not the domestic companies that used to power the economy. This also can contribute to the inflation caused by the “spending effect” mechanism described above.

[@LynAldenContact 's work on this is amazing, and would highly recommend everyone read her book “Broken Money”]

United States’ Major Export: Debt

Remember, a $20 bill is essentially no different than a government bond with 0% yield. In fact, if you hold capital in a money market fund (comprised of short term govt bonds ’T-Bills’), your brokerage will usually calculate this as “Cash and Cash Equivalents”. The only difference between cash and a 10yr bond is that the bond pays you interest.

Since the rest of the world is dependent on you for dollars, you must issue lots of debt (dollars). If you do not supply the necessary dollar liquidity, the dollar rapidly appreciates causing a squeeze on the rest of the world. This is the “Dollar Milkshake Theory”.

Our major export, other than worthless algorithms and apps, is now debt.

Our once-great manufacturing sector has been crushed, in favor of what?

Finance and financial services.

Just like happened in the Netherlands, we now have engineers, scientists and our brightest minds, not going to build amazing new things- they’re going to Wall Street. Income inequality is at historic levels, all the while, the bankers are getting obscenely rich.

This dynamic is called Financialization. You make more orders of magnitude more money building a derivatives model for a hedge fund, than working to actually build something useful. This is what our economy has been engineered to become.

Is @JDVance1 correct? Are you better off with a financialized economy? Is America?

If you ask that question in Manhattan, San Francisco, or the swamp of Washington DC, you will get a much different answer than if you ask a blue collar American in the heartland. Ultimately, it is up to you to decide whether JD Vance is on the money, or not.

I'm glad these discussions are at the very least, finally happening.

免责声明:本文版权归原作者所有,不代表MyToken(www.mytokencap.com)观点和立场;如有关于内容、版权等问题,请与我们联系。